The second edition of HLTH Europe has just wrapped at the RAI Convention Centre in Amsterdam, and the numbers alone tell a story of growing momentum. Organisers reported more than 5,000 leaders and innovators on-site—a 40 per cent jump on last year, the digital health ecosystem in Europe is thriving. The halls, meetup areas and coffee/water stations were buzzing from the conference breakfast to the late-evening welcome party in the park, confirming that the HLTH brand’s trademark mix of content, carnival energy, and laser-focused matchmaking resonates strongly on both sides of the Atlantic while offering offering a vivid snapshot of where digital health funding and the broader ecosystem are heading. Here are our 10 Trends from HLTH Europe 2025:

1. GenAI: from novelty to non-negotiable

If last year’s talk tracks introduced generative AI, 2025 turned it into an executive mandate. Across keynotes and side-stage demos, the message was blunt: do more with less, or be left behind. Boards now expect every function—from revenue cycle management to clinical decision support—to embed GenAI-driven insights. Start-ups flaunted copilots that summarise radiology reports in milliseconds; health-system CIOs compared real-world savings from ambient clinical-documentation pilots; and NVIDIA’s health lead argued that LLM-powered tooling has pushed model-training costs down by 80 per cent, creating “the first deflationary force in modern healthcare.” The upshot is that there is no patience for lengthy manual research cycles or 18-month pilots. Those who cannot demonstrate immediate productivity gains risk falling out of the next budget cycle.

2. Investors: herd instinct meets exit constipation

You could feel the tension in the investor community. After 18 months of rapid deal-making—an attempt to deploy mountains of dry powder—VCs now find themselves caretakers of crowded portfolios with few obvious exit doors, at present. Macro-headwinds dominate corridor conversations, with no clarity on a US-China trade deal yet, uncertainty surrounding a new US tax bill, and the drag of regional conflicts. Interest-rate relief has helped, but IPO windows remain narrow, and buyers are cautious.

Processes, however, have hardly evolved: partners still slog through 60-slide pitch decks, and most due diligence checklists could have been written in 2015. Several panellists asked aloud whether a “pitch-deck PDF” is still the optimal medium in the GenAI era—why not an interactive data room that adjusts to each investor’s priorities in real time? Until that shift happens, expect capital to concentrate on existing cohort winners while newcomers find the bar significantly higher.

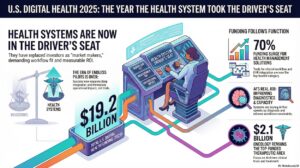

3. Health System/Provider voice grows louder in Digital Health Ecosystem

A notable change in 2024 was the even stronger presence of providers. European hospital CEOs and US provider chiefs flew in en masse, adding a dose of operational reality to debates often dominated by start-ups and investors. In closed-door roundtables, they pushed vendors to prove that their solutions integrated and fit clinical workflows, not just demonstrated algorithmic accuracy. Echoing sessions on interoperability later in the week, leaders warned that without plug-and-play data exchange, the most brilliant tools will stall at the pilot stage.

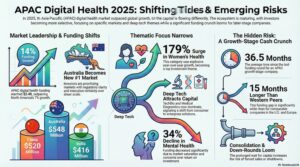

4. Femtech breaks out of its niche

The Summit Stage at HLTH Europe 2025 was the highlight for many, as Women’s Health took centre spotlight. Femtech, once narrowly defined by fertility apps, is now tackling everything from cardio-metabolic risk and menopause to chronic pain and mental health. The conversation cut deep: why is growth funding still elusive, how can startups move beyond consumer apps, and where is the next unicorn hiding? One thing was clear—Women’s Health is no longer a niche; it’s a movement gaining unstoppable momentum.

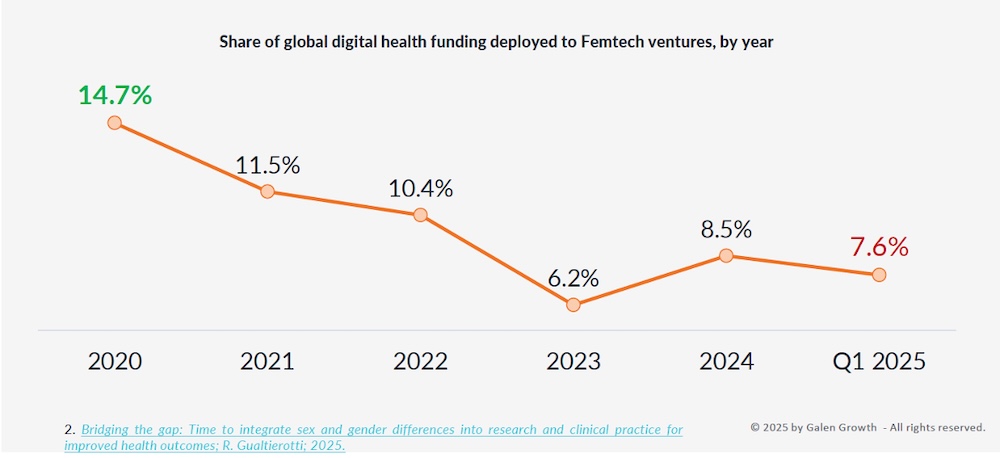

Galen Growth’s HLTH Special Edition Deep-Dive on Femtech supplied the data: venture funding bounced back to 2021 levels, yet fewer than 5 per cent of digital health exits since 2015 were in women’s health—an open goal for first movers. Investors who once lumped femtech under “consumer wellness” now see it as a pipeline for reimbursable therapeutics, diagnostics, and care pathways. Expect a surge of B2B models that sell into payers and employers hungry for retention-boosting benefits.

According to Galen Growth’s data, Femtech’s share of global digital health funding slid from 14.7 % in 2020 to just 6.2 % in 2023, before staging a modest rebound to 8.5 % in 2024 and holding at 7.6 % in Q1 2025—evidence that while momentum is returning, the sector is still regaining lost ground.

5. The agenda that mattered

HLTH’s many parallel stages could feel like trying to drink from a fire hose, but several topics cut through:

| Hot Topic | Why It Mattered |

| Women’s-health revolution | Venture dollars and regulatory tailwinds converge to correct decades of under-investment. |

| AI inside pharma | From target discovery to omnichannel medical affairs, GenAI is squeezing months out of development timelines. |

| Ambient listening | Clinical NLP that runs in the background promises to hand back 40 percent of physicians’ documentation time. |

| GLP-1 & metabolic care | Blockbuster weight-loss drugs dominate headlines, and GLP-1 specific algorithms are working their way into solutions from women’s health to cardio-metabolic tracking. However, long-term outcomes and equitable access remain unresolved. |

| Interoperability & EHDS | March’s European Health Data Space regulation sets the rules—and the market—for secondary use of data. |

| Digital Health M&A | Recent Galen Growth data show 70 percent of all deals are venture-to-venture—consolidation, yes, but still early-stage stacking rather than true scale exits. |

6. Europe’s mid-year digital health funding pulse

As we cross the halfway mark of 2025, Europe’s digital health funding deal flow is running well ahead of last year’s pace—evidence that investor conviction is returning even before exit markets fully reopen:

- USD 3.1 billion raised across 126 deals in the first five months, up 47 per cent year on year versus the same period in 2024.

- That haul already represents 60 per cent of 2024’s full-year total, putting the region on track to beat last year comfortably if momentum holds.

- May 2025 closed at USD 591 million, the third-strongest month of the year behind March and January.

A note of caution, however: preliminary numbers for June show just USD 28 million in fresh capital, far below the USD 404 million booked in June 2024. Unless a few late-month mega-rounds land, June could mark the first real cooling-off point of the year, reminding founders that market sentiment remains fragile and deal timing still matters.

7. Sunshine, serendipity and a dancing unicorn

Logistics matter, and this year HLTH nailed them. Fabulous early-summer weather meant many “Connect” meetings continued onto terrace tables; the well-orchestrated matchmaking programme generated queues of smiling participants swapping calendars. Petunia, the unicorn mascot, was everywhere—from selfies at registration to dancing at the after-hours park party—reminding us that business results and a bit of whimsy are not mutually exclusive. And yes, the breakfast spread (stroopwafels included) once again justified the early starts.

8. Galen Growth’s debut “Viosk”

For Galen Growth, the week was special: our first-ever on-site Viosk became a natural meeting point, blending live product demos with real-time deal-intel briefings. Clients appreciated a go-to spot to compare pipeline heatmaps and M&A multiples between back-to-back sessions. At the same time, curious passers-by popped in to understand how data-driven scouting differs from scatter-gun networking.

9. Exclusive offer: free HealthTech Alpha premium access

To extend the conference momentum, Galen Growth is unlocking complimentary premium access to HealthTech Alpha until 30 June 2025—exclusively for HLTH Europe participants and readers of this recap. Dive into 15,000+ digital-health companies, funding timelines, and live deal-flow analytics via this sign-up link. Whether you’re a founder validating white space, an investor tracking cohorts or a corporation evaluating the competitive landscape, the platform puts real-time evidence behind every decision.

10. Mind the process gap

Despite a show floor packed with breakthrough tech, discussions frequently circled back to execution friction. Health systems still struggle to integrate innovative point solutions into their legacy architecture; start-ups still underestimate procurement cycles; and investors still default to PowerPoint. Until the ecosystem modernises its processes with the same vigour it applies to product, scaling digital health will remain slower than the underlying technology curve.

11. Final thoughts

HLTH Europe 2025 crystallised a few truths:

- GenAI is a board-level KPI, not a moon-shot experiment.

- Capital is plentiful but patience is thin; proof points need to arrive earlier.

- Femtech’s time is now—and ignoring it is a fiduciary error.

- Regulation (EHDS, AI Act) is moving fast; data strategies must move faster.

- Fun matters. Community-building flourishes with the right ingredients.

- Perks help. Free HealthTech Alpha access turns inspiration into action—grab it before 30 June.

Special thanks to the entire HLTH Europe team for a flawlessly executed week. Galen Growth is already pencilling June 2026 in the diary. If Amsterdam in June taught us anything, it’s that serious progress and pleasure can, and should, coexist. See you next year and our Trends from HLTH Europe 2026!

About Galen Growth

The GenAI revolution has triggered a new wave of expectations—from boards, shareholders, and investors—for organisations to do more with less. Efficiency is no longer optional; it’s a mandate. Business leaders are under pressure to redesign processes, re-allocate resources, and even rethink operating models. In this environment, those who embed GenAI-driven intelligence into their decision-making will seize the advantage; those who don’t will fall behind.

Market intelligence and research are no exception—the days of slow, manual analysis are over. Galen Growth’s mission is to move clients from data to actionable insight—faster, smarter, and without the noise. Our proprietary platform, HealthTech Alpha, harnesses GenAI purpose-built for healthcare to deliver targeted, clinically relevant intelligence at speed. That frees your teams to focus on high-value strategy instead of gathering or interpreting raw data.

Whether you’re building internal GenAI capabilities or seeking a trusted intelligence partner, Galen Growth is purpose-built to help you lead in a digital-health economy that rewards speed, precision, and insight. We were founded in 2016, and today HealthTech Alpha tracks more than 17,000 health-tech companies, 120,000 funding rounds, and every partnership, M&A deal and clinical milestone shaping the sector. With headquarters in Singapore and teams in Europe and the United States, we provide a truly global lens, redefining digital-health intelligence.