TL;DR

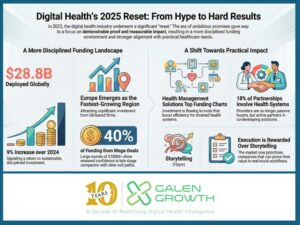

Global Digital Health funding reached USD 20.6 billion across 964 deals in the first nine months of 2025, with Q3 2025 funding down 23% quarter-on-quarter but signalling renewed investor selectivity and resilience in AI-driven innovation. While AI-first ventures and mega-deals continued to dominate, the market leaned towards later-stage consolidation and strategic partnerships, particularly in oncology, mental health, and women’s health. Digital Health Funding in Q3 2025 saw USD 5.7 billion raised, with standout rounds by Strive Health, Judi Health, EliseAI, and Ambience Healthcare.

Despite the funding slowdown, Galen Growth forecasts total 2025 global funding to close near USD 25–26 billion, underscoring a stabilising post-correction ecosystem poised for sustainable, data-driven growth.

Overview: A Year of Cautious Acceleration

The global Digital Health ecosystem in 2025 has been navigating a volatile geopolitical and macro-economic environment, shaped by persistent inflationary pressures, divergent monetary policies, and ongoing geopolitical tensions — from the war in Ukraine to renewed US–China trade frictions. A weaker US dollar and fluctuating capital markets have revived cross-border deal activity but heightened uncertainty around valuations and exit timing. Meanwhile, AI has emerged as both a tailwind and a headwind: it continues to attract significant investor capital and redefine value creation, yet its rapid evolution has made corporates more cautious, delaying investment decisions and partnership commitments.

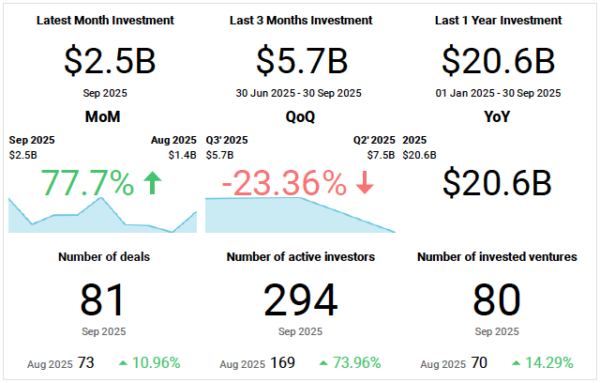

After two years of correction, 2025 marks a year of measured confidence in Digital Health. Global investors deployed USD 20.6 billion across 964 deals by the end of Q3, down 4% compared to the same period last year, when exuberant valuations gave way to capital discipline.

While funding volumes fell 23% quarter-on-quarter to USD 5.7 billion, the decline reflects a flight to quality rather than contraction. Average Q3 2025 deal size increased to USD 28.8 million, indicating investor confidence in proven business models and strong clinical evidence.

Notably, 294 investors were active in September alone — a 74% month-on-month surge, highlighting ongoing interest from corporates and financial backers in validated ventures. Funding strength across early, growth, and late stages remains moderate, signalling steady but deliberate capital flows.

The year has also seen 165 venture exits, including IPOs and acquisitions, suggesting that the Digital Health maturity curve continues to bend towards commercial viability and integration with incumbent healthcare systems.

AI: From Buzz to Backbone

AI has cemented its position as the engine of Digital Health innovation in 2025. AI-enabled ventures dominate the largest rounds, ranging from clinical decision-support systems to generative patient engagement and drug discovery platforms.

Flagship deals include Ambience Healthcare (USD 243 million, Series C) and EliseAI (USD 250 million, Series E) — emblematic of the dual narrative driving investor attention: workflow automation and patient-clinician interaction. AI ventures now permeate every cluster, from diagnostics to population health, and increasingly serve as middleware that stitches together disparate data silos across systems.

However, investors are shifting from “AI-as-hype” to “AI-with-evidence”. Ventures capable of proving measurable clinical outcomes or operational ROI now command the largest rounds. The rise of “AI-augmented clinicians” and the normalisation of regulatory pathways for decision-support tools have moved AI from experimentation to adoption.

Mega-Deals (USD 100 million+)

Despite an overall funding slowdown, mega-deals continued to anchor confidence. The first 9 months of 2025 alone saw 38 rounds across the globe above USD 100 million:

| Rank | Venture | Deal Type / Round | Funding (USD m) |

| 1 | Hims & Hers | Convertible Note | 1,000 |

| 2 | Isomorphic Labs | Strategic Investment | 600 |

| 3 | Transcarent | Private Equity | 481 |

| 4 | Pathos | Series D | 365 |

| 5 | Truveta | Series C | 320 |

| 6 | Fitness Park | Strategic Investment | 318 |

| 7 | Strive Health | Series D | 300 |

| 8 | Tempus AI | Debt Financing | 300 |

| 9 | Abridge | Series E | 300 |

| 10 | Innovaccer | Series F | 275 |

These top-tier rounds demonstrate the gravitational pull of AI-enabled care orchestration, digital diagnostics, and wearables in a maturing market.

Notably, Strive Health’s dual rounds (debt and equity) position it as a model for hybrid financing amid tightening venture appetites.

Partnerships: The New Currency of Scale

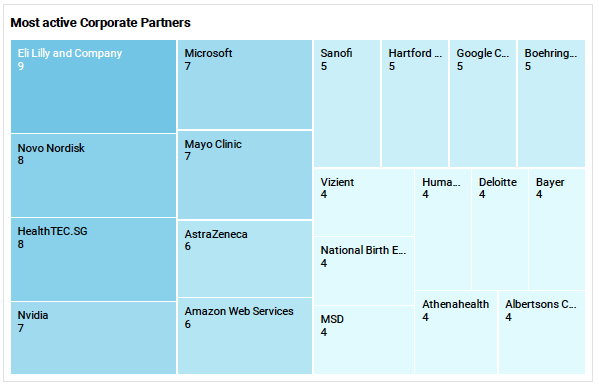

Partnerships remain a cornerstone of Digital Health’s expansion strategy, as both corporates and ventures pursue market access and data synergies over pure capital inflow.

Between January and September 2025, Galen Growth recorded 1,913 global partnerships, a 52% decline year-over-year, signalling fewer but more strategic collaborations.

The United States (1,038 partnerships), Japan (282), and South Korea (206) lead the pack. Within corporate partnerships alone, 1,591 deals were logged, with Eli Lilly & Company (9 partnerships), Novo Nordisk (8), and HealthTEC.SG (8) among the most active.

AI-oriented collaborations dominate — Microsoft, Nvidia, and Google Cloud each appear in multiple high-value partnerships, underlining the fusion of data infrastructure and clinical intelligence. On the pharma side, AstraZeneca, Sanofi, and Boehringer Ingelheim maintained consistent engagement, particularly in real-world data (RWD), remote monitoring, and chronic disease management.

By cluster, Health Management Solutions (404) and Medical Diagnostics (351) drive the majority of collaborations, reflecting a shift from consumer wellness toward regulated, evidence-based digital interventions.

Therapeutic Areas: From Wellness to Evidence-Driven Care

Oncology remains the most funded therapeutic area globally, attracting USD 3.1 billion across the first nine months of 2025. This is followed by Women’s Health (USD 2.5 billion) and Mental Health (USD 2.1 billion), reaffirming sustained interest in sectors where digital solutions can meaningfully augment patient outcomes.

Q3 alone saw strong traction in preventive health, chronic disease management, and nephrology, with deals such as Thyme Care (USD 97 million) and Inspiren (USD 100 million) showcasing personalised, data-rich approaches.

The broader trend: digital therapeutics and care-coordination platforms are converging with AI-powered predictive analytics, blurring lines between preventive and interventional care. Investors now favour ventures that demonstrate measurable patient engagement and validated endpoints, not just technology novelty.

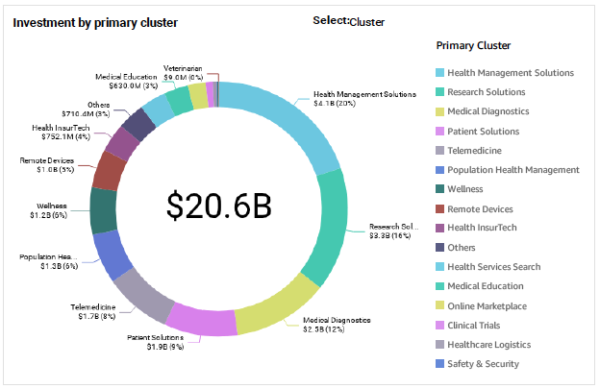

Cluster View: Diagnostics, Data, and Disease Management

Across clusters, Health Management Solutions and Patient Solutions continue to dominate funding and partnership activities, followed by Medical Diagnostics and Research Solutions, also known as Techbio.

These clusters increasingly overlap: AI-driven diagnostics feed into personalised care platforms, while health management tools capture longitudinal outcomes to refine predictive models.

Telemedicine and Wellness, once pandemic darlings, have matured into enablers of hybrid care models rather than standalone categories. Meanwhile, Health InsurTech is re-emerging, fuelled by payers’ growing interest in data-driven risk stratification and behavioural health integration.

IPO and M&A: Pathways to Liquidity

The 165 exits recorded to date underscore the improving market readiness for Digital Health consolidation.

Strategic buyers, especially those in pharma, med-tech, and AI, are acquiring digital capabilities to address gaps in clinical intelligence, patient experience, and decentralised trials.

IPOs remain selective, with valuation discipline prevailing after earlier market corrections. However, private-equity interest is increasing, particularly for ventures that have achieved profitable scale or occupy critical infrastructure positions in the digital care continuum.

The Q3 2025 Picture

Q3 was a transitional quarter — total funding reached USD 5.7 billion across 234 deals, down from USD 7.5 billion in Q2, but supported by larger average rounds.

The top 10 funding rounds of the quarter illustrate the shift toward capital concentration in proven, AI-backed ventures:

| Rank | Venture | Funding (USD m) | Round / Financing Type |

| 1 | Strive Health | 300 | Series D |

| 2 | Judi Health | 252 | Series F |

| 3 | Oura | 250 | Debt Financing |

| 4 | EliseAI | 250 | Series E |

| 5 | Ambience Healthcare | 243 | Series C |

| 6 | OpenEvidence | 210 | Series B |

| 7 | Aidoc | 150 | Strategic Investment |

| 8 | Harbor Health | 130 | Series C |

| 9 | Inspiren | 100 | Series B |

| 10 | Eight Sleep | 100 | Series D |

Together, these ten deals accounted for 35% of Q3 funding, reaffirming the “quality over quantity” narrative driving investor strategy in 2025.

Why It Matters for Investors, Pharma, Health Systems and Startups

For investors, 2025’s market signals a pivot from exuberance to evidence. Growth capital is chasing ventures with validated outcomes, defensible data moats, and regulatory traction. The current climate rewards patient capital and cross-sector co-investment.

For the pharma and med-tech industries, the year marks a strategic pivot towards the digital enablement of clinical trials, AI-guided patient support, and direct-to-patient (DTP) engagement. As the line between digital health and core R&D blurs, these firms increasingly rely on digital platforms for trial acceleration, adherence monitoring, and post-market evidence generation.

For health systems and payers, the shift toward population health, mental health, and chronic care coordination presents opportunities to integrate digital tools that extend clinical reach and reduce operational strain. AI-driven triage and predictive care are already enhancing efficiency in major hospital networks.

For startups, the message is clear: evidence beats enthusiasm. The ventures that thrive in 2026 will be those that can convert data into proof and partnerships into scale.

Galen Growth Point of View

From Galen Growth’s perspective, 2025 represents a return to rational growth after years of volatility. Our HealthTech Alpha platform showcases a resilient innovation pipeline, with nearly 1,000 active funding rounds and over 1,900 partnerships as of Q3.

While total funding continues to trend below previous highs, we forecast global Digital Health investment to close 2025 at USD 25–26 billion — a solid baseline for sustainable expansion. AI, clinical validation, and ecosystem interoperability are defining this next phase.

In Galen Growth’s view, the winners of 2026 will be those ventures that bridge data, evidence, and commercial scalability, supported by strategic partners who understand the long-term clinical and economic value of Digital Health.

About Galen Growth and HealthTech Alpha

Galen Growth is the global leader in Digital Health intelligence, trusted by pharma, med-tech, investors, insurers, and health systems to navigate and benchmark innovation.

Its flagship platform, HealthTech Alpha, is the most comprehensive data and analytics engine for digital technology innovation in healthcare, covering over 50,000 ventures, 15,000 corporates, 16,000 investors, and more than one billion data points.

From deal flow and partnerships to evidence validation and AI-powered analytics, HealthTech Alpha enables clients to make faster, smarter, and data-driven decisions in an increasingly complex ecosystem.

In 2025, as the industry moves from hype to health impact, Galen Growth continues to redefine Digital Health intelligence — delivering clarity where others deliver noise.