TL;DR

- $1.2B raised across 102 deals in APAC, marking 4% YoY growth despite an 11% global decline.

- AI-powered ventures secured 63% of funding, especially in diagnostics and precision medicine.

- Top markets: Australia ($286M), Hong Kong ($233M), Japan ($202M).

- Top categories: Medical Diagnostics, Research Solutions (aka TechBio), Health Management Solutions.

- Therapeutic leaders: Women’s Health ($313M), Oncology ($311M).

- Remote Devices funding grew 10x YoY, reflecting IoT and hospital automation demand.

- 48% of partnerships involved AI, though total partnerships fell 26%.

- Key deals: Harrison.ai ($112M), Insilico Medicine ($123M), Saluda Medical ($100M).

- 10 exits recorded: 8 M&A, 2 IPOs; 70% of M&As were venture-to-venture.

“The second quarter of 2025 highlighted APAC’s resilience amid global market recalibration, with $1.2B raised across 102 deals, marking 4% YoY growth even as global digital health funding declined by 11%.” — Galen Growth, Q2 Digital Health 2025 APAC Funding Report

To dive deeper into the data and explore category-level insights, download and read the full report on HealthTech Alpha.

A Resilient Region: Geographic Leaders and Capital Flow

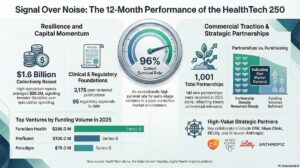

The digital health landscape across the Asia-Pacific (APAC) region is experiencing a significant transformation. While other regions deal with a decline in venture capital, APAC continues to grow, driven by a strong mix of AI innovation, demographic demand, and regulatory changes. In the first half of 2025, the region secured $1.2 billion in funding—accounting for 9% of global digital health investment—despite a broader 11% global downturn.

Three markets dominated in Q2 2025:

- Australia: $286.4M

- Hong Kong: $233.0M

- Japan: $202.1M

Together, they contributed over 60% of regional funding. High-profile raises such as Harrison.ai ($112M) and Insilico Medicine ($123M) highlighted APAC’s strength in AI diagnostics and drug discovery.

Southeast Asia also gained traction, with Singapore ($78.5M) and New Zealand ($26.0M) attracting capital for remote care and telemedicine.

AI Takes the Wheel: Investment Themes and Category Leaders

Artificial Intelligence is no longer a trend—it’s the bedrock of innovation in 2025. AI-powered startups captured 63% of APAC’s digital health funding, up from 41% last year. These ventures are especially dominant in:

- Medical Diagnostics ($279M): Focused on AI imaging and detection.

- Research Solutions aka TechBio ($250M): Fuelled by AI drug discovery platforms like Insilico Medicine.

- Health Management Solutions ($181M): Platforms that optimise hospital workflows and chronic care management.

Meanwhile, Remote Devices funding experienced a 10x YoY growth to $120M – an indicator of surging demand for IoT-enabled monitoring.

Therapeutic Funding: Women’s Health and Oncology in the Lead

Digital health funding in Q2 2025 reflects shifting societal and demographic needs. Topping the therapeutic investment chart:

- Women’s Health: $313M

- Oncology: $311M

- Geriatrics: $280M

- Neurology: $211M

Women’s health platforms—covering fertility, maternal health, and personalised diagnostics—led the way. Oncology experienced steady growth due to genomic testing and AI-driven therapies. Geriatrics and neurology also increased, reflecting the region’s ageing population and the rise in age-related neurocare tools.

Deal Sizes and Exit Strategies: Conservative Capital, Strategic Outcomes

While the total number of deals in APAC remained steady at 102 after Q2 2025, the average deal size decreased from $19.3M in Q1 to $15.3M in Q2. This indicates a deliberate shift in investor behaviour: instead of concentrating capital into fewer mega-rounds, investors are spreading their investments across a larger number of smaller, strategic deals to diversify risk and gain early momentum in promising sectors.

However, this cautious approach to capital distribution coexists with a strong appetite for maturity. Late-stage deals (Series D and beyond) make up nearly 75% of total funding, while early-stage capital remains limited. The message is clear—investors are shifting towards ventures that show proven traction, scalable business models, and demonstrable clinical or commercial validation.

Exit Landscape: M&A Dominates, IPOs Lag

Reflecting this trend, exit activity in APAC during Q2 2025 continued to prioritise substance over speed. The region recorded 10 exits, consisting of eight mergers and acquisitions (M&A) and 2 IPOs. Although modest compared to the 43 exits documented globally in 2021, the deals in 2025 indicate a more strategic, ROI-focused acquisition approach.

M&A remained the dominant exit path, especially among ventures with robust clinical and operational track records. Key players included:

- Healthcare providers are seeking digital solutions to streamline care delivery and integrate AI tools.

- Pharma and biotech firms are augmenting their drug development pipelines through AI and precision platforms.

- Insurance companies and tech giants are embedding digital health into their customer engagement ecosystems.

The subdued IPO market highlights the hesitation of public markets, but the few IPOs that did occur came from later-stage ventures with validated models and regulatory readiness. This suggests a slow but steady progression towards more public listings in H2 2025 and beyond.

Partnership Trends: Fewer Deals, Stronger ROI

Partnership activity in APAC decreased by 26% compared to H2 2024. However, the nature of these alliances has shifted towards ROI-focused engagements, particularly with health systems (14%) and technology giants (12%).

Crucially, 48% of all partnerships after Q2 2025 involved AI ventures, emphasising their role in clinical decision support and operational efficiency. Medical Diagnostics and Health Management Solutions led the charge, contributing to over 44% of announced partnerships.

The report underscores that AI is no longer a differentiator but a baseline requirement, with ventures lacking AI capabilities falling behind in forming strategic alliances.

Mega Deals: Strategic Scaling Over Speculation

Globally, mega deals (≥$100M) have decreased significantly since their 2021 peak. However, in APAC, the proportion of funding from mega-deals compared to total funding increased considerably from 23% in 2024 to 38% in Q2 2025, indicating a focus on larger deals in more established ventures rather than early- and growth-stage investments.

Standout mega deals include:

- Harrison.ai (Australia) – $112M Series C

- Insilico Medicine (Hong Kong) – $123M Series E

- Saluda Medical (Australia) – $100M Private Equity round

Looking Ahead: What’s Next for APAC Digital Health?

APAC’s digital health ecosystem is developing intentionally. Investment is increasingly focused on evidence-supported, AI-integrated ventures. Regulatory filings are rising—particularly in diagnostics and remote care—indicating readiness for expansion.

As partnerships strengthen and exits develop, the region is likely to shift from tech hype towards impact-focused digital health, where capital flows to measurable outcomes, scalable infrastructure, and long-term system value.

To explore the data further and gain category-level insights, download and review the full report on HealthTech Alpha.