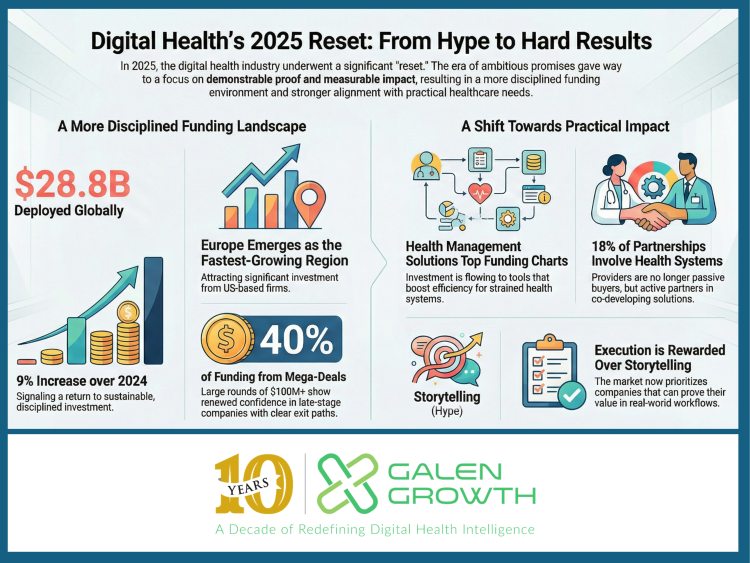

For much of the last decade, digital health was defined by ambition. Big visions, bold claims, and exponential growth narratives dominated boardrooms and pitch decks alike. But in 2025, the industry entered a different chapter, one shaped less by promise and more by proof.

This was the year digital health recalibrated. In 2025, digital health funding entered a reset phase, marked by disciplined capital allocation, fewer speculative bets, and a renewed focus on measurable healthcare outcomes. Funding stabilized, expectations matured, and attention shifted decisively toward solutions that deliver measurable impact in real healthcare environments. The result wasn’t a slowdown; it was a reset. And resets, when done well, create stronger foundations for long-term growth.

TL;DR

- Digital health funding shifted from hype to measurable results in 2025, stabilizing and a focus on real-world impact.

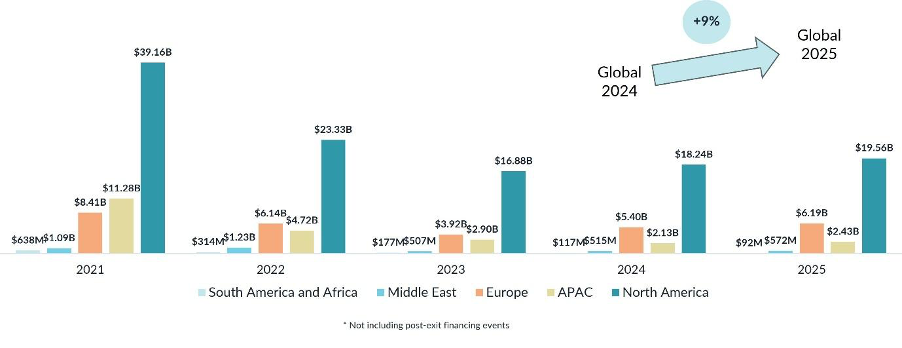

- Global digital health funding reached $28.8B (up 9% from 2024); Europe saw the fastest growth at 15%.

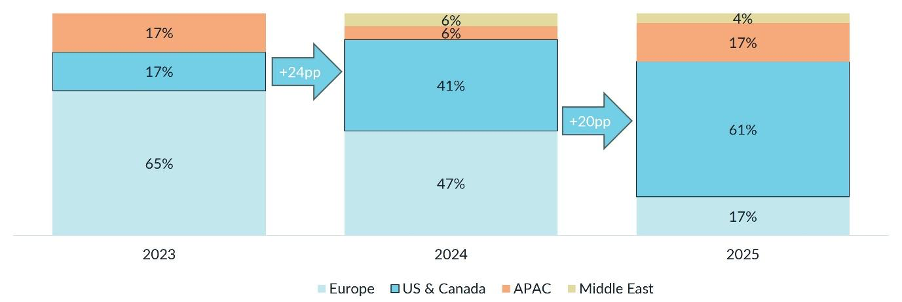

- US investors surged into European late-stage deals, with the volume of US investors in European-founded ventures up twenty percentage points, making up 61% of participants and driving up valuations.

- Health systems, under pressure from workforce shortages and rising demand, became active drivers of digital health innovation and partnerships, capturing 18% of all newly announced partnerships.

- As 2025 ends, digital health stands on firmer ground, with a more resilient and focused ecosystem ready for sustainable growth.

A Healthier Funding Environment Emerges

After several volatile years, global digital health funding returned to a more sustainable rhythm in 2025, with USD 28.8 billion deployed, a 9% increase over 2024. Capital didn’t disappear; it just became more disciplined. Investors moved away from scattershot experimentation and toward companies with clear paths to revenue, scalability, and exits.

The US remained the largest market by total capital deployed, underlining its continued leadership in late-stage financing and mega-rounds. Yet the more dynamic shift occurred in Europe. With funding up 15% year-over-year, Europe emerged as the fastest-growing region globally, reinforcing a trend Galen Growth has highlighted repeatedly: regional ecosystems mature fastest when capital, talent, and policy align.

Companies such as Doctolib, Flo HealthandSword Health exemplify this evolution. Once viewed as regional success stories, they are now recognized as scalable platforms with international relevance. Their growth reflects not only improved access to capital but also a clearer focus on operational integration within healthcare systems, which is something investors increasingly reward.

US Capital Rediscovers Europe

One of the most defining structural shifts of 2025 was the growing presence of US investors in European digital health rounds. While European investors dominated late-stage funding locally just two years ago, US participation surged in 2025, accounting for nearly two-thirds of investors in late-stage European deals.

This influx of capital had immediate consequences. Larger rounds became more common, average ticket sizes increased, and valuations rose accordingly. Companies such as Oura illustrate why global investors are paying closer attention to Europe. What began as a consumer-focused wearable has evolved into a data-rich health platform increasingly relevant to enterprise wellness, research, and preventive health—areas where scale, longitudinal data, and behavioural insight matter deeply.

For investors, this shift reflects both opportunity and necessity. As competition for high-quality assets intensifies in the US, Europe offers scale, talent, and regulatory clarity, often at valuations that still leave room for upside. The investor focus is not only on European ventures that have shifted focus to the US, but also on ones that are high-potential and European-focused. For ventures, it provides access not just to capital but also to networks, strategic partners, and exit pathways that were previously harder to reach.

European Deal Sizes Are Rising – Are They Being Pushed Too Far?

Rising deal sizes across Europe have become one of the most closely watched digital health trends of 2025. A key driver has been the growing presence of US investors in European late-stage rounds—investors who often bring valuation benchmarks shaped by the US market, where larger deal sizes, higher revenue multiples, and faster scaling assumptions are the norm. While this influx of capital has accelerated growth and visibility for European ventures, it also risks pushing valuations beyond levels the region has historically supported, particularly given Europe’s fragmented healthcare systems and longer go-to-market timelines.

The concern is not that European valuations are increasing, but that they may do so unevenly. Companies with global demand and platform economics—such as Oura, which combines strong consumer traction with expanding enterprise and research relevance—may justify higher pricing. However, applying similar expectations broadly across the ecosystem could create misalignment between valuation and execution reality. For investors, this raises the importance of discipline and regional context; for founders, higher valuations bring ambition but also less room for error. How Europe balances global capital with local market dynamics will shape whether this cycle produces durable category leaders or future valuation corrections.

Details on the growth of average deal size by stage for European ventures can be found in Galen Growth’s full report, which will be published on 8 January 2026.

Health Systems Under Pressure—and Finally in the Driver’s Seat

Perhaps the most consequential shift of 2025 wasn’t geographic or financial, but operational.

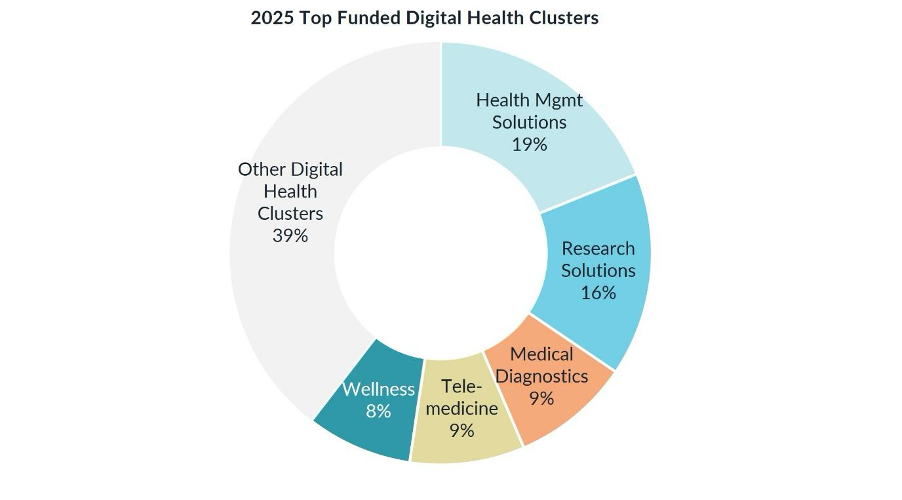

Health systems across the globe are under unprecedented strain. Workforce shortages, clinician burnout, cost inflation, and rising patient demand have transformed digital transformation from a “nice to have” into a strategic imperative. In response, Health Management Solutions overtook Research Solutions as the most funded digital health cluster of the year.

This shift mirrors what Galen Growth has observed across multiple cycles: when healthcare systems are under pressure, investment flows toward tools that improve efficiency, coordination, and decision-making. Companies such as Innovaccer, Notable, and Abridge have gained traction by addressing exactly these pain points—streamlining workflows, automating administrative tasks, and enabling data-driven operations at scale. While industry mammoths such as Epic and Oracle try to keep up by introducing their own AI-based tools(see Galen Growth’s blog, “Epic Joins the AI Scribe Race: Can Startups Still Win?”), innovation is clearly being driven by digital health startups.

Importantly, providers are no longer passive buyers. In 2025, health systems accounted for 18% of more than 3,150 digital health partnerships announced globally. These partnerships signal a deeper form of engagement—one where hospitals and health systems actively shape product roadmaps, co-develop solutions, and commit to long-term adoption.

Mega-Deals Return with a Purpose

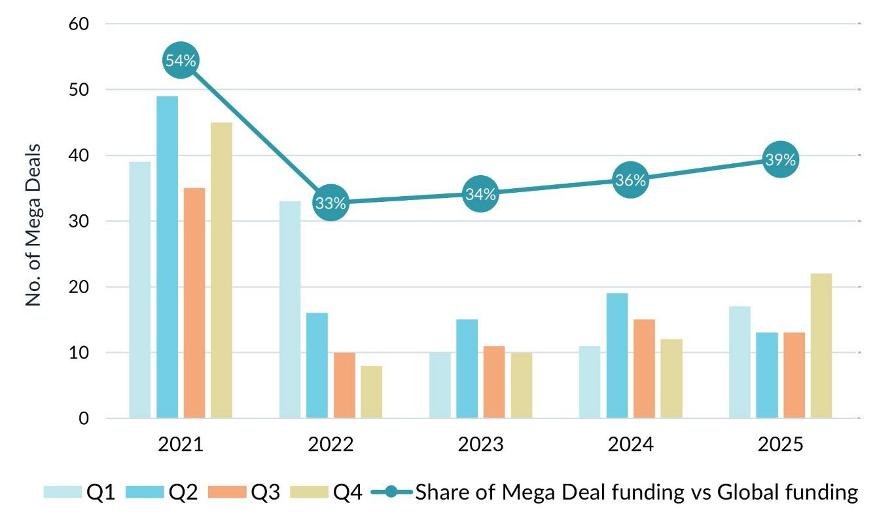

While overall deal counts fell to a five-year low in 2025, capital concentration increased. Mega-deals (rounds of $100 million or more) remained a defining feature of the funding landscape, accounting for nearly 40% of total digital health investment.

This trend reflects renewed confidence in exit pathways. With IPO windows showing signs of reopening and strategic M&A activity expected to pick up in 2026 after a flat 2025, investors are once again willing to fund growth- and late-stage companies aggressively, provided they demonstrate readiness.

For ventures, this environment rewards proof points. Companies that can articulate a compelling growth story, backed by metrics and market fit, are finding capital available. Those that can’t are being forced to consolidate, pivot, or exit, which is another hallmark of a maturing market.

Why This Reset Matters — for Everyone

The changes of 2025 carry different implications depending on where you sit in the ecosystem.

For corporates, the reset offers an opportunity to engage with digital health more strategically. The market is no longer crowded with undifferentiated point solutions. Instead, it’s populated by more resilient companies solving real problems. This creates opportunities for meaningful partnerships, targeted acquisitions, and long-term platform integration.

For investors, the signal-to-noise ratio has improved dramatically. Fewer deals, larger rounds, and clearer benchmarks make it easier to identify winners and to support them through multiple growth phases. The return of disciplined capital allocation doesn’t limit upside; it improves the odds of capturing it.

For ventures, the message is both challenging and encouraging. Storytelling alone is no longer enough — execution is rewarded. Companies that embed deeply into healthcare workflows, demonstrate measurable impact, and align with system-level priorities are finding both customers and capital.

Digital Health Funding Outlook for 2026

Looking ahead, digital health funding is expected to remain selective in 2026. Capital is likely to concentrate further around late-stage companies demonstrating EBITDA visibility, enterprise adoption, and defensible data assets, while early-stage funding remains constrained outside priority categories such as AI-enabled workflow automation and infrastructure.

Looking Ahead: A Stronger, Sharper Digital Health Sector

After the close of 2025, digital health stands on firmer ground than it has in years. The excesses of the past have given way to a more focused, resilient ecosystem, one better aligned with the realities of healthcare delivery and the expectations of capital markets.

The next phase of digital health growth will be built by companies that understand healthcare’s constraints as well as its possibilities and by investors and corporates willing to engage with nuance rather than hype. If 2025 proved anything, it’s that the industry is finally ready to do exactly that.

Stay Informed: Be the First to Access the Full Analysis

Galen Growth’s full analysis of 2025, packed with detailed data, insights, and forecasts, will be published on 8 January 2026. Don’t miss out on this indispensable resource for understanding the future of digital health.

The report aims to fill gaps left by competitors by exploring niche areas such as AI’s role in digital health solutions, global healthcare market trends, and impactful M&A strategies, making it an indispensable resource for industry leaders.

Subscribe now to be notified as soon as the report is live. Stay ahead of the curve and gain the intelligence you need to make informed decisions in 2025.

Disclaimer

The insights and trends discussed in this blog are based on preliminary data and analysis from Galen Growth’s proprietary HealthTech Alpha platform. While every effort has been made to ensure accuracy, the information is subject to further validation and refinement in our full “State of Digital Health 2025” report, which will be published on 8 January 2026. Readers are encouraged to consult the full report for a comprehensive and detailed understanding of the digital health landscape. Galen Growth assumes no liability for decisions made based on the information presented in this blog.