TL;DR

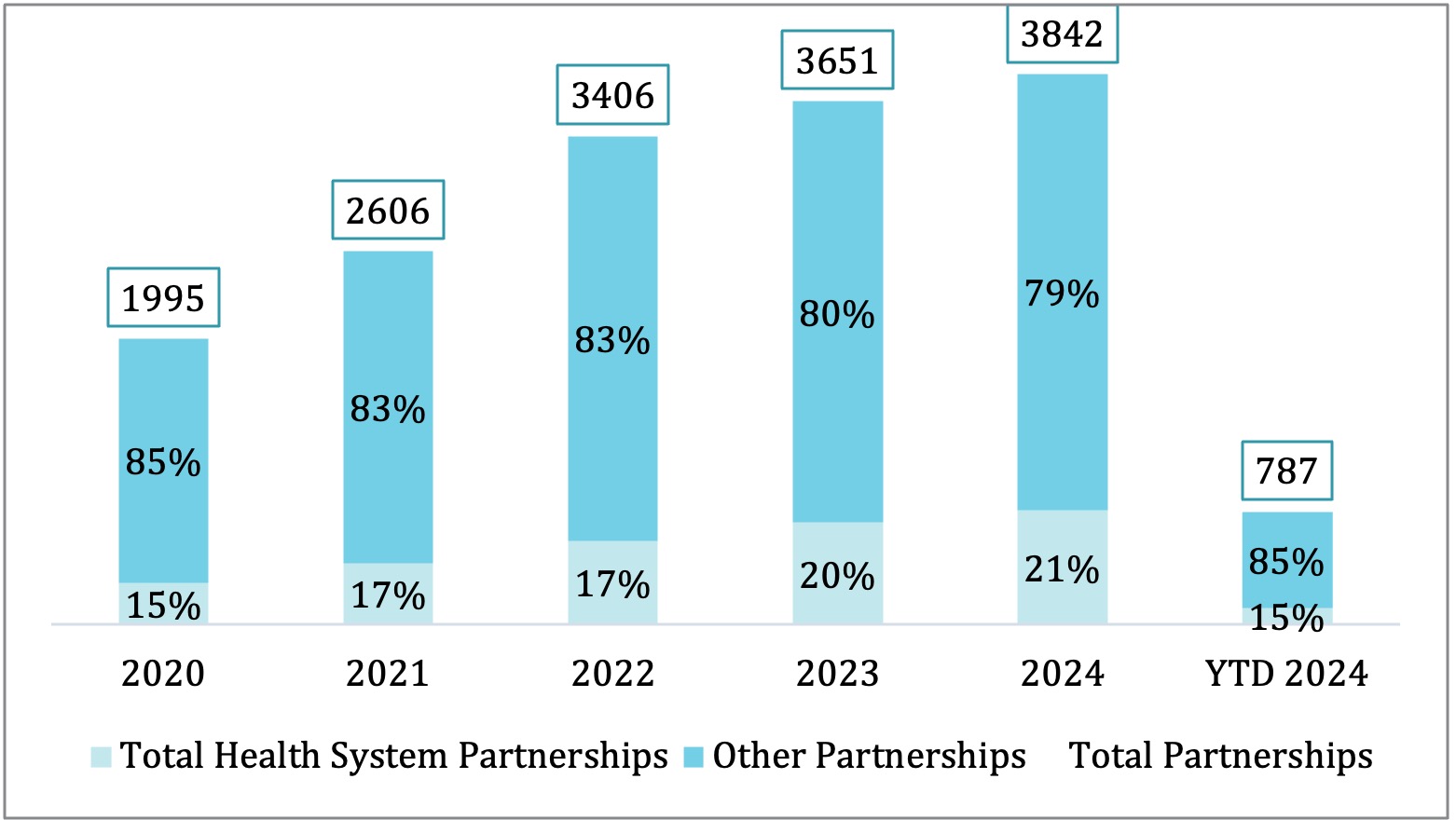

Health Systems (aka Healthcare Providers in the U.S.) are rapidly becoming the cornerstone of digital healthcare technology innovation (aka digital health). In 2024 alone, they accounted for 21% of all partnerships in digital health ecosystem in the United States, more than any other sector. These organisations are not only investing in digital ventures and incubators but are also prioritising technologies like AI and telemedicine to address key operational pain points. Despite challenges such as funding stress and unclear ROI, Health Systems are doubling down on digital solutions to enhance care delivery, efficiency, and patient outcomes.

Introduction: A Digital Health Renaissance Driven by Health Systems

In the ever-evolving landscape of healthcare, digital transformation has shifted from a buzzword to a necessity. At the forefront of this revolution are Health Systems — vast networks of hospitals, clinics, and care providers — that are increasingly becoming the epicentre of innovation in digital health. These systems face the challenge of balancing growing costs, the rising disease burden, and workforce challenges such as shortages and burnout. Technology has become indispensable in achieving this balance while ensuring the delivery of high-quality healthcare services.

According to the Galen Growth’s 2024 Digital Health Funding and Key Trends report, Health Systems are now the most active players in forming partnerships with digital health ventures, surpassing even the pharmaceutical and insurance sectors.

A key catalyst accelerating this transformation is HLTH Europe, which has emerged as a global platform connecting Health Systems, technology providers, investors, and innovators. By convening stakeholders from across continents, HLTH Europe is facilitating knowledge exchange, partnership formation, and ecosystem development at scale. For Health Systems, the event provides a rare opportunity to evaluate cutting-edge digital solutions, benchmark global best practices, and collaborate on strategies to improve care delivery through technology.

This article delves into the growing influence of Health Systems in digital health ecosystem, the strategic imperatives driving their investments, and the technologies shaping the future of patient care in 2025 and beyond.

Health Systems as Digital Health Catalysts

1. Leading the Charge in Partnerships

In 2024, Health Systems accounted for 21% of all global partnerships with digital health ventures, making them the most active industry vertical in this space. This marks a 1.1x year-on-year increase in partnership activity from 2024. The United States took a leading position, with 22% share of venture partnerships in the country with health systems, while Europe and Asia Pacific were not far behind – each with a 19% share.

This proactive engagement stems from a strategic imperative: modernise legacy systems, improve patient outcomes, and navigate the financial and operational challenges faced by many healthcare institutions today.

2. A Response to Systemic Pain Points

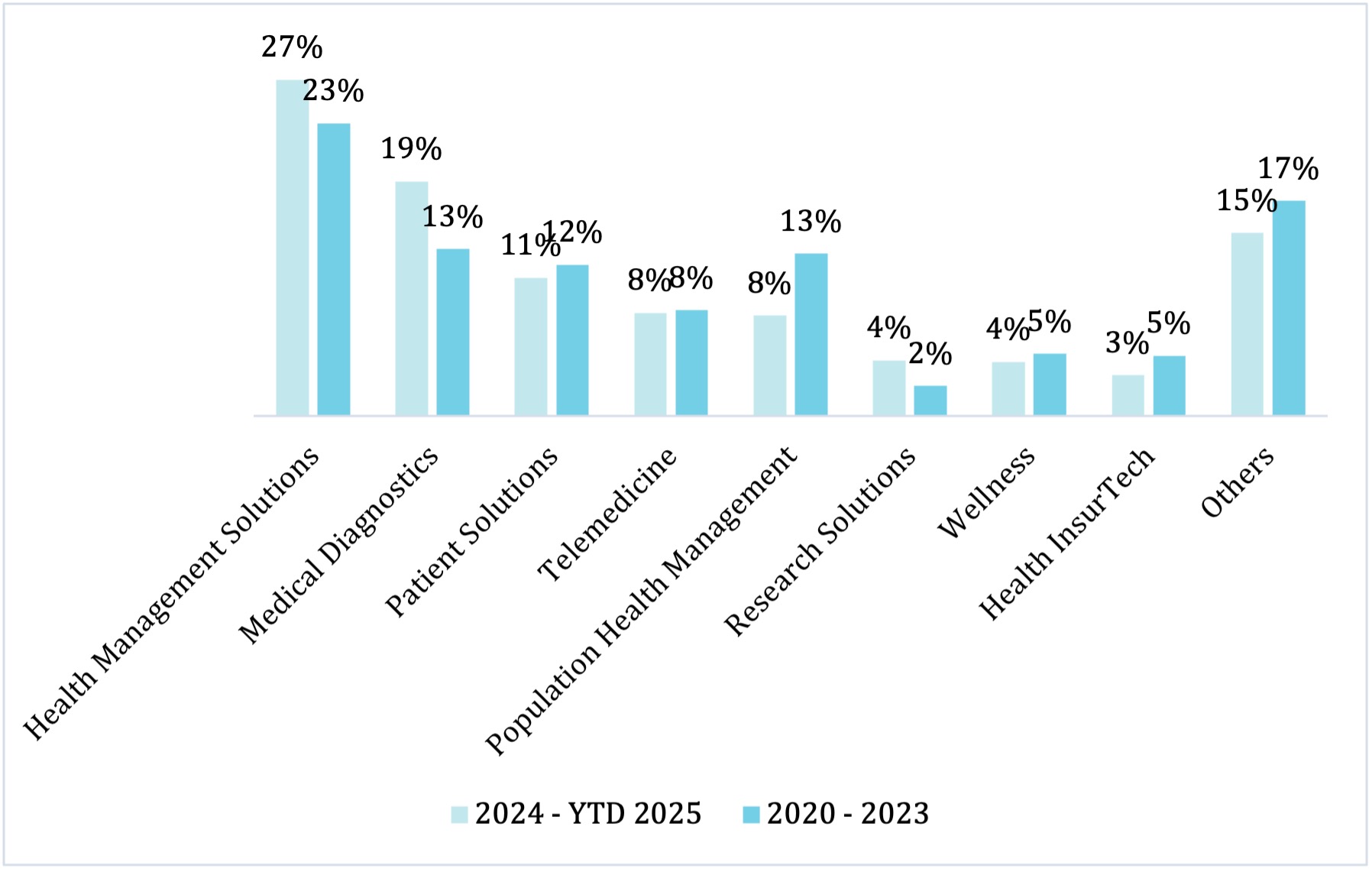

The rise in Health System partnerships is driven by urgent needs: staffing shortages, administrative inefficiencies, and outdated infrastructure. Digital health solutions — particularly in areas such as telemedicine, health management, and population health — provide a scalable approach to alleviating these stressors.

For instance, digital health solutions for medical diagnostics (including AI analysis of medical imaging, omics-related diagnostics, and other diagnostic tools) saw a surge in 2024, increasing their partnership share to 19% from an average of 13% in the previous four years. Meanwhile, AI tools for Health Management Systems also saw a substantial growth, underlining the operational lens through which many Health Systems view digital tools.

Strategic Pathways to Digital Adoption

1. Incubation and Acceleration of Innovation

In the United States, leading Health Systems like the Mayo Clinic, Cleveland Clinic, and Cedars-Sinai are not just consumers of digital health; they are creators and nurturers. Through in-house accelerators, incubators, and university partnerships, these institutions are shaping the development of solutions tailored to real-world hospital environments.

These programmes provide vital mentorship, clinical access, and implementation support, which increase the chances of long-term success for digital health ventures.

2. Investment and Corporate Venture Capital

Many Health Systems have formalised their investment strategies through venture capital arms, such as Optum Ventures and Kaiser Permanente Ventures. This dual role — as both funders and adopters — creates a unique ecosystem where innovation can be both tested and scaled internally.

Optum Ventures alone has made over 81 investments, with the capital infusion ensuring alignment between startup innovation and hospital workflow needs.

3. Partnering Beyond Borders

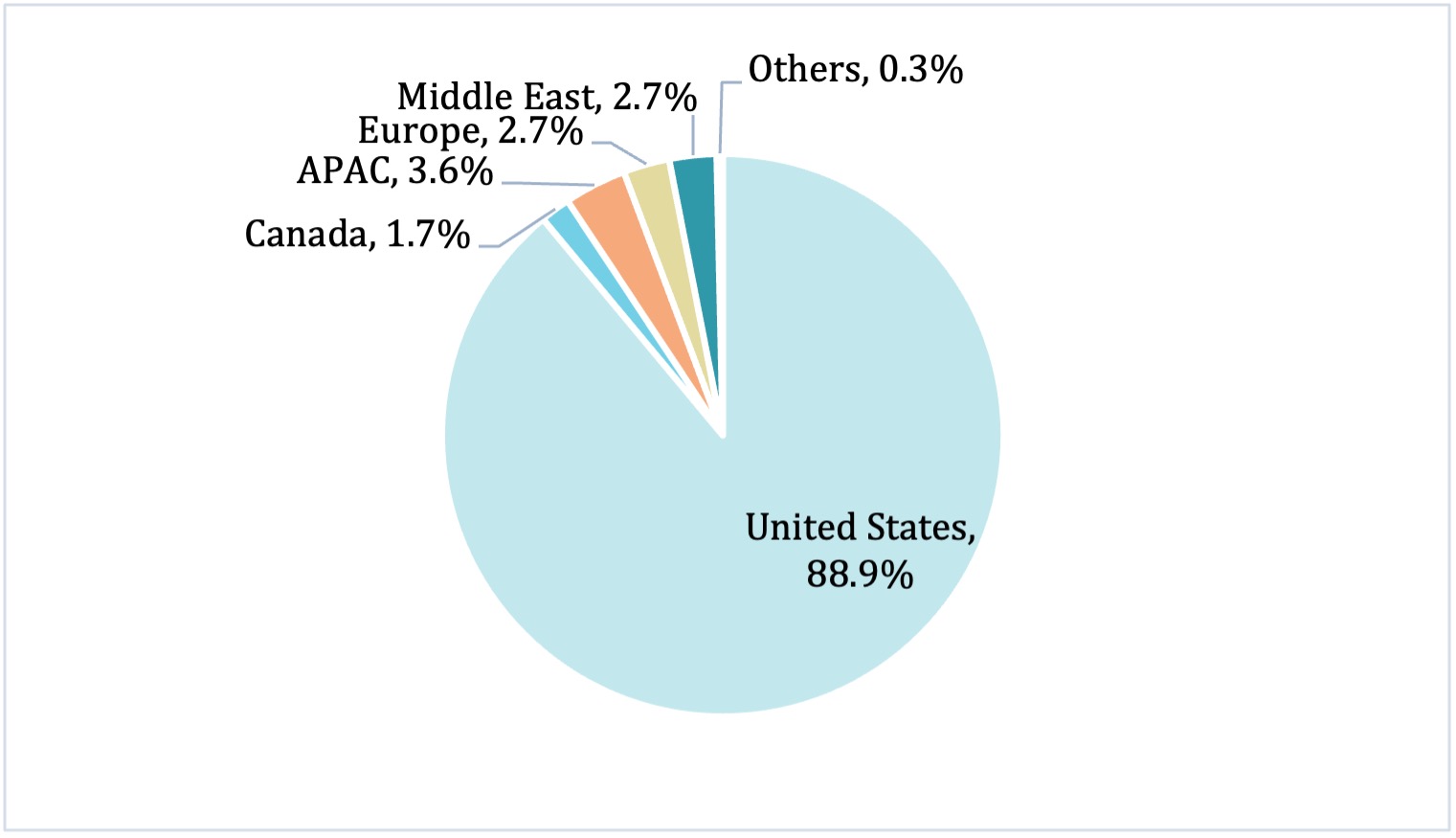

While the majority of partnerships by Health Systems are with domestic ventures, there is growing interest in global innovation, particularly in AI and diagnostics. Considering only health systems in the US, ventures initially founded in Asia and Europe have also found entry points through strong value propositions and clinical relevance.

The AI and GenAI Boom in Health Systems

Over 56% of ventures partnering with Health Systems leverage artificial intelligence. Of these, 11% are already deploying Generative AI (GenAI) — a rapidly growing subset of AI. The use of AI in diagnostics, patient triage, and operational efficiency has made it indispensable.

The FDA has approved over 1000 AI-based medical devices, signalling regulatory support for AI adoption in clinical workflows (as of 25 March 2025, www.fda.gov).

GenAI, though still in its infancy, is gaining traction within Health Systems. Use cases include:

- Automated clinical documentation. Abridge, an AI platform for transcribing medical conversations into structured clinical notes raised has partnered with health systems such as Johns Hopkins Medicine, Kaiser Permanente, and CHRISTUS Health.

- Advanced diagnostics and pathology. As the first company to receive FDA breakthrough designation for computational pathology, Paige builds products with AI-based technology to drive the future of diagnostics.

- Personalised treatment . Navina is a healthcare technology company focused on streamlining the way physicians interact with patient data and supporting clinical decision-making. Its platform uses AI and machine learning to transform complex, unstructured medical information into an organized overview of each patient.

With the promise of reducing administrative burden and improving precision care, GenAI is still gaining support in 2025, with Abridge closing a $250M Series D funding round in February.

A Look at some of the Leading Health Systems Attending HLTH Europe 2025

Motivated by a commitment to advancing patient care and operational efficiency, more than “one hundred healthcare providers” from health systems across the globe will be presenting at HLTH Europe 2025 (europe.hlth.com) to explore and engage with cutting-edge digital health innovations from around the world – visit the curated list of startups attending HLTH Europe 2025 in HealthTech Alpha. The presence of health systems at HLTH reflects a growing interest in identifying scalable, impactful technologies that can be integrated into existing care models, enhancing outcomes, reducing administrative burden, and improving the overall healthcare experience. A compendium of all ventures attending HLTH Europe 2025 can be found on HealthTech Alpha in the Featured Collections.

| Health System | Number of digital health startup partnerships | Recent partnership |

| Mayo Clinic | 144 | Axena Health |

| NHS | 111 | Navenio |

| Johns Hopkins | 26 | Caregility |

| Charité Berlin | 39 | Cure51 |

| Cedars-Sinai | 26 | Get Well |

Challenges Ahead: ROI, Interoperability, and Talent

Despite momentum, significant hurdles remain. The biggest is the lack of demonstrable ROI from digital solutions. According to a 2024 EY Health Pulse Survey (EY Health Pulse Survey: Solutions Boost Efficiencies and Automation, but ROI has Yet to Come; 9 Feb 2024), hospital executives appreciate the operational efficiency gains but are still awaiting clear financial benefits.

Other challenges include:

- Interoperability of digital tools

- Data privacy and security

- Training of staff for digital-first workflows

To overcome these, many Health Systems are appointing Chief Digital Officers and establishing dedicated digital health teams to manage implementation and change management.

The Road Ahead in 2025

The pace of digital adoption will accelerate further in 2025, driven by the necessity of efficiency gains. As a sign of long-term commitment, health systems like Intermountain Health are restructuring their executive teams to include dedicated digital health leadership, ensuring strategic oversight and sustained innovation in digital transformation efforts. (Intermountain names 2 digital health leaders – Becker’s Hospital Review | Healthcare News & Analysis)

Emerging areas to watch include:

- Bias reduction in AI/GenAI models

- Advanced EHR interoperability

- Patient-centric platforms with built-in outcomes tracking

Digital health is no longer an add-on; it is becoming the backbone of modern healthcare delivery.

Conclusion: From Partnership to Transformation

Health Systems have emerged as the dominant force in digital health, not merely as adopters but as innovators, investors, and orchestrators. Their strategic alignment with digital health ventures is reshaping healthcare as we know it.

While funding pressures and ROI concerns remain, the evidence is clear: Health Systems are committed to a digital future. The ones that succeed will be those that prioritise clinical outcomes, evidence-based solutions, and integrated care delivery models.

The digital health ecosystem is consolidating, but within this upheaval lies opportunity. Health Systems, with their scale, influence, and access to patients, are uniquely positioned to lead the next chapter of healthcare transformation.

Galen Growth – A Strategic Partner with HLTH Europe

At Galen Growth, our mission is to redefine Digital Health intelligence. To power that mission and deliver actionable insights to our clients, we built HealthTech Alpha—the leading business intelligence platform dedicated to Digital Healthcare Technology Innovation. As a strategic partner of HLTH Europe once again this year, we’re proud to support the ecosystem with data-driven clarity. A compendium of all startups participating in the conference is available in HealthTech Alpha. In addition, all HLTH Europe participants can take advantage of full, complimentary premium access to HealthTech Alpha throughout June—unlocking deep insights on health systems’ innovation strategies, partnership activity, and much more.