TL;DR

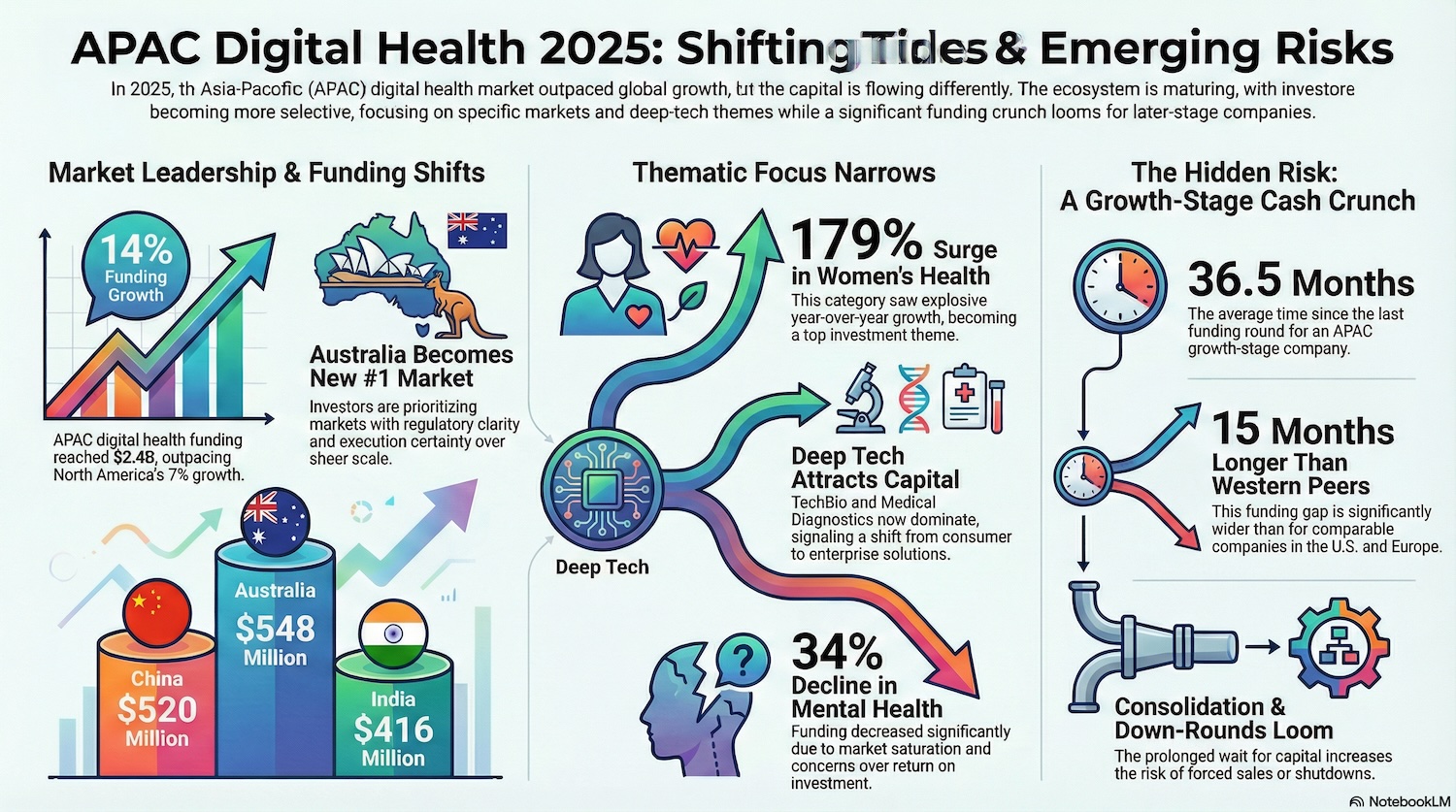

- APAC outperformed global markets in 2025, with digital health funding up 14% YoY to $2.4B, even as global growth stabilized.

- Australia unexpectedly became APAC’s top-funded market, overtaking China and India, signaling a shift toward markets with clearer regulation and execution certainty.

- Investor focus narrowed sharply: Women’s Health funding surged 179% YoY, Oncology remained strong, while Mental Health funding declined 34%, reflecting saturation and ROI concerns.

- TechBio and diagnostics now dominate, as capital moves away from generalist and consumer-first models toward deep-tech, infrastructure-heavy solutions.

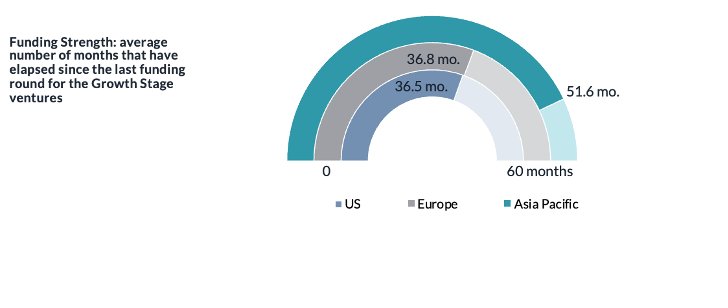

- A serious cash crunch is building at growth stage: APAC scale-ups average 36.5 months since last raise, far longer than US and Europe peers.

- APAC remains structurally mobile-first, requiring different product and go-to-market strategies than Western enterprise software–led markets.

- Partnerships are diverse but slowing, reinforcing that local fit beats regional scale in APAC.

For much of the past decade, the Asia Pacific (APAC) digital health story has been framed through a familiar lens: enormous population scale, uneven regulation, and capital cycles closely tethered to global investor sentiment. In 2025, that framing no longer holds.

While global digital health funding has stabilized rather than rebounded, APAC has quietly reasserted itself as a growth engine. Capital is flowing, but not in the ways many expected. Leadership within the region has shifted. Therapeutic priorities have sharpened. And beneath the headline growth, a structural risk is emerging that could reshape the ecosystem over the next 18–24 months.

Insights from Galen Growth’s 2025 global digital health funding analysis show a clear transition from breadth to selectivity. Investors are concentrating on fewer markets, fewer themes, and fewer companies, while asking harder questions about capital efficiency and time-to-scale.

This is not a retrenchment, as reinforced by HealthTech Alpha’s market intelligence. It is a maturation phase.

APAC’s Growth Is Real, But Leadership Has Changed

APAC posted meaningful year-on-year growth in digital health funding in 2025. Total capital deployed rose 14% to reach $2.4 billion, outpacing North America’s 7% growth, according to Galen Growth’s Q2 2025 APAC funding analysis.

On the surface, this suggests a region regaining investor confidence. The more important signal lies in where that capital landed.

In a notable shift, Australia emerged as APAC’s top-funded digital health market in 2025, with $548 million deployed. This exceeded funding raised in 2024, as detailed in Galen Growth’s 2024 APAC funding snapshot, and placed Australia ahead of China ($520 million) and India ($416 million).

This is not a story of China or India declining. Rather, it reflects a redistribution of capital toward markets offering a combination of regulatory clarity, advanced health systems, and deal sizes that align with investor risk appetite in a more disciplined funding environment.

Australia’s rise highlights a broader trend: APAC capital is increasingly selective, favoring markets where reimbursement pathways, clinical validation, and commercial adoption are more predictable. Scale is still valued, but not at the expense of execution certainty.

Women’s Health and TechBio Move to the Center

If geographic leadership shifted in 2025, thematic focus narrowed even more dramatically.

Women’s Health emerged as the most striking growth story in APAC, with funding increasing sharply year-on-year to become the most funded category. This surge is explored in detail in HealthTech Alpha’s Women’s Health startup analysis. Oncology remained a strong category but declined year-on-year, while Mental Health funding fell sharply, reflecting saturation and growing concerns around ROI.

This thematic rotation is mirrored at the cluster level. Research Solutions (often described as TechBio) and Medical Diagnostics attracted the highest levels of funding, as outlined in HealthTech Alpha’s Research Solutions cluster report.

These are capital-intensive, infrastructure-heavy domains, far removed from the consumer wellness apps that once defined APAC’s innovation narrative. The signal is maturity.

Investors are prioritizing technologies that plug directly into drug discovery, clinical workflows, and diagnostic decision-making. These models promise slower but more defensible growth, clearer enterprise customers, and tighter alignment with pharma and health system budgets.

For founders, the bar has been raised. Storytelling alone no longer suffices. Scientific credibility, regulatory readiness, and enterprise-grade integration have become table stakes.

The Hidden Risk: A Capital Crunch at Growth Stage

Headline funding growth masks a more uncomfortable reality: APAC’s growth-stage ventures are under mounting financial pressure.

On average, growth-stage digital health companies in the region have gone 36.5 months since their last funding round—nearly 15 months longer than comparable companies in the US and Europe.

Extended time between raises often signals valuation mismatches, slower-than-expected revenue traction, or investor hesitation about scalability. In APAC, it is likely a combination of all three.

Companies that have not raised in over 18 months face increasing odds of down-rounds, forced consolidation, or quiet shutdowns. This creates a bottleneck where promising ventures struggle to transition from pilots to scaled deployment.

2025 may therefore mark the beginning of a consolidation cycle in APAC digital health, where fewer, better-capitalized players absorb talent, IP, and market share from those unable to bridge the growth-stage gap.

APAC Remains Fundamentally Mobile-First

Product strategy continues to set APAC apart from Western markets in subtle but consequential ways.

In APAC, 49% of digital health venture products are mobile applications, compared with just 32% in North America and Europe, according to HealthTech Alpha’s APAC regional breakdown.

This reflects structural realities: fragmented provider networks, variable infrastructure quality, and the importance of direct-to-consumer engagement.

The implication for global players is clear. Enterprise-first strategies that succeed in the West do not translate cleanly to APAC without adaptation. Conversely, APAC-native companies that master mobile engagement and local distribution can scale faster—if monetization is clear.

Partnerships Are Broad, but Momentum Is Slowing

Partnerships remain a defining feature of APAC’s digital health ecosystem. Collaborations span healthcare providers, pharma companies, technology firms, and startups.

Momentum slowed noticeably in late 2025. After a strong start to the year, partnership announcements dropped sharply in Q4. While reporting delays may play a role, the slowdown reflects tighter capital conditions and more selective corporate priorities.

For ventures, the lesson is clear: local fit beats regional scale. A one-size-fits-all APAC strategy is increasingly untenable.

Strategic Implications by Stakeholder

- Pharma: APAC’s shift toward Women’s Health, Oncology, and TechBio creates opportunities for deeper integration, but requires patience and localized strategies.

- Insurers: Mobile-first engagement offers potential only when tied to measurable outcomes.

- Founders: Cash discipline, realistic valuations, and focus on high-probability markets are now existential.

- Investors: Expect consolidation, down-rounds, and selective follow-on support, as reflected in insights from the HealthTech Alpha platform.

- Policymakers: Australia’s rise underscores the capital impact of regulatory clarity and innovation-friendly frameworks.

Conclusion

APAC digital health in 2025 is neither overheated nor retreating.

Growth is real, but concentrated. Leadership has shifted. Thematic focus has narrowed. Capital discipline has tightened. The unanswered question is not whether APAC will continue to grow—but which players are structurally prepared to survive the transition.