An HLTH USA 2025 field guide for data-led networking and strategic dealmaking in digital health

HLTH USA 2025 is the flagship health innovation conference bringing together 13,000+ global decision-makers across payers, providers, employers, life sciences, med-tech, investors, big tech, and policymakers.

From Galen Growth’s data-driven vantage point, it’s the most effective Q4 2025 digital health conference for accelerating commercial conversations. HLTH USA lands at the exact moment when enterprises set 2026 budgets, finalize partnerships, and evaluate product pipelines.

With the backing of HealthTech Alpha, Galen Growth’s proprietary digital health intelligence platform, this guide helps you navigate the show floor, identify high-potential startups, and engineer meetings that convert into partnerships, pilots, and investments.

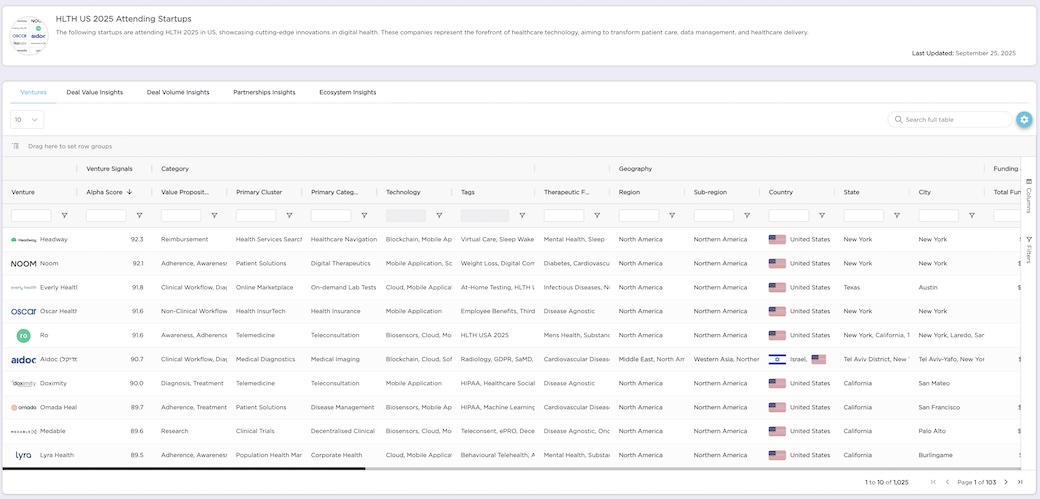

What the Data Says About the HLTH USA 2025 Startup Cohort

Scale and momentum. The latest dataset covers 1000+ digital health ventures, with 39 new entrants in the past 12 months—a steady flow of innovation despite tighter capital markets. The ventures report 4,131 announced partnerships, a sign that go-to-market increasingly runs through enterprise collaborations. The average Alpha Score sits at 56.2, indicating a balanced mix of early promise and operational maturity across the group.

Evidence continues to compound. Since 2020, this ecosystem has produced 9,886 peer-reviewed publications, 1,277 regulatory approvals, and 660 clinical trials, underscoring growing clinical credibility and regulator engagement. For participants walking HLTH USA 2025, such as investors and strategics, this is crucial: you can now benchmark Digital Health startups on published evidence, trial involvement, and approvals, rather than relying solely on slide decks.

Resilience remains high. 90% of ventures are private, and the survival rate is 99 in 100, suggesting strong operational endurance—even for companies still pre-profit. Ninety-two ventures have exited via IPO or acquisition; the dataset indicates that ~6.6% were acquired and 2.9% went public, with the remainder remaining private—useful context for corporate development teams scanning for pipeline opportunities and for investors seeking comparables.

Therapeutic focus clusters. Mental Health remains the most represented therapeutic area in this cohort (143 ventures), followed by Chronic Diseases (107), Women’s Health (89), Cardiovascular (86) and Oncology (84)—a distribution that maps closely to payer priorities and employer demand. For time-poor attendees, this concentration helps pre-plan tracks and identify peer clusters for roundtables.

US-centred, but globally fed. The United States anchors the cohort with 850 ventures; notable contributors include the United Kingdom (43), Israel (28) and Canada (47)—an increasingly international supply of assets seeking US distribution and reimbursement. Expect a rich mix of go-to-market conversations around FDA pathways, CMS coding, and commercial pilots.

Funding cadence = selective growth. Funding Strength (average months since last round) averages 27months for early-stage companies, 29 months for growth-stage companies, and 22 months for late-stage companies—i.e., moderate for most, with late-stage companies showing relatively tighter cycles. Translation: capital is available for proven models; new concepts must arrive with stronger evidence and clearer routes to ROI.

Problem framing is balanced. The cohort is roughly split between disease-agnostic (46%) and disease-specific (54%) propositions—useful for investors or partners deciding whether to prioritise platform plays (e.g., workflow, reimbursement, data infrastructure) or deep therapeutic point solutions.

Galen Growth’s View: Four Key HLTH 2025 Insights

- Evidence is the new currency. With thousands of publications, approvals, and trials in the mix, HLTH USA 2025 deals will favour ventures that convert evidence into operational outcomes—reduced total cost of care, faster time-to-diagnosis, and measurable uptake. Expect procurement to ask sharper questions and compare vendors based on quantified Evidence rather than narrative alone.

- Partnerships compound advantage. The 4,000+ partnership announcements demonstrate that distribution, data access, and reimbursement are being increasingly secured through alliances. At HLTH USA 2025, the most effective startups won’t just pitch—they will co-sell with channel partners, present joint case studies, and align on shared KPIs.

- The US remains the go-to beachhead—but international variety is a strength. US payers and providers still set the commercial tempo. Yet, global ventures arriving with CE-marked products, real-world evidence, and cost-effective engineering are reshaping the value equation for buyers.

- Series A is where differentiation sharpens. With moderate funding intervals and rising proof requirements, Series A teams that align product-market fit with reimbursement or workflow ROI will unlock the fastest paths to scale.

Top 10 Series A Startups to Meet at HLTH USA 2025

Based on Galen Growth’s review of Series A-stage startups in the HLTH USA 2025 cohort, here are ten to prioritise for meetings. Use this as a route map for your diary:

| Company | Primary Category | Description |

|---|---|---|

| Entia (Alpha Score: 78.0) | Remote Monitoring Devices | Comprehensive home monitoring for life-changing conditions. |

| Axena Health (Alpha Score: 76.8) | Digital Therapeutics | Noninvasive treatment for women’s pelvic floor disorders with real-time monitoring. |

| Nomi Health (Alpha Score: 75.7) | Medical Payments | Platform for direct healthcare purchasing and real-time provider payments. |

| Fabric (Alpha Score: 73.5) | Hospital | Workflow automation to boost capacity and reduce administrative burden. |

| Antidote Health (Alpha Score: 72.0) | Teleconsultation | Uses AI and machine learning to reduce the cost of healthcare delivery. |

| WhiteCoat (Alpha Score: 71.2) | Teleconsultation | On-demand video telemedicine for instant doctor consultations. |

| Canary Speech (Alpha Score: 71.2) | Diagnosis Tools | AI-powered vocal biomarker screening for mental and neurological disorders. |

| Kintsugi (Alpha Score: 70.8) | Diagnosis Tools | Voice biomarkers to detect depression and anxiety through API-first models. |

| xCures (Alpha Score: 70.4) | Prescriptive Analytics | AI-driven platform linking cancer patients and physicians with optimal therapies. |

| XO Health (Alpha Score: 68.8) | Health Insurance | Employer-centric reimbursement innovation reducing benefit costs via smarter plan design. |

These ten reflect where we see Series A differentiation coalescing: reimbursement navigation, workflow automation, adherence engines, and enabling infrastructure for distribution and data. If you’re capacity-constrained, start here—each has attributes that lend themselves to pilotable, partner-friendly progress at enterprise scale.

How to Use This List to Plan HLTH USA 2025 for Success

- If you’re a payer or self-insured employer, explore solutions driving reimbursement efficiency and adherence (e.g., Nomi Health, Entia, XO Health — employer-centric reimbursement innovation built to bend benefit costs via smarter plan design and member guidance).

Providers should prioritize workflow and evidence-rich clinical tools (e.g., Fabric, Paradigm, xCures).

Life sciences and med-tech strategics can capitalize on data and distribution plays (e.g., Canary Speech, Kintsugi, Axena Health). - Require an evidence narrative. Ask each startup for its latest publications, trial IDs, and regulatory milestones—and request outcomes or operational KPIs tied to those artefacts. The dataset shows there’s enough evidence in the market to make apples-to-apples comparisons.

- Anchor meetings around partnerships. With thousands of collaborations already announced, align early on channel, data-sharing, and reimbursement pathways. Where there’s an existing partner overlap, request a joint demo to expedite diligence.

- Prioritise US-ready roadmaps. For international ventures, pressure-test FDA status, coding, and contracting readiness; for US ventures, focus on proof points that are transferable across systems and states. The regional distribution suggests you’ll meet both types at HLTH.

Why HealthTech Alpha Is Your Essential HLTH USA Planning Tool

The HealthTech Alpha platform provides real-time intelligence on every HLTH USA 2025 startup — including Alpha Scores, evidence strength, partnerships, funding, and clinical signals.

Use it to shortlist high-value targets, map introductions, and compare peers before and during the conference.