The European Digital Health landscape is undergoing a significant transformation, evolving beyond the initial hype to a phase where tangible results and proven impact dictate investment. As global funding recalibrates, Europe has emerged as a beacon of growth, attracting record capital and solidifying its position as a critical innovation hub. This analysis, drawing from Galen Growth’s Q2 report on Digital Health Funding and Key Trends in Europe, uncovers the key trends shaping this dynamic sector in the first half of 2025 and beyond.

TL;DR: Top 5 Key Takeaways

- Europe’s Funding Surge: European Digital Health funding saw an impressive 52% year-on-year increase in H1 2025, reaching $3.4 billion across 182 deals, capturing a record 26% share of global funding. This surge was propelled by seven mega deals, marking a significant shift in investor confidence.

- Shift to Growth and Late-Stage Investing: Investors are increasingly backing proven ventures ready for growth and late-stage capital, evidenced by a 4.7x year-over-year jump in deal value for late-stage ventures. This indicates a maturing ecosystem where substantial capital is deployed into high-potential companies with demonstrated impact.

- AI Dominance in Investment and Partnerships: AI-powered ventures are a clear magnet for capital, accounting for 65% of total funding in H1 2025 in Europe, with $2.3 billion invested. The majority of this investment is concentrated in Research Solutions (40%) and Medical Diagnostics (23%), highlighting AI’s transformative role in scientific discovery and disease diagnosis. Big Tech partnerships also show a strong focus on AI technology.

- Urgent Call for Harmonisation: A coalition of 33 industry associations and startups has issued an urgent call for the EU to establish harmonised, EU-wide rules for medical technology certification, evaluation, and reimbursement. The current fragmented landscape is creating hurdles for companies, hindering innovation and delaying patient access.

- Focus on Real-World Impact: The industry is demanding concrete outcomes and efficiency over experimentation, leading to more selective investor behaviour and a 35% decline in partnership activity in Q2 2025 compared to Q1. Future investment will prioritise ventures that deliver real-world impact and cost savings, particularly those leveraging AI with purpose.

Overall Key Trends: A Maturing Digital Health Landscape

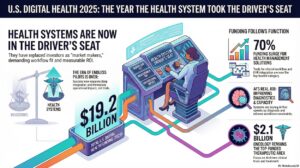

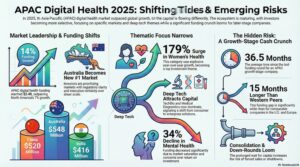

The first half of 2025 signals a pivotal moment for Digital Health, as the sector matures globally and focuses on measurable results over speculative ventures. While global Digital Health funding declined by 11% year-on-year to $12.6 billion, reflecting a broader market recalibration, Europe defied this trend with an impressive 52% year-on-year increase, reaching $3.4 billion invested across 182 deals. This propelled Europe’s share of global funding to a record 26% in the first half of the year, a stark contrast to the US, where funding sank to its lowest level in five years.

Funding Climate and Investor Behaviour

The funding landscape is increasingly selective, with investors prioritising high-value deals with proven impact. This is evident in Europe’s 4.7x year-over-year increase in deal value for late-stage ventures, signalling a definitive shift towards growth and late-stage investing. The emergence of “mega deals” (investments of $100M or more) has been a significant driver, with seven such deals contributing to 56% of the total venture capital investment in Europe in H1 2025. This trend indicates a maturing ecosystem where companies are accumulating enough evidence to gain substantial investor confidence.

The average deal size in Europe for H1 2025 reached $18.6 million, which is 3.0x higher than Q2 2024, further underlining the focus on larger, high-conviction investments. Investors are expected to deploy capital selectively in the latter half of 2025, showing a strong preference for AI ventures that can convert clinical validation into tangible revenue. Solutions offering a clear “productivity premium” by streamlining care pathways or reducing operational costs will continue to attract interest.

Strategic Shifts and Partnerships

The industry is moving away from a “spray and pray” approach towards a demand for clear outcomes and sharper focus. This strategic shift has led to a slowdown in partnership activity, with 35% fewer partnerships in Q2 2025 compared to Q1. Despite this, over 155 partnerships were announced by European-founded ventures in H1 2025, with a significant 45% share focusing on Medical Diagnostics, Research Solutions, and Patient Solutions.

A notable development is the growing presence of Big Tech in Digital Health partnerships in Europe, representing 12% of all ecosystem partnerships announced in H1 2025. This highlights the sector’s increasing reliance on cloud, AI, and platform technologies, with 65% of Tech partnerships specifically targeting AI-powered ventures. Conversely, new Pharma partnerships are in decline, influenced by restructuring and a sharper focus on return on investment.

Snapshot of Q3 2025

While the first half of 2025 demonstrated strong growth, the initial data for Q3 2025 shows a significant month-on-month slowdown. August 2025 recorded $73 million in investment, a sharp 76% decrease from July 2025’s $298 million. Similarly, the number of deals plummeted to 3 in August 2025, down 84% from 19 in July. The number of invested ventures and active investors also saw significant declines in August, mirroring the drop in deal volume. This indicates a period of adjustment or heightened selectivity following the robust performance earlier in the year, with Q3 2025 funding currently standing at $370 million.

Regional Analysis: Europe’s Ascendance in Digital Health

Europe’s Digital Health ecosystem is not just growing but thriving, outpacing global rates with a 5-year CAGR of 7% by the end of 2024. It now represents the second-largest regional ecosystem globally, home to 29% of all Digital Health ventures.

Key Funding Dynamics in Europe

The $3.4 billion invested in H1 2025 represents a substantial uplift, driven by a particularly strong Q1 which saw funding values 1.7x higher than Q1 2024. This strong performance has led to Europe’s average funding strength for growth- and late-stage scale-ups being the most successful in raising capital over the past 12 months, compared to the US and Asia Pacific.

Geographically, the United Kingdom leads European funding with 41% ($1.37 billion), followed by France (18% / $612M), Germany (14% / $473M), Switzerland (8% / $286M), and Sweden (8% / $264M). This concentration highlights established hubs of innovation.

Partnership Activity

Despite a general slowdown, partnerships remain crucial for scaling solutions and expanding patient access. In Europe, Medical Diagnostics (16%), Research Solutions (15%), and Patient Solutions (14%) were the most active clusters for partnerships in H1 2025. Venture-to-venture alliances continued to dominate (21%), but Big Tech’s involvement, especially with AI-focused ventures, has moved into second place (12%). This strategic collaboration suggests a move towards leveraging advanced technologies for efficiency and impact.

Top Digital Health Clusters: Why They’re Attracting Capital

The significant funding flowing into specific Digital Health clusters can be attributed to their potential for disruptive innovation, particularly through AI integration.

- Research Solutions: Securing $938 million in H1 2025, this cluster leads the funding race. The investment in Research Solutions is driven by the promise of AI and omics-related research to accelerate drug discovery, bioinformatics, and clinical trial design. Ventures like Isomorphic Labs, which secured a $600 million strategic investment, exemplify this trend.

- Medical Diagnostics: Attracting $669 million, this cluster ranks second in funding and first in the number of deals (49). The focus here is on AI-powered diagnosis tools, medical imaging, and omics-related diagnosis, promising more accurate and efficient disease detection. Neko Health‘s $260 million Series B deal highlights the substantial capital in this area.

- Wellness: With $503 million in funding, the Wellness cluster includes smart equipment, wearables, and wellness apps, catering to a growing consumer demand for proactive health management. Fitness Park‘s strategic investment of $317.8 million (though sourced as $120M in the cluster focus) demonstrates significant interest.

- Health Management Solutions: Receiving $372 million, this cluster focuses on improving operational efficiencies through EHR/PHR, hospital management, and prescriptive analytics. CMR Surgical‘s $200 million Series F round underscores the value placed on optimising healthcare delivery infrastructure.

- Medical Education: This cluster saw a remarkable 1683% year-on-year growth, securing $261 million. With ventures like AMBOSS raising $259 million in a Series C round, the focus is on enhancing consumer and HCP education through innovative platforms.

These clusters are attracting capital because they directly address critical pain points across the healthcare value chain, leveraging advanced technologies to offer solutions that promise both clinical and economic value.

Top Therapeutic Areas and Their Funding Momentum

The therapeutic areas receiving the most funding reflect areas with high unmet needs and significant potential for digital intervention. In H1 2025, ventures offering Disease Agnostic solutions captured over half (55%) of the funding in Europe.

- Oncology: Remained the top recipient of funding, bringing in $515 million for H1 2025 with a 66% year-on-year gain. This enduring focus highlights the critical need for innovation in cancer care, from early detection to treatment and patient management. Haya Therapeutics‘ $65 million Series A deal exemplifies significant investment in this area.

- Cardiovascular Diseases: Moved into the second spot with $491 million in funding. By Q3 2025, funding for ventures in this area had already reached 95% of the total funding deployed in 2024, indicating strong momentum. Swedish-founded Neko Health‘s $260 million mega deal in January 2025 alone contributed 53% of this funding, focusing on preventative health technologies.

- Dermatology: Secured $386 million in H1 2025.

- Women’s Health: Saw $272 million in funding, though it fell to fourth place year-over-year.

- Geriatrics: Realised the greatest percentage growth among the top areas, growing a staggering 2126% quarter-on-quarter to $234 million. This surge was largely driven by the $148 million mega deal for Cera, a digital-first home healthcare company focused on empowering older adults to live longer, better lives at home.

The focus on Research Solutions and Medical Diagnostics within these therapeutic areas further underscores the industry’s commitment to leveraging technology for scientific advancements and improved diagnostic capabilities.

Exit Trends: Consolidation and Strategic Growth

While funding inflows are robust, exit activity provides crucial insights into market maturity and investor returns. In H1 2025, 30 ventures either went public or were acquired.

Following significant M&A activity in 2024, the first half of 2025 saw a slight slowdown, recording 25 M&A transactions. However, a key trend within these exits is the dominance of venture-to-venture transactions, accounting for 75% of recorded acquisitions. This signals a phase of consolidation and strategic growth within the Digital Health sector, where successful ventures acquire others to expand their market share, technology, or capabilities.

Compared to IPOs and SPACs, M&A remains the primary exit route, with only 1 IPO and 3 SPACs recorded in H1 2025. This pattern suggests that private acquisitions are currently the preferred mechanism for investors to realise returns and for companies to achieve strategic growth, driven by new growth-stage capital flowing into the region.

Why It Matters

The insights from H1 2025 in European Digital Health carry significant implications for various stakeholders:

- For Industry Leaders: The urgent call for harmonised EU-wide rules for medical technology is a critical signal. Navigating the fragmented regulatory and reimbursement landscape across member states poses a significant hurdle, particularly for SMEs. Leaders must actively engage with policymakers to advocate for a streamlined process for certification (CE marking), evaluation (HTA), and reimbursement, thereby unlocking the full potential of the European market and preventing a “brain drain” of talent and technology. Focusing on solutions that deliver clear “productivity premiums” and cost savings will be essential for market adoption and investment.

- For Investors: Europe represents a compelling investment opportunity, particularly in growth and late-stage Digital Health ventures. The market is maturing, with a clear preference for companies demonstrating clinical validation, tangible revenue, and strong evidence signals (e.g., clinical trials, regulatory filings, peer-reviewed publications). Investing in AI-powered solutions, especially within Research Solutions and Medical Diagnostics, appears to be a high-conviction strategy. The increasing volume of mega deals suggests a capacity for larger, impactful investments.

- For Startups: The competitive landscape demands a clear value proposition and a focus on generating real-world impact and revenue. Building a strong “Evidence Signal” through clinical trials and regulatory filings is paramount, as demonstrated by leading ventures like Amboss and Cera. Startups should strategically leverage AI to create solutions that offer a “productivity premium” and be prepared for potential venture-to-venture M&A as a viable exit strategy. Furthermore, understanding and advocating for the harmonisation of EU Medtech rules is crucial for market access and growth.

Unlock Deeper Insights

The European Digital Health market is dynamic, offering immense opportunities for innovation and investment. To truly grasp the nuances and make informed strategic decisions, a detailed understanding of market trends, investor behaviour, and regulatory landscapes is indispensable.

Create your HealthTech Alpha account today to access the complete market intelligence report, conduct your own in-depth analysis, and explore 15,500+ ventures with unparalleled data-driven insights.

For a personalised walkthrough of our platform or to discuss how Galen Growth’s expertise can help you achieve your strategic healthcare goals, contact our team to book a demo. Gain the competitive edge with trusted, unparalleled research.