TL;DR

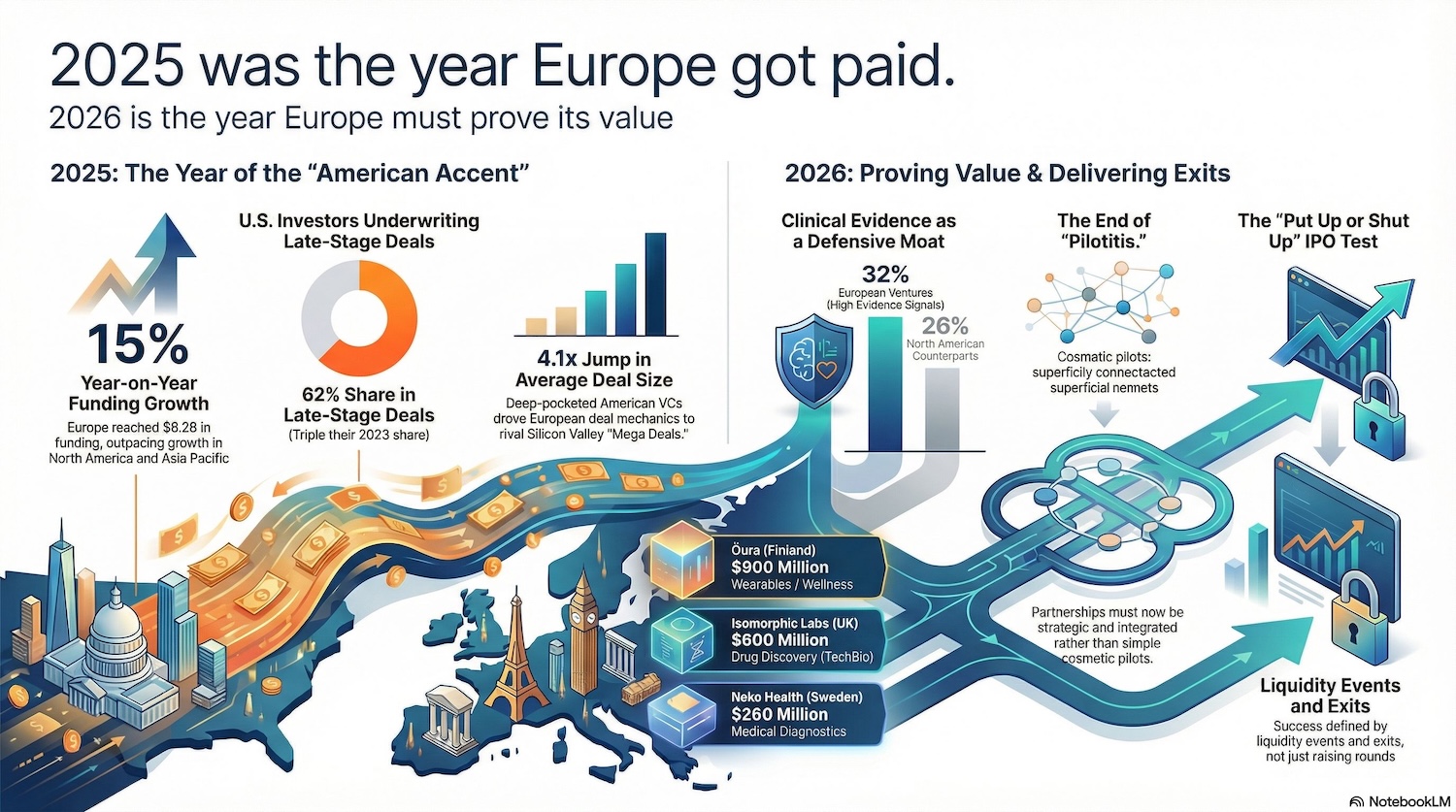

- Europe Leads Growth: Europe was the fastest-growing region in 2025, with funding rising 15% year-on-year to $6.2 billion, outpacing North America.

- The “American Accent”: U.S. investors fuelled this surge, participating in 62% of late-stage deals (triple the 2023 rate) and driving average late-stage deal sizes up 4.1x.

- Strategic Export: American capital is actively targeting European category winners—particularly in Preventive Health and TechBio—to scale them within the U.S. market.

- The Valuation Risk: The flood of capital raises uncomfortable questions about whether valuations are now outpacing Europe’s slower go-to-market cycles and limited exit infrastructure.

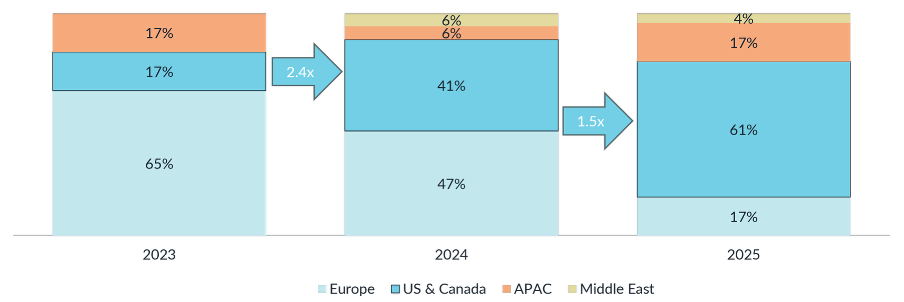

If you looked purely at topline growth percentages for 2025, you might assume Europe had suddenly solved the puzzle of scaling digital health. The region delivered the strongest growth globally, with funding rising 15% year-on-year to $6.2 billion. For context, this outpaced the mature North American market, which grew 7% to $19.5 billion, as well as the recovering Asia Pacific region, which rose 14% to $2.4 billion. Even the Middle East, while growing 11%, did so from a much smaller base.

Europe’s Boom Has a U.S. Underwriter

On the surface, this appears to signal that European ventures have finally found the growth capital historically missing from an ecosystem long dependent on government grants and smaller, risk-averse funds. However, beneath these headline figures lies a structural shift that changes the narrative entirely. Europe may be booming, but U.S. investors are now effectively underwriting its late-stage growth.

This analysis draws on the Galen Growth Global Digital Health Funding and Key Trends 2025 report, which shows how foreign capital has reshaped Europe’s funding dynamics heading into 2026.

The “American Accent” in European Deal Flow

The defining trend of 2025 was the aggressive entry of U.S. capital into European boardrooms. Historically, late-stage rounds were syndicated primarily by local or regional investors. That era now appears firmly over.

By 2025, U.S. investors accounted for 62% of all participants in European late-stage digital health deals—roughly triple their share in 2023. The impact on deal mechanics has been profound. The influx of deep-pocketed American venture capital drove the average late-stage deal size in Europe to increase 4.1x compared with 2024.

We are no longer talking about modest Series B rounds. Europe is now seeing mega-deals that rival anything in Silicon Valley, including:

- Ōura in Finland securing a $900M Series E, led by Fidelity Management & Research Company

- Isomorphic Labs in the UK raising $600M in a strategic round involving Alphabet,

- Neko Health in Sweden closing a $260M Series B, led by Lightspeed Venture Partners, and

- Amboss in Germany raising $259M for medical education.

Why the U.S. Expansion Play Is Driving Capital Inflows

This surge is not simply a diversification strategy for American investors. The primary driver is that Europe’s leading digital health ventures are no longer operating solely within national or regional boundaries. Many are already active in, or explicitly targeting, the U.S. healthcare market.

U.S. investors are identifying best-in-class European technologies and funding them specifically to scale on American soil. These ventures often arrive with deeper clinical validation than U.S.-born startups raised in growth-at-all-costs environments. As a result, American capital is effectively importing de-risked innovation—using Europe as a high-quality R&D engine for navigating FDA scrutiny and demanding U.S. payers.

| Venture | Funding | Category | Investors |

| Ōura | $900M | Wearables | Fidelity, ICONIQ Partners, Whale Rock, Atreides Management |

| Neko Health | $260M | Medical Diagnostics | Lightspeed Venture Partners, General Catalyst, OG Venture Partners, Rosello, Lakestar, Atomico |

| Amboss | $259M | Medical Education | KIRKBI, M&G Investments, Lightrock and more. |

| Isomorphic Labs | $600M | Drug Discovery | Thrive Capital, GV, Alphabet |

| CMR Surgical | $200M | Prescriptive Analytics | Trinity Capital, Lightrock, SoftBank |

The Uncomfortable Question: Valuation Versus Reality

This flood of capital raises a difficult question for European boards and early backers. European healthcare systems remain fragmented, with go-to-market cycles slowed by more than 27 distinct regulatory and reimbursement environments. At the same time, Europe’s exit infrastructure—particularly large-scale M&A and deep public markets—lags far behind North America.

The capital is undeniably real. Whether the ecosystem can generate exits at levels that justify increasingly American-style pricing is the central test heading into 2026.

Regional Powerhouses: The UK and Finland

Capital distribution across Europe was far from uniform. The United Kingdom maintained its position as the region’s heavyweight, attracting $2.11 billion in funding. This was supported by a favourable policy environment, including AI-enabled pathways that significantly reduced clinical trial approval timelines.

Finland surged into second place with $1.16 billion, heavily skewed by the Ōura mega-round. Meanwhile, France ($731M) and Germany ($612M) experienced funding declines, suggesting investor concentration around specific high-growth assets rather than broad ecosystem exposure.

Where the Money Went: Preventive Health and TechBio

Europe’s capital allocation differed markedly from the U.S. market. Preventive Health emerged as the top-funded therapeutic area, rising 88% year-on-year to $869 million, largely driven by wellness-focused models that blend consumer engagement with clinical rigour.

At the same time, Research Solutions and TechBio remained core pillars of the ecosystem, while Oncology continued to attract substantial investment, reinforcing Europe’s strength in deep-tech biology and AI-driven discovery.

Partnerships: The End of Logo Hunting

While funding accelerated, partnership activity told a more sobering story. New partnership announcements involving European ventures collapsed in the second half of 2025, falling to just 26 in Q4.

This decline signals the end of pilot-driven “logo hunting.” Corporates and health systems are rationalising stacks, and venture-to-venture partnerships—now representing 28% of collaborations—point to ecosystem consolidation as single-point solutions struggle to survive procurement scrutiny.

Europe’s Competitive Edge: Clinical Evidence

Despite these challenges, Europe retains a decisive structural advantage: clinical evidence. Thirty-two percent of European ventures demonstrate strong validation signals, outperforming North America and APAC.

As regulators and payers tighten evidence requirements, this evidence-first culture—once viewed as a drag on speed—has become both a defensive moat and an offensive weapon for U.S. market entry.

2026 Outlook: The IPO Test

As IPO windows show early signs of reopening and companies such as Doctolib appear on watchlists, 2026 represents a “put up or shut up” moment. Raising capital is no longer the benchmark of success. Liquidity is.

If Europe can deliver exits that justify the 4.1x increase in deal sizes, it will cement its status as a true peer to the U.S. If not, a valuation correction may follow.

Stakeholder Playbook for Digital Health Funding in 2026

- Investors: With capital concentrating into operational winners and risk shifting from technology to execution, investors are prioritising diligence on unit economics and retention rates over narrative-driven rounds to ensure returns in an increasingly polarised market.

- Corporates (Pharma): As the industry pivots toward Direct-to-Patient (DTP) infrastructure, pharmaceutical companies are shifting partnering strategies away from broad innovation scouting and toward fewer, deeper relationships with ventures that offer established distribution and measurable operating outcomes.

- Health Systems: Acting as the sector’s market makers, health systems are using increased procurement leverage to reject pilotitis and demand standardised interoperability, immediate workflow relief, and contracts tied to hard clinical or economic outcomes.

- Digital Health Startups: The era of selling on vision has ended. To raise capital or exit in 2026, ventures must demonstrate durable adoption, defendable distribution, and clinical evidence that satisfies increasingly strict procurement committees.

Why This Matters Now

The digital health market has moved decisively from hype to hard results. Funding is rising, but it is more selective. Partnerships are fewer and deeper. Buyers are more demanding.

The full dataset, analysis, and forward-looking insights are available in Galen Growth’s 2025 digital health funding research.