An in-depth analysis of US digital health Q3 2025 funding trends, partnerships, exits, and AI dominance.

In a year marked by shifting capital flows and recalibrated expectations, the US digital health sector is displaying the poise of a maturing market. Gone are the exuberant rounds and speculative partnerships of years past. In their place: a more focused landscape, where capital favours evidence over promise, and AI ventures are forced to prove their worth beyond buzzwords. For operators tracking venture funding and deal flow, Q3 underscores this pivot to outcomes and reimbursement readiness.

US Digital Health Funding Summary, Q3 2025

From January to September 2025, US-based digital health ventures attracted USD 13.7 billion across 509 deals. The third quarter accounted for USD 4.1 billion of that total—down 25% from Q2. Yet the contraction in deal count (183 in Q2 to 124 in Q3) tells a more revealing story: capital is concentrating in fewer, higher-quality ventures.

Indeed, Q3 average deal size reached USD 34.7 million, and September alone saw a 42% month-on-month rebound. The message from investors is clear—scale and clinical traction now command a premium. Benchmark these trends in real time with HealthTech Alpha’s US funding dashboards.

Artificial Intelligence: From Novelty to Infrastructure

If one theme defines Q3, it is the institutionalisation of artificial intelligence in US healthcare. No longer a curiosity, AI is now the central thesis driving venture formation, corporate partnerships, and exit strategies.

Deals such as OpenEvidence’s USD 210 million Series B, Ambience Healthcare’s USD 243 million Series C, and EliseAI’s USD 250 million Series E exemplify this shift. These are not consumer-facing tools—they are enterprise-grade platforms with explainability, clinical integration, and payer alignment built in.

Partnerships reinforce the trend. Nvidia and Mayo Clinic, Microsoft and Teladoc, Eli Lilly and Tempus AI—each exemplifies the new race to embed AI into care pathways, not as a feature but as a foundational layer. See also the Galen Growth perspective on clinical AI adoption patterns. For policy context on AI-enabled care and diagnostics, refer to CMS resources.

With many corporates rolling out Microsoft Copilot internally, HealthTech Alpha’s integration offers a strategic edge—structured digital health data directly accessible inside enterprise GPT environments.

Mega Deals Reflect Maturity

At least nine US ventures raised USD 100 million or more in Q3, accounting for nearly half the quarter’s funding. The top three—Strive Health (USD 300M), Judi Health (USD 252M), and Ambience Healthcare—are building the digital backbone for value-based care.

The return of mega-deals signals that investor confidence has not disappeared. It has simply become more selective, focused on ventures with defensible moats: robust clinical validation, payer contracts, and established distribution through health systems. Explore late-stage rounds and valuations in HealthTech Alpha. For a market barometer on enterprise AI partnerships, see Nvidia’s healthcare hub.

Partnerships Down, But Not Out

While the number of US digital health partnerships fell sharply—down 55% YoY to 1,041 YTD—the signal-to-noise ratio improved. September recorded just 43 partnerships, continuing a decline from 160 in March. But those that did occur were anything but superficial.

Collaborations are shifting from pilots to platforms, from tactical tests to strategic alignment. Key examples include Humana-Vizient’s chronic disease ecosystem, Teladoc-Oura’s integration of biometric data, and Parsley Health’s metabolic wellness offering with L-Nutra. Track evolving partnership networks and deal flow in HealthTech Alpha. Additional reading on payer–provider collaborations: Vizient insights.

Policy & Payer Outlook

Reimbursement alignment is increasingly driving venture viability. CMS pilots in chronic care and AI-enabled diagnostics are steering both funding and partnerships. Ventures that can navigate the billing code maze—backed by HealthTech Alpha’s reimbursement tracking—are more likely to scale within health systems.

Reference our Reimbursement module to follow code utilization and payer coverage. For national policy updates, start with CMS innovation models.

Therapeutic Focus Sharpens

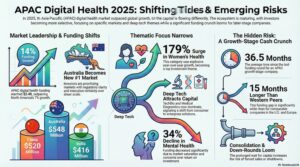

Oncology (USD 2.0B), women’s health (USD 1.9B), and mental health (USD 1.7B) led the funding charts in 2025. Each also topped partnership activity, with women’s health seeing a 40% YoY surge.

This clustering reflects more than clinical need—it speaks to market momentum. Ventures in these spaces are increasingly able to show outcomes, unlock reimbursement, and scale through health systems. Compare cohorts and evidence levels in HealthTech Alpha market maps. For context on women’s health innovation trajectories, review NIH women’s health research priorities.

From Pandemic Darling to Marginal Player: The Telemedicine Reckoning

Once a symbol of digital health’s potential, telemedicine is now facing a more sobering reality. It remains active in partnership activity but has lost its funding allure. Investors are no longer rewarding generalist virtual care. Differentiation, integration, and clinical nuance are now required to stay relevant.

See how virtual care models are evolving in our sector deep-dives. For a macro lens on telehealth utilization policy, monitor CMS telehealth resources.

Exit Window Narrow, But Active

Exit activity remained healthy, with 109 US ventures either acquired or listed by the end of Q3. Notable deals included Tempus AI’s USD 300 million debt raise post-IPO, and Hims & Hers’ USD 1 billion convertible note.

Private equity is also moving in, reshaping late-stage rounds with a focus on governance and profitability. This reflects a broader truth: exits will happen, but only for ventures built on solid business models, not speculative hopes. Review exit pathways and acquirer profiles in HealthTech Alpha. For company-specific filings and investor materials, see Tempus AI IR and Hims & Hers IR.

Market Outlook: From Hype to Health Impact

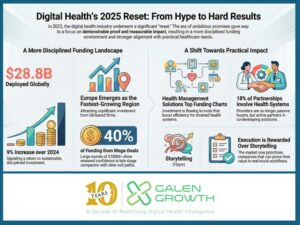

According to Galen Growth’s HealthTech Alpha platform—which tracks 50,000+ digital health ventures globally—2025 is on track to close with USD 17–18 billion in US digital health funding. That would be modestly below 2024, but with far better fundamentals.

The market has matured. Startups are expected to demonstrate regulatory traction, peer-reviewed validation, and payer readiness. Pharma, medtech, and providers are demanding solutions that integrate seamlessly into existing systems and deliver ROI from day one.

The winners? Ventures that can combine precision technology with evidence-based outcomes—and that know how to navigate increasingly complex commercial pathways.

Why It Matters Now

For investors, the signal is unmistakable: capital is gravitating toward startups with proof, not just potential.

For corporate innovators, the new mandate is clear: solutions must not only work, but scale.

And for founders, the message is simple: this is not a market retreating from digital health. It is one maturing into a more disciplined, evidence-driven, commercially astute era.

About Galen Growth & HealthTech Alpha

Galen Growth is the global authority on digital health intelligence. Its flagship platform, HealthTech Alpha, is used by investors, pharma, medtech, payers, and health systems to navigate and benchmark innovation. Covering 60,000+ ventures, corporates and investors, and over one billion data points, it is the source of truth for digital health decision-making.

In 2025, as enterprise GPT tools proliferate, HealthTech Alpha can be integrated directly into internal copilots—ensuring that evidence-based decisions stay front and centre.

Learn more by reaching out to our Galen Growth team. We are integrating across major platforms including OpenAI, Claude and Microsoft Copilot.

Because in digital health, the data isn’t optional. It’s everything.