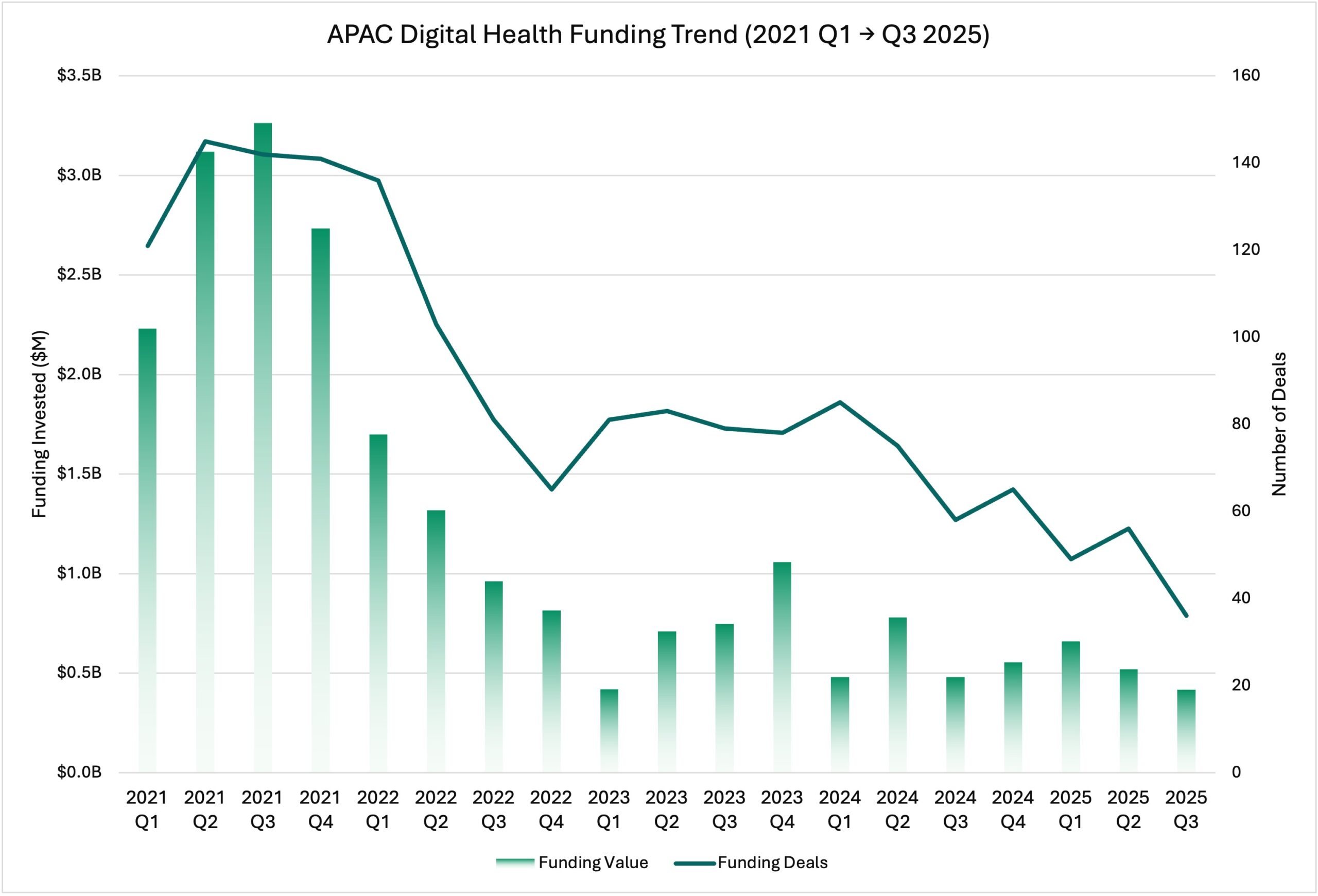

A Cooling Quarter with Deeper Value Creation

The APAC digital health funding Q3 2025 cycle recorded $416.3 million in new venture investments — down 19.6% quarter-on-quarter but part of a $1.6 billion cumulative total for the first nine months of 2025.

While this moderation mirrors trends in the US digital health market, Asia-Pacific continues to evolve from volume-driven growth to evidence-based scaling. Investors are focusing on clinical validation, regulatory readiness, and AI-driven precision health.

Q3 2025 in Numbers: $416M Across 36 Deals

- Quarterly funding: $416.3M across 36 disclosed deals.

- YoY trajectory: Cumulative YTD total of $1.6B.

- Average deal size: $17.3M, an 8% increase from Q2.

- Monthly distribution: July ($126.8M), August ($142.6M), September ($146.9M).

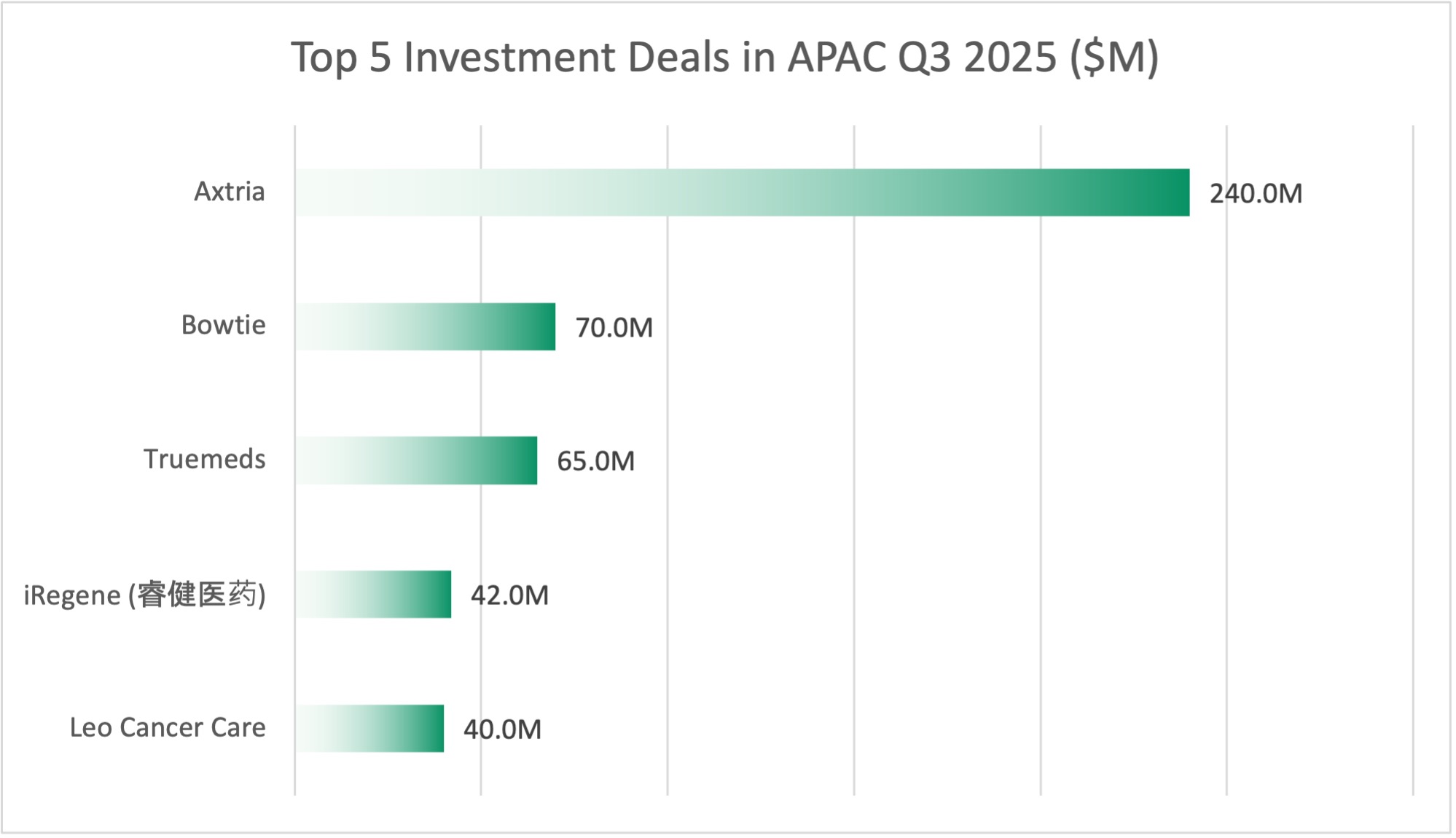

- Funding leaders: Axtria ($240M, India), Bowtie ($70M, Hong Kong), Trumeds ($65M, India).

Noteworthy Investments in Q3 2025

Q3 2025 saw several high-impact investments reflecting APAC’s continued strength in regulated and evidence-based innovation.

| Date | Company | Country | Funding Round | Amount (USD) | Primary Category (Taxonomy) |

|---|---|---|---|---|---|

| 23 Sep 2025 | Axtria | India / Global | Strategic | $240 M | Health Management Solutions |

| 18 Jul 2025 | Bowtie | Hong Kong | Series C | $70 M | Health InsurTech |

| 11 Aug 2025 | Truemeds | India | Series C2 | $65 M | Online Marketplace |

| 04 Sep 2025 | iRegene (睿健医药) | China | Series B2 | $42 M | Research Solutions |

| 24 Sep 2025 | Leo Cancer Care | Australia | Series C | $40 M | Medical Devices |

| 02 Sep 2025 | BrainCo (强脑科技) | China | Series B | $30 M | Remote Devices |

| 18 Aug 2025 | Huimei Technology (惠每科技) | China | Series D2 | $27.8 M | Health Management Solutions |

| 16 Jul 2025 | Truemeds (additional round) | India | Series C1 & Secondaries | $20.2 M / $20M | Online Marketplace |

| 10 Sep 2025 | Metagen Therapeutics (メタジェンセラピューティクス) | Japan | Series B | $15.7 M | Research Solutions |

| 26 Sep 2025 | Thorough Future (透彻未来) | China | Series A2 | $14.0 M | Medical Diagnostics |

Together, these rounds accounted for over 60% of total Q3 funding, highlighting capital concentration around proven technologies and mid-to-late-stage ventures.

Regional Hotspots: Singapore, Japan, and India Lead Quality over Quantity

Singapore: Precision Health Leadership

Singapore continues to anchor precision diagnostics, buoyed by MiRXES’s $40M raise and public-market debut in May. The city-state’s integrated clinical research ecosystem and clear regulatory frameworks keep it attractive to investors seeking scalable innovation.

Japan: Maturity and Exit Activity

Japan remains the most mature APAC market, led by KAKEHASHI’s Series D and UniHealth’s $178M IPO. Together with EcoNaviSta’s M&A ($113.7M), Japan accounted for over 60% of regional exit value in 2025.

India: Digital Health Adoption Accelerates

India’s Truemeds ($65M) and iRegene ($42M) exemplify the region’s move toward affordable chronic-care management and AI-enabled telehealth, driven by strong domestic demand and private-payer adoption.

Australia & Southeast Asia: Specialist Niches

Australia’s Saluda Medical and Leo Cancer Care drew global capital, while Indonesia and Vietnam continued to see growth in corporate-wellness and remote-care startups — smaller deals, but growing fast.

Sector Focus by Primary Category

Using the HealthTech Alpha taxonomy of Primary Categories, funding in Q3 2025 concentrated in a few dominant areas:

- Medical Diagnostics ($357.1M / 22%) – Early detection, genomics, and clinical testing ventures remained top-funded.

- Research Solutions ($307.9M / 19%) – Bioinformatics, R&D analytics, and precision medicine enablers attracted strong institutional capital.

- Health Management Solutions ($185.5M / 12%) – Digital care coordination, clinical decision support, and workflow automation saw rising adoption across hospitals.

- Remote Devices ($197.9M / 12%) – Wearables and AI-enabled sensors continued to fuel connected care and rehabilitation.

- Health InsurTech ($70.1M / 4%) – Digital-first insurers like Bowtie led activity, focusing on tech-enabled underwriting and preventive benefits.

Collectively, these clusters accounted for nearly 70% of all APAC Q3 funding, underscoring a shift from wellness apps to regulated, clinical-grade innovation.

Partnerships Momentum Across APAC

Despite slower funding, strategic partnerships surged in 2025, reinforcing ecosystem maturity and commercial validation.

According to Galen Growth data, over 614 partnerships were recorded year-to-date, with APAC representing 100% of tracked activity across 3,600+ partnerships since 2021.

Key Partnerships in Q3 2025

| Date | Venture | Partner | Country | Type | Focus |

| 29 Sep 2025 | Leo Cancer Care (Australia) | IHH Healthcare | Australia | Healthcare Provider | Oncology imaging & proton therapy expansion |

| 26 Sep 2025 | Leo Cancer Care (Australia) | Sumitomo Heavy Industries | Japan | Manufacturing | Radiotherapy innovation & medical equipment R&D |

| 16 Sep 2025 | VALD (Australia) | ETS Performance | Australia | Sports Science | Musculoskeletal health & athlete analytics |

| 29 Aug 2025 | JD Health (China) | Eli Lilly and Company | China | Pharmaceutical | Diabetes digital engagement & DTx co-development |

| 29 Aug 2025 | Osara Health (Australia) | Unimed | Australia | Healthcare Provider | Cancer survivorship programs & care pathways |

| 28 Aug 2025 | oncoMASTER (South Korea) | SG Medical | South Korea | Healthcare Distribution | Oncology data integration & precision therapy |

| 26 Aug 2025 | RxPx (Australia) | Lumia Care | Australia | Strategic | Patient adherence platform for rare diseases |

| 25 Aug 2025 | GoApotik (Indonesia) | MDLA | Indonesia | Association | Pharmacy e-commerce for local patient access |

| 25 Aug 2025 | VertisPro (Singapore) | Expecto Health Science | Singapore | CRO | Clinical research data collaboration |

| 20 Aug 2025 | Asleep (South Korea) | Daewoong Pharmaceutical | South Korea | Pharmaceutical | Sleep health monitoring and AI biomarker validation |

Partnership Trends

- Oncology and precision medicine continued to lead partnership formation, with Leo Cancer Care and oncoMASTER expanding international collaboration.

- Pharma–startup integrations strengthened across chronic disease management, notably JD Health’s partnership with Eli Lilly.

- Sports and rehabilitation tech partnerships, led by VALD and ETS Performance, demonstrated diversification into preventive and performance health.

- Digital pharmacy and patient adherence collaborations (GoApotik–MDLA, RxPx–Lumia Care) illustrate the growth of retail–tech convergence.

These partnerships underline a shift toward co-development, validation, and commercialization, showcasing how APAC healthtech ecosystems are aligning capital with collaboration to accelerate impact.

Exits in Focus: 14 Ventures Went Public or Were Acquired

2025 saw 14 digital health exits totalling $434.4M, led by MiRXES (Singapore, IPO $139M), UniHealth (China, IPO $178M), and EcoNaviSta (Japan, M&A $113.7M).

The overlap between high-funded Primary Categories and successful exits demonstrates a maturing investment-to-exit continuum.

Outlook: 2026 and Beyond

While Q4 2025 is forecasted to dip by another $124M, the groundwork for 2026 is strong. Growth is expected in:

- AI-driven Diagnostics and Predictive Analytics

- Corporate Wellness and Chronic Care

- Integrated Insurer–Startup Ecosystems

According to the World Health Organization, APAC will account for over 40% of global health-spending growth by 2030, positioning the region as the epicentre of digital health transformation.

Conclusion: From Consolidation to Confidence

The APAC digital health funding Q3 2025 cycle underscores a market maturing through fewer deals, higher quality, and stronger cross-sector partnerships. As the focus shifts toward clinical-grade, interoperable, and scalable solutions, APAC continues to strengthen its role in global health innovation.

👉 Explore the full APAC dataset or request a custom HealthTech Alpha briefing to uncover country- and category-specific insights.