TL;DR

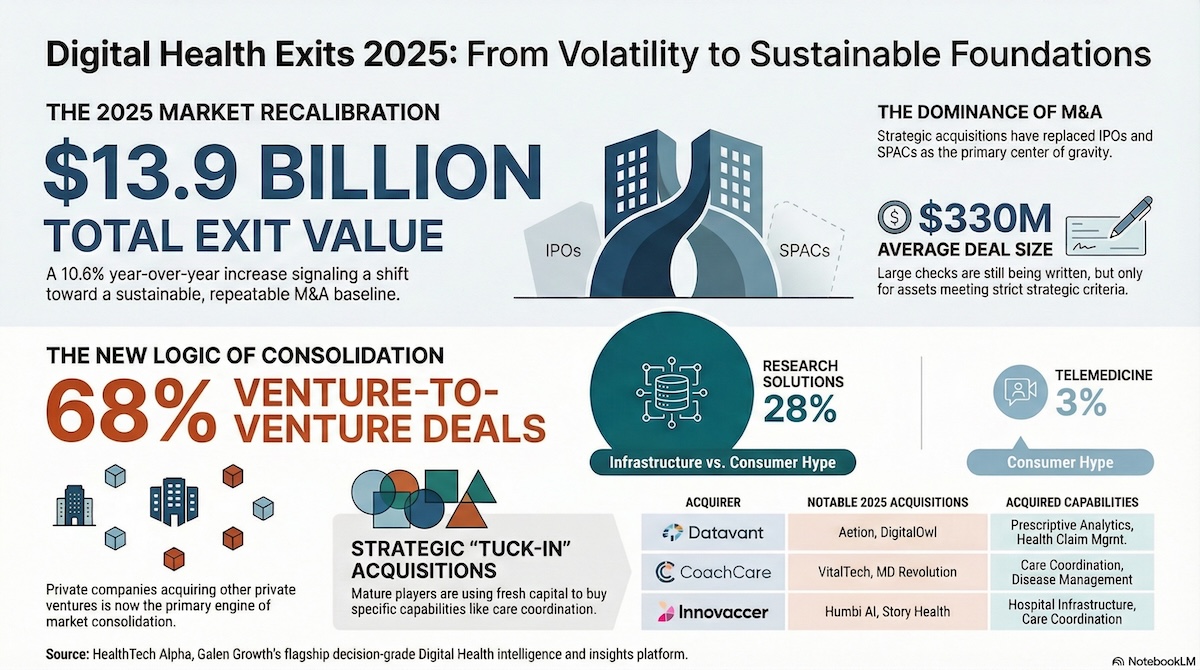

- Market Stabilization: Digital health exits rose 10.6% to $13.9 billion in 2025, signaling a shift from volatility to a sustainable baseline driven by consistent M&A.

- Venture Consolidation: Venture-to-venture acquisitions became the primary driver of consolidation, accounting for 68% of deals in 2025 as mature players acquired specific capabilities.

- Infrastructure Focus: Capital concentrated on B2B infrastructure like Research Solutions (28%), while consumer-centric sectors like Telemedicine dropped to just 3% of exit value.

- 2026 Outlook: M&A remains the dominant exit path, though the IPO window is expected to reopen for a select cohort of scaled companies.

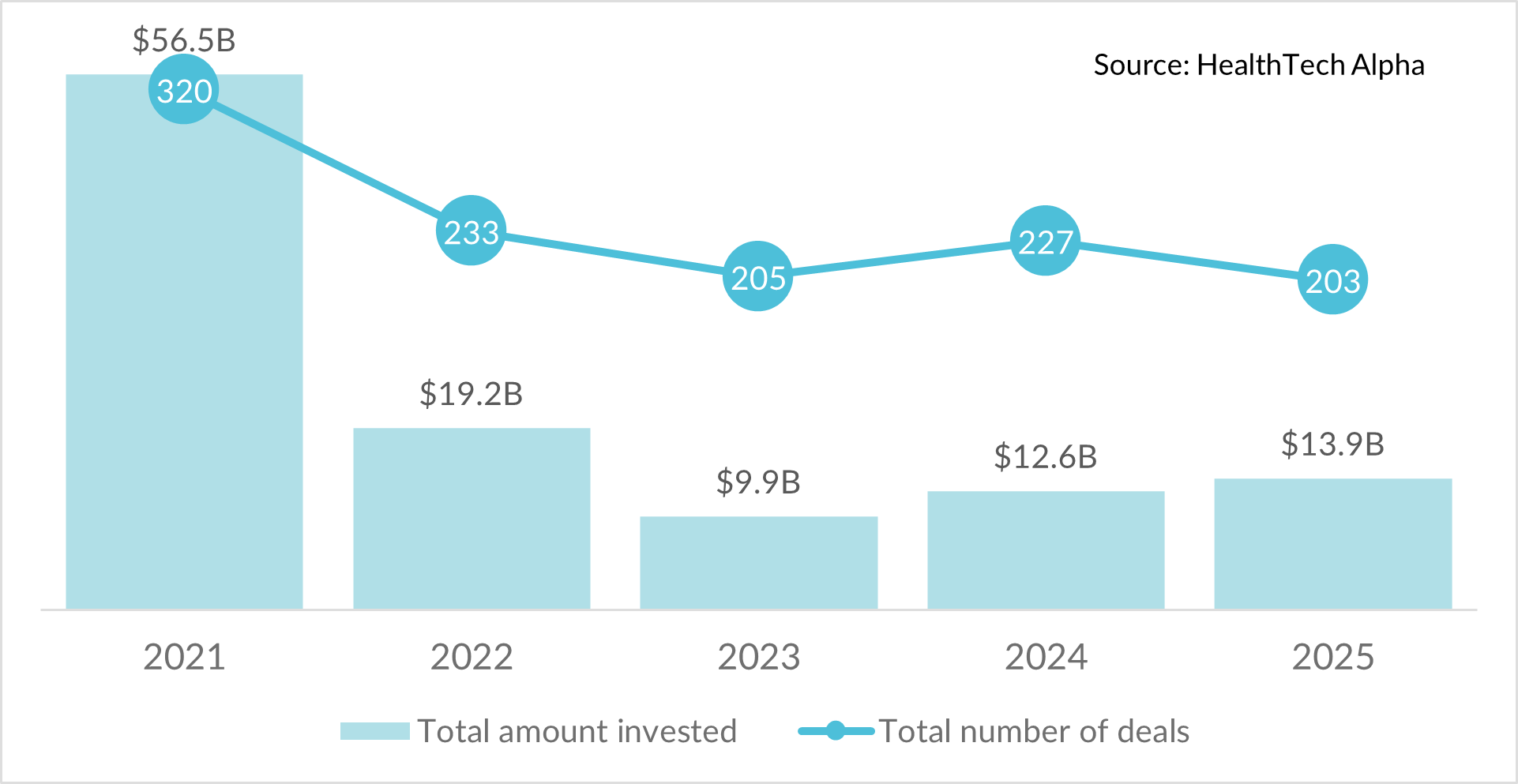

For much of the past three years, digital health has lived in the long shadow of its own excesses. The exuberant valuations of 2020–21 gave way to a bruising correction, as rising interest rates, tighter capital markets and sceptical public investors reshaped expectations of what the sector could credibly deliver. Against that backdrop, the exits data from 2023 to 2025 tell a more nuanced story than the familiar narrative of collapse. The market has not disappeared. It has recalibrated.

5-Year Trend of Cumulative Exit Value in Digital Health

Between January 2023 and December 2025, 620 digital health ventures were acquired or taken public, generating a cumulative exit value of $36.3bn. That figure alone dispels the idea of a frozen market. But the distribution of that value — by year, quarter and exit type — reveals how profoundly the character of digital health exits has changed.

A three-year reset, not a retreat

The immediate post-correction year, 2023, was marked by volatility rather than paralysis. Exit value reached $11.9bn, but it was unevenly spread: Q1 2023 alone accounted for $4.5bn, followed by a steady deceleration through the year. This pattern reflected transactions initiated under earlier valuation assumptions that were finally cleared, even as new deals became harder to justify.

In 2024, the market steadied. Annual exit value rose to $12.6bn, an increase that owed less to exuberance and more to volume. Quarterly exit values remained largely within a narrow band — $1.8bn to $4.4bn per quarter — signalling that the market is adjusting to a lower, more sustainable baseline. This was not a return to growth-at-all-costs. It was a market learning to transact again under discipline.

Then came 2025 — the most instructive year of the cycle.

2025: Momentum without mania

In 2025, digital health exits climbed to $13.9bn, up 10.6% year-on-year, marking the strongest annual performance of the past three years. Crucially, this growth was not driven by a single outlier transaction or a brief reopening of IPO markets. Instead, it reflected consistent deal flow across all four quarters, with exit values of $3.3bn in Q1, $4.7bn in Q2, $2.5bn in Q3 and $3.4bn in Q4.

The second quarter was the high-water mark, delivering 60 exit deals and $4.7bn in value, before a modest softening later in the year. Even the traditionally volatile final months of the year showed resilience. While December 2025 saw just $150m across eight deals, the prior quarters had already done the heavy lifting.

This matters because it shows a market driven by repeatable M&A, not fragile capital-market sentiment. IPOs and SPACs — once the defining exit routes for venture-backed digital health — have become marginal in both value and frequency. The centre of gravity has shifted decisively towards strategic and private-equity-led acquisitions.

Bigger cheques, fewer illusions

The average exit deal size across the three-year period stood at $330m, reflecting a market where buyers are willing to write large cheques — but only for assets that meet far stricter criteria. The largest transactions of the period underscore this point: multibillion-dollar acquisitions rather than speculative listings now anchor exit value.

Exit capital has also concentrated in specific parts of the digital health stack. Research Solutions accounted for 28% of total exit value ($10.3bn), followed by Health Management Solutions (16%) and Health Insurtech (13%). These are not consumer-led, engagement-driven categories. They are infrastructure-heavy, data-rich businesses embedded in enterprise workflows, reimbursement systems and regulated environments.

Telemedicine, once the emblem of pandemic-era exuberance, accounted for just 3% of the exit value. Wellness barely registered. The market has voted — and it has voted for depth over reach and defensibility over growth narratives.

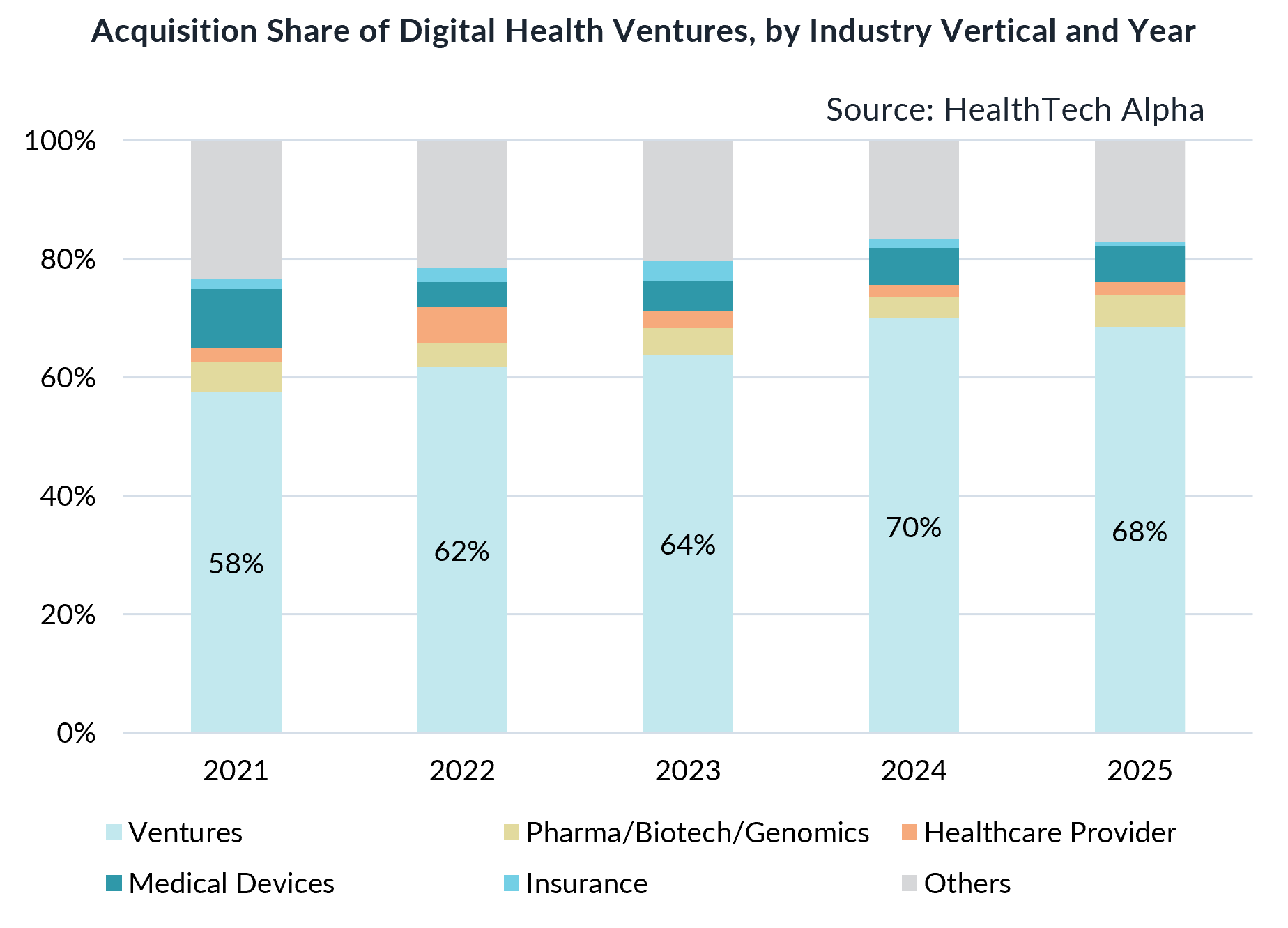

The Consolidation Engine: Venture-to-Venture M&A

A critical shift in the exit landscape over the last five years has been the identity of the acquirers. While strategic buyers and private equity remain active, venture-to-venture acquisitions have become the primary engine of consolidation. This trend has strengthened significantly over the past five years. In 2021, ventures accounted for 58% of acquisitions; by 2025, that figure rose to 68%.

This surge in venture-to-venture activity is driven by growth- and late-stage companies that have reloaded their balance sheets with fresh capital and are now acting as consolidators. Financial pressure on younger or less capital-efficient ventures has driven acquisition prices down, creating attractive opportunities for these established players to expand their capabilities and market share through “tuck-in” deals.

Most Active Acquirers in 2025

The following highlights the three private ventures — Datavant, CoachCare, and Innovaccer — that were most active in acquiring other digital health companies in 2025, focusing on capability expansion in areas like care coordination and prescriptive analytics.

Datavant

- Category Focus: EHR / PHR

- Notable 2025 Acquisitions: Aetion, DigitalOwl

- Acquired Capabilities: Prescriptive Analytics, Health Claim Mgmt

CoachCare

- Category Focus: Physician / Clinic

- Notable 2025 Acquisitions: VitalTech, MD Revolution

- Acquired Capabilities: Care Coordination, Disease Management

Innovaccer

- Category Focus: EHR / PHR

- Notable 2025 Acquisitions: Humbi AI, Story Health

- Acquired Capabilities: Hospital Infrastructure, Care Coordination

Why this matters

For investors, liquidity has not vanished, but it now accrues to fewer companies with clearer paths to scale, margin and strategic relevance. Exit timing has elongated, and underwriting assumptions must now incorporate realistic M&A multiples rather than speculative public-market comparables. Portfolio construction will matter more than ever: concentration risk has returned.

For startups, 2025 confirms that exits are possible — but not for everyone. Buyers are paying for assets that reduce cost, manage risk or unlock operational leverage for healthcare incumbents. Evidence of integration into clinical, administrative or payer workflows is no longer optional. Nor is capital efficiency. Companies that raised aggressively in earlier cycles without building durable economics are unlikely to find sympathetic acquirers.

For strategics, the past year signals opportunity. Consistent exit volumes and disciplined pricing suggest a buyer’s market for high-quality assets. The fact that exit value is holding up — even as IPO markets remain largely closed — reflects pent-up demand for capabilities that incumbents cannot build fast enough internally, particularly in data infrastructure, analytics and clinical optimisation.

For governments and policymakers, digital health exits are increasingly driven by strategic alignment with health system priorities rather than capital-market cycles. Stable regulation, reimbursement clarity and procurement pathways will determine where the next generation of digital health champions is built and sold.

2026 Outlook

Looking ahead to 2026, the exits data suggest not a reopening of the floodgates, but a further sharpening of selectivity. The steady, M&A-led exit momentum of 2025 points to a market where acquisitions will remain the dominant liquidity pathway, while IPOs and SPACs continue to play a marginal role. Freenome has already announced a planned SPAC merger targeting a NASDAQ listing in Spring 2026, and Doc.com has filed paperwork for a late Spring NASDAQ listing as well. Buyers are likely to focus even more narrowly on scaled, revenue-generative assets aligned to core healthcare cost, productivity and risk priorities — particularly in research solutions, health management and payer-adjacent infrastructure. For venture-backed companies, this implies a bifurcation: a smaller cohort capable of generating credible, strategic exits, and a longer tail facing consolidation, recapitalisation or stagnation. In that sense, 2026 is unlikely to mark a cyclical rebound in digital health exits, but rather the deepening of a structural shift — away from valuation-led outcomes and towards transactions driven by strategic necessity, integration readiness and long-term economic resilience.