TL;DR

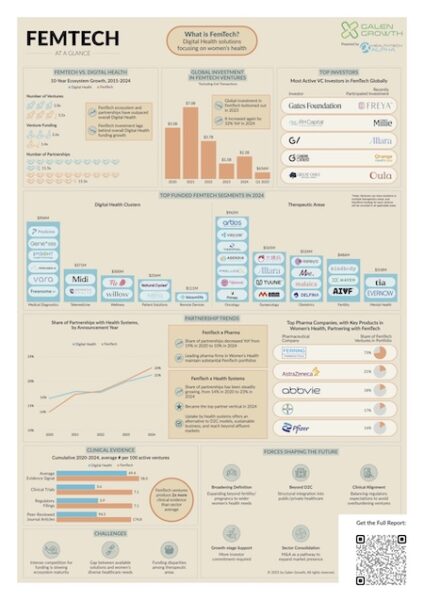

- Global Femtech investment hit $2.2B in 2024, yet it accounts for only 8.5% of total digital health funding.

- Despite growing 3.2x in the past decade, 71% of Femtech startups under six years old haven’t reached Series A.

- Femtech is held to higher clinical standards, with nearly double the evidence output vs. the average in the digital health ecosystem.

- The top-funded therapeutic areas (Oncology, Gynaecology, Fertility) don’t align with the most prevalent women’s health needs like cardiovascular disease or mental health.

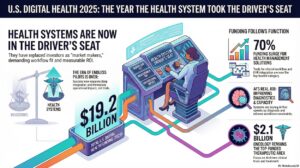

- Health system partnerships are growing, now accounting for 23% of all Femtech collaborations, surpassing big pharma.

- Strategic M&A and unicorn emergence signal commercial maturity, yet most exits are venture-to-venture.

- Read the full report to gain deeper insights into how these trends impact industry stakeholders.

Galen Growth is proud to partner with HLTH Europe 2025 to spotlight groundbreaking innovation in Femtech. As HLTH continues to lead the charge in advancing health equity, this year’s agenda features dedicated sessions designed to catalyse investment, innovation, and dialogue around the future of Women’s Health. Stop by Galen Growth’s booth #B131 to pick up your complementary Femtech cheatsheet and continue the dialogue.

The Femtech Frontier in Digital Health Ecosystem

Over the past ten years, Femtech—technology-enabled products and services addressing women’s health—has evolved from a niche term into a transformative force within healthcare. The number of strategic partnerships in Femtech has tripled since 2014, as new entrants, investors, and healthcare providers have begun to recognize the vast potential of this underserved market. In 2024, the industry achieved a major milestone with the emergence of its first unicorns—companies valued at over $1 billion. Meanwhile, funding has rebounded to and even surpassed pre-pandemic levels, signaling a renewed wave of momentum.

Yet, Galen Growth’s latest analysis reveals that as the category grows in sophistication and reach, Femtech faces a sobering truth: there remains a profound mismatch between the solutions currently available and the complex healthcare needs of women. High-value areas such as fertility and pregnancy have attracted substantial investment and media attention, often generating hype that distracts from equally urgent but under-addressed segments like chronic pain, autoimmune disorders, and menopause. These neglected areas, referred to as “ghost markets” in Amboy Street Ventures’ women’s health report, represent vast unmet clinical and commercial potential. The next chapter in Femtech’s journey will depend not just on innovation, but on how deeply it can integrate into existing systems, expand inclusively, earn trust at scale, and address real market needs.

A Decade of Growth and Breakthroughs

Femtech’s trajectory has mirrored broader shifts in digital health ecosystem but with a uniquely underserved audience at its center. Originally associated with fertility tracking apps and reproductive health devices, the category continues to expand to include menopause care, chronic condition management, mental health, pelvic health, and maternal care, among others. From AI-powered diagnostic platforms to remote monitoring tools for pregnancy, Femtech is now a multidimensional domain.

The number of strategic partnerships in Femtech has tripled over the past decade, reflecting increasing collaboration across tech, healthcare, pharma, and research. These partnerships have accelerated innovation, expanded access, and helped Femtech players integrate more deeply with the broader healthcare ecosystem.

Meanwhile, funding levels have returned to—and in many cases exceeded—their pre-pandemic highs, driven by both generalist investors and a new generation of funds specifically focused on women’s health. This resurgence of capital has enabled Femtech companies to scale more rapidly, enter global markets, and build deeper integrations with clinical care. This surge has helped move the sector beyond point solutions, encouraging end-to-end platforms that combine diagnostics, remote monitoring, telehealth, and behavioral support.

The rise of the first Femtech unicorns in 2024—combined with increased capital inflows—underscores the commercial viability of the space. No longer viewed solely as a “women’s niche,” Femtech is being redefined as a scalable, high-growth pillar of digital health.

Here are recent large investments in Femtech:

- Flo Health, $200 million Series C led by General Atlantic

- Maven, $125 million Series F led by StepStone Group

- Sword Health, $130 million Series D1 led by Saphire Ventures

- BillionToOne, $140 million Debt Funding by Oberland Capital

- Freenome, $254 million Series E led by Roche

Persistent Challenges: Trust, Access, and Structure

Despite this progress, critical challenges remain. First is the lack of reimbursement. Many Femtech services—especially digital tools in mental health, menopause, and preventative care—are not covered by insurance or public health systems, making them inaccessible to many users and financially unsustainable for providers.

Ethical concerns around data privacy are also rising. Femtech solutions often handle deeply personal data related to sexual health, fertility, mental well-being, and hormonal cycles. In the absence of strong data protections and transparency, user trust is vulnerable. Recent debates over reproductive rights in the U.S. have made it clear that data from seemingly benign apps could be used in harmful ways if not securely managed.

Additionally, many current solutions fail to serve the full diversity of women+ populations. Most products still disproportionately target urban, affluent users, leaving out communities of color, rural populations, and LGBTQ+ individuals. Moreover, critical areas like autoimmune diseases and cardiovascular diseases disproportionally affect women, but gender-focused solutions are still uncommon. Without intersectionality and targeted innovation in these underserved sectors, Femtech risks reinforcing existing health disparities and missing significant opportunities for impact.

Finally, regulatory ambiguity is an ongoing barrier. Many products fall into gray zones—neither clearly medical devices nor straightforward consumer wellness tools—making approval processes unpredictable and slow. This hampers investor confidence and slows clinical adoption.

What’s Next: Five Forces Shaping the Future of Femtech

The next era of Femtech will depend on the sector’s ability to scale with purpose. Five key forces will shape its trajectory:

1. Broadening Definitions of Women’s Health

Femtech must continue to evolve from its narrow focus on fertility and pregnancy to encompass the full arc of women’s lives. Chronic pain, autoimmune conditions, cardiovascular disease, menopause, and hormone-related disorders represent massive unmet needs. Companies that embrace this broader mandate will define the next wave of impactful innovation.

2. Scientific and Regulatory Advancement

Clinical validation and regulatory approval will be essential to secure both investor confidence and user trust. This requires updating outdated medical device regulations to reflect the realities of software-enabled, AI-driven personal health tech. Regulatory bodies must ensure robust standards around testing, data accuracy, and ongoing monitoring for safety.

3. Greater Inclusivity and Structural Support

To truly scale, Femtech must be embedded within healthcare systems—with support from insurers, public health agencies, and employers. Moving beyond direct-to-consumer models will allow solutions to reach underserved populations and become part of long-term care pathways. Without structural support, the sector risks becoming another layer of privilege in healthcare access.

4. Investment in People

Technology is only as powerful as the people behind it. Increasing digital health literacy among women and health workers is essential to effective adoption. Equally important is diversifying leadership within Femtech and digital health at large. Women must have a central role in designing, implementing, and governing the systems that affect their care.

5. Strengthening Legislation and Regulation

Femtech companies must be held to rigorous ethical standards, particularly when handling sensitive personal data. Updated privacy laws, medical device frameworks, and clear guidance around digital contraceptives and fertility tools are all urgently needed. These protections are critical to both safety and trust.

Final Thoughts

Femtech has reached a powerful inflection point. A tripling of partnerships, a rebound in funding, and the emergence of the first unicorns have all signaled its coming of age. But scale alone isn’t success. True impact will be measured by whether Femtech can bridge the gap between innovation and access, promise and proof.

The companies and leaders who thrive in the next decade will do more than build smart apps. They will reimagine healthcare systems, earn trust through evidence, and center the voices of those too often left behind. Femtech is no longer just a movement—it is a mandate for change.

The Digital Health for Femtech Cheatsheet

Frequently Asked Questions (FAQ) about Femtech

Q: What is Femtech, and why is it important in 2025?

Femtech refers to digital health solutions specifically addressing women’s health needs across the life course, including fertility, menopause, maternal care, cardiovascular disease, and mental health. In 2025, Femtech is emerging as a strategic growth sector in the digital health ecosystem, with the potential to unlock a $360 billion market that has historically been underserved and underfunded.

Q: How much investment has gone into Femtech recently?

In 2024, global Femtech investment reached $2.2 billion, representing 8.5% of total digital health funding. However, this marks a decline from a peak of 14.7% in 2020, signalling a need for renewed investor focus despite growing demand and clinical rigour in the sector.

Q: What are the fastest-growing areas within Femtech?

While fertility and gynaecology remain the top-funded categories, there is growing momentum in mental health, menopause care, and cardiovascular solutions. Notably, menopause-related ventures have gained strong traction in recent years, particularly in Europe.

Q: How does Femtech perform in terms of clinical evidence?

Femtech startups outperform their digital health peers in clinical strength, producing twice the number of clinical trials, regulatory filings, and peer-reviewed publications. This positions Femtech as a leading category in evidence-based digital health innovation.

Q: Why is there still a gap in digital health funding if the sector is growing?

Despite strong venture growth—3.2x over the last decade—Femtech has only seen a 1.4x increase in funding, compared to 2.6x in the broader digital health ecosystem. Over 70% of ventures under six years old have not yet reached Series A, highlighting an early-stage funding bottleneck.

Q: What role do health systems and partnerships play in scaling Femtech?

Health systems are increasingly embracing Femtech, with 23% of all Femtech partnerships in 2024 involving providers—surpassing pharma for the first time. This trend points to greater clinical integration, reimbursement potential, and long-term viability within mainstream healthcare.

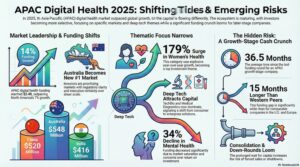

Q: How does Femtech vary across regions like North America, Europe, and Asia-Pacific?

- North America remains the funding leader, capturing 65% of global Femtech investment.

- Europe saw a 157% year-on-year growth in 2024 and leads in clinical validation strength.

- Asia-Pacific, once an innovation hub in diagnostics, experienced a 24% decline in investment, signalling potential for revitalisation through health system partnerships and public-sector engagement.

Q: Why should payors and pharmaceutical companies pay attention to this space?

For payors, Femtech solutions offer proven pathways to reduce long-term healthcare costs, particularly in chronic disease management and maternal health. For pharma, Femtech presents partnership opportunities for digital therapeutics, lifecycle extension, and precision medicine—especially as companies with strong clinical validation gain traction in regulatory and healthcare ecosystems.

Q: What are the key trends shaping the future of Femtech?

- Broadening the definition: Expanding from fertility to “Women + Health,” including chronic conditions and hormonal health.

- Clinical integration: Moving beyond consumer apps into reimbursed, evidence-backed care pathways.

- Funding the growth gap: A need for capital beyond early-stage investment to scale proven solutions.

- Consolidation: Increased M&A activity as ventures mature and seek sustainable exits.

- Regulatory balance: Aligning evidence standards with innovation timelines to avoid stifling progress.

Q: How can investors and innovators act on these insights?

Investors should prioritise data-backed ventures with health system traction, while innovators must shift from lifestyle UX toward enterprise-ready, clinically validated offerings. The report makes clear that distribution—not validation—is now the biggest barrier to growth.