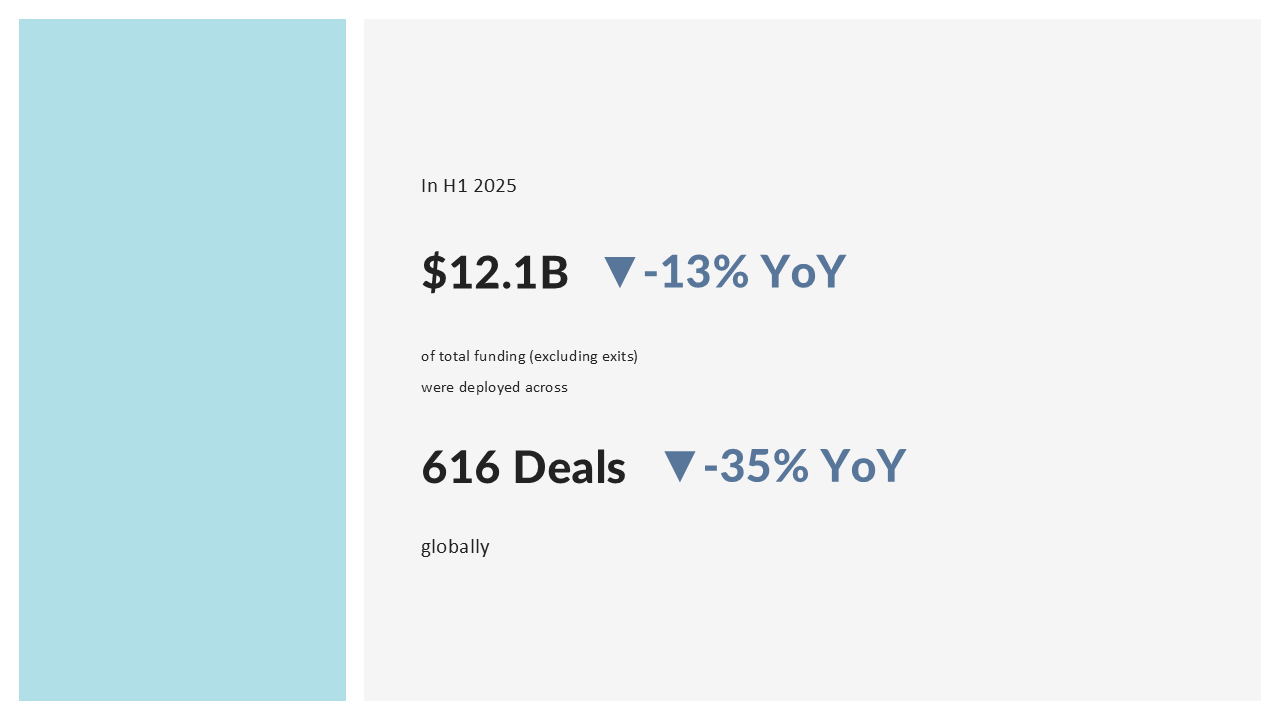

At the end of Q2 2025, Digital Health is showing clear signs of maturity. The sector is shifting from broad enthusiasm to a focus on outcomes and efficiency. Investors are being more selective, prioritizing clinically validated solutions with proven impact and sustainable models. According to Q2 2025 Digital Health Funding data, $12.1B was invested across 616 deals in the first half of the year, reflecting a market that is still active but more discerning.

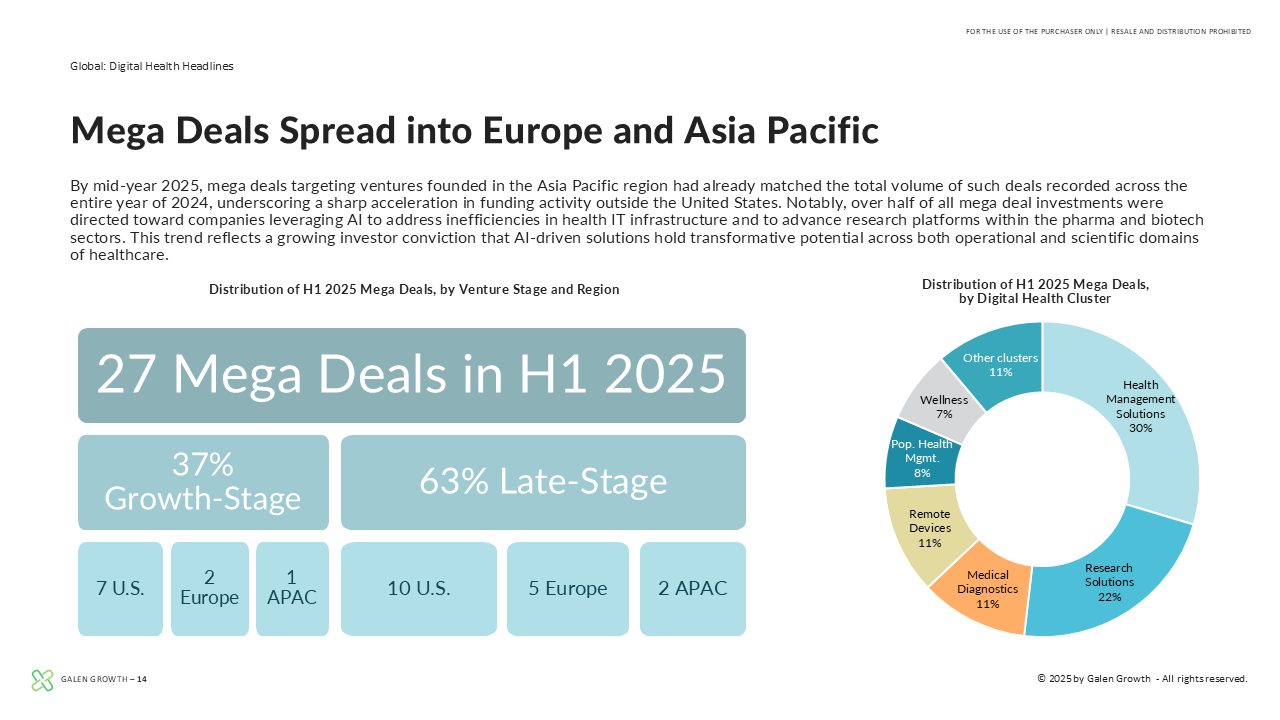

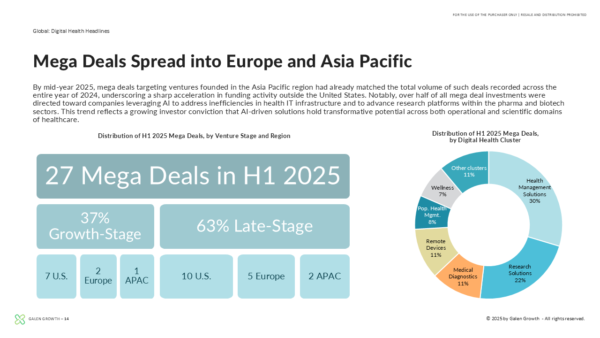

AI-driven diagnostics and health management tools led funding activity, with Europe growing 1.5x year-over-year, signaling stronger confidence in the region’s innovation capacity.

Exit activity stayed low, with 113 exits globally—6 IPOs and 107 M&As—suggesting a continued delay in IPO market recovery. Key therapeutic areas—cardiovascular, mental health, oncology, women’s health, and neurology—drew nearly $6B in funding, highlighting where investors see the greatest need and opportunity.

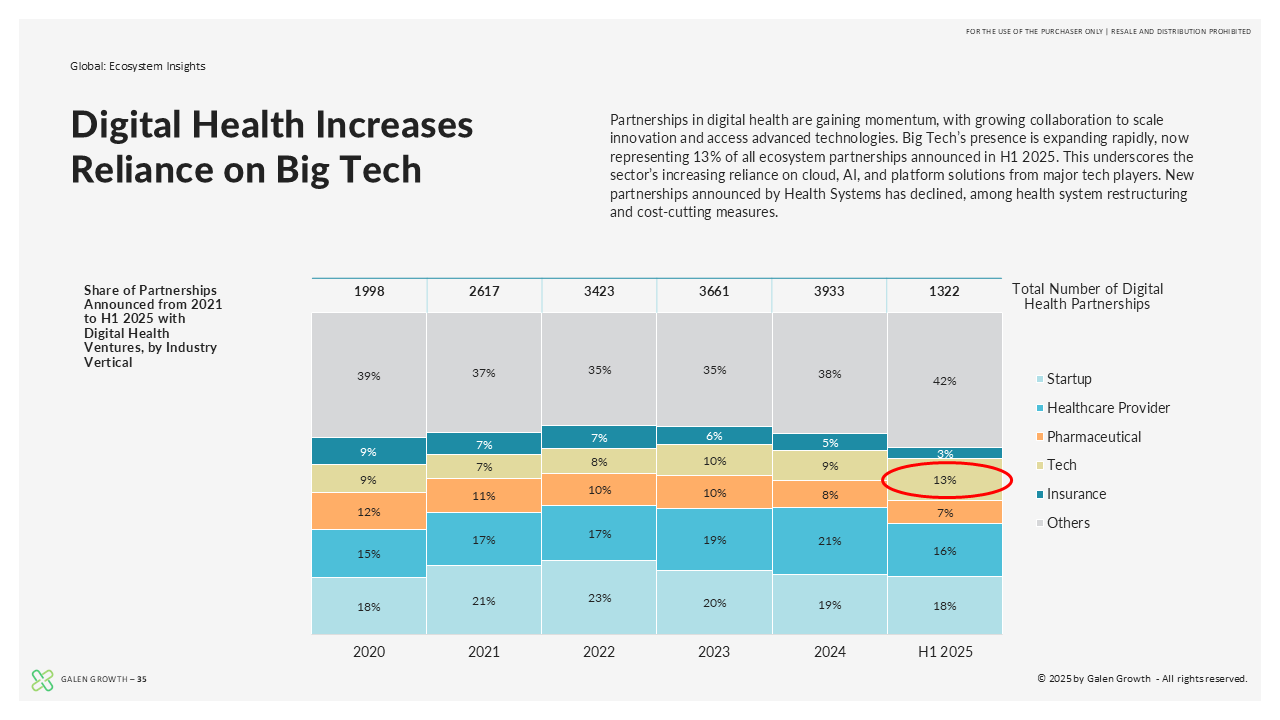

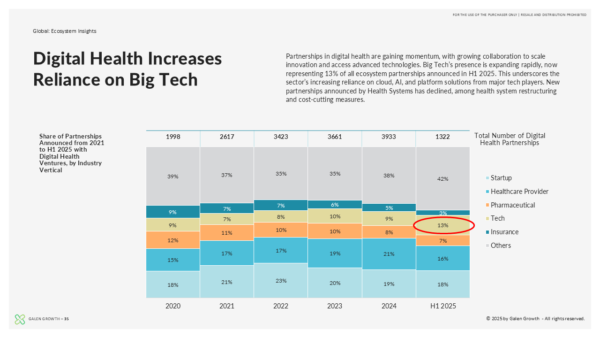

Partnership activity declined, down 27% in Q2 compared to Q1, as stakeholders focused on efficiency and real-world impact over experimentation.

2025 is shaping up to be a year of disciplined growth. In the second half, success will depend on the ability to deliver cost-effective, clinically meaningful solutions—particularly those applying AI with purpose.

Key Insights Include

- $12.1B invested across 616 deals globally – Despite a 13% year-on-year decline, funding remained robust, signalling a shift toward quality over quantity in digital health investment.

- European funding surged 1.7x YoY – Europe emerged as a growth engine, defying global trends with strong investor confidence in regional innovation.

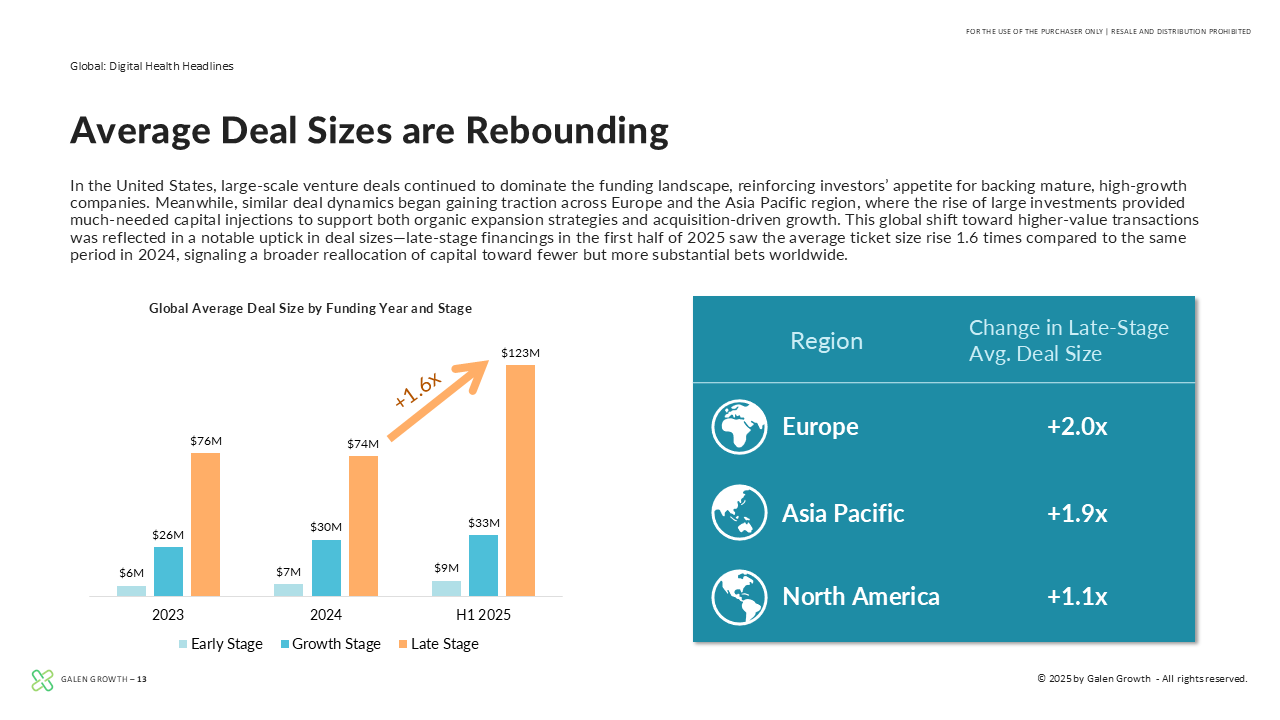

- Average deal size grew 1.6x, indicating more selective investments, with deal size growing across all funding stages

- Investment in AI-powered ventures reached 65% of total investment, with the bulk of funding flowing into AI-driven clusters such as Health Management Solutions and Research Solutions.

- Top-funded therapeutic areas: Cardiovascular health, mental health, oncology, women’s health, and neurology attracted nearly $6B combined, highlighting urgent unmet needs and innovation potential.

- Partnership activity declined 27% quarter-on-quarter, indicating a significant shift in industry dynamics is leading to an expectation of concrete outcomes, greater focus, and less “spray and pray” activity.

- 113 global exits, including 6 IPOs and 107 M&As. 70% of M&A activity remains venture-to-venture.

Ventures and Companies Covered in the Report

The “Q2 2025 Digital Health Funding” report includes data on the following companies: Beta Bionics, Kestra Medical Technologies, MiRXES (觅瑞早筛), Hinge Health, Omada Health, Caris Life Sciences, Commure, Sword Health, Abridge, Axmed, Tennr, General Catalyst, Khosla Ventures, Andreessen Horowitz, Gates Foundation, GV, Sword Health, Isomorphic Labs, Neko Health, Cera, Fitness Park, Pathos, Empathy, harrison.ai, Science Corporation

Powered by HealthTech Alpha

The Q2 digital health Funding report is powered by HealthTech Alpha, the premier digital health intelligence platform delivering unparalleled data and insights into the evolving healthcare technology landscape. Leveraging an extensive database of over 15,000 ventures and cutting-edge analytics, HealthTech Alpha provides a data-driven foundation to analyse the critical trends shaping the future of digital health.

Designed to empower stakeholders—including investors, pharmaceutical leaders, and medical device manufacturers—HealthTech Alpha offers actionable intelligence to navigate digital transformation complexities. This collaboration ensures readers gain a comprehensive, evidence-based view of the intersection between digital health and healthcare, equipping them to identify strategic opportunities, assess market dynamics, and stay ahead in this fast-evolving industry.

About our Premium Reports

Our Premium Reports are specialized reports that are only available to active users with HealthTech Alpha Pro and HealthTech Alpha Enterprise accounts and are provided at no additional cost.

Source of Data

Galen Growth’s proprietary platform, HealthTech Alpha, provides the data source for this report. Corporate Business Development, Business Intelligence, and Digital Health Partnership teams worldwide prefer HealthTech Alpha, the world’s most-trusted Digital Health data, intel, and insights platform. Visit https://www.healthtechalpha.com to learn more about our data or https://www.galengrowth.com research for our reports.

Our Mission

Founded in 2016 by Digital Health experts, Galen Growth empowers global Fortune 500 companies, institutional investors, and promising Digital Health ventures to fast track their digital health strategy to create significant financial and social values. To find out more, visit https://www.galengrowth.com

| Pages | Section | Description | Content |

|---|---|---|---|

| 2–8 | Introduction | – | |

| 9–18 | Digital Health Headlines | 9 charts, 2 tables | |

| 19–31 | Investment Insights | 14 charts, 4 tables | |

| 32–40 | Ecosystem Insights | 13 charts, 5 tables | |

| 41–46 | Cluster Focus | 4 charts, 2 tables | |

| 47–51 | Therapeutic Focus | 4 charts, 2 tables | |

| 52–66 | Regional Snapshots | North America, Europe, Asia Pacific | 15 charts, 3 tables |

| 67–73 | Key Information | – |

PRO

-

Sign up now to download all premium research

-

Access and download all data in HealthTech Alpha

Enterprise

-

Get full access to unmatched premium research for your organization

-

Additional collaboration features to take your team's research and collaboration to the next level