TL;DR

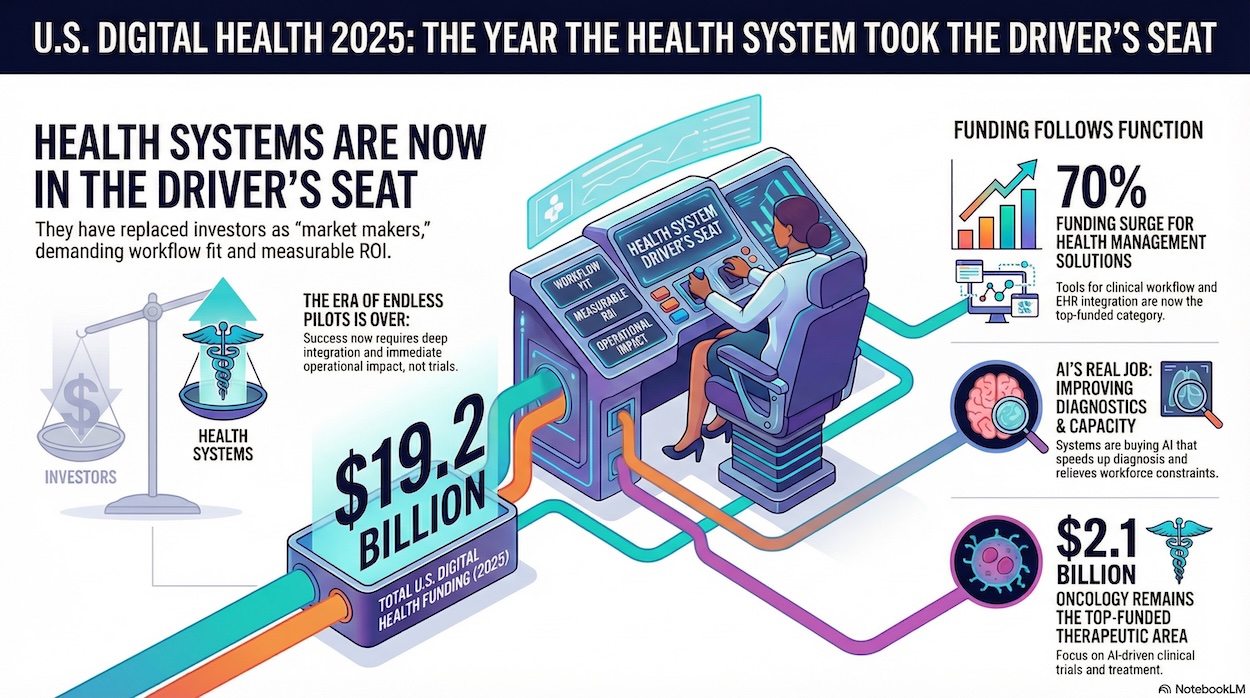

- Digital health funding reset: U.S. digital health funding reached $19.2 billion in 2025, shifting decisively toward provider-led, workflow-driven solutions with measurable ROI.

- Health systems rule: Providers have replaced investors as market makers, enforcing strict requirements around workflow fit and operational impact.

- Funding follows function: Capital surged 70% into Health Management Solutions, favouring practical EHR integrations over speculative moonshots.

- The EHR moat: Epic’s entry into ambient AI forces startups to justify external tools when incumbents bundle native alternatives.

- The 2026 mandate: Endless pilots are over; success now requires deep integration and immediate operational value.

For the past several years, the narrative of digital health funding has been dominated by the relationship between startups and investors. The story has been one of valuations, term sheets, and the shifting appetites of venture capital. However, looking at the 2025 data, a far more consequential shift has occurred in the United States. The power dynamic has moved. It is no longer the investor picking the winners; it is the Health System.

According to the Galen Growth Global Digital Health Funding and Key Trends 2025 report, the United States remained the gravitational centre of the global ecosystem, accounting for $19.2 billion—99% of all North American funding. What defined 2025, however, was not the amount of capital deployed, but where it went. U.S. health systems have become the primary engine of adoption, effectively dictating what the market—and investors—should build.

The Great Rotation: From “Moonshots” to “Workflow”

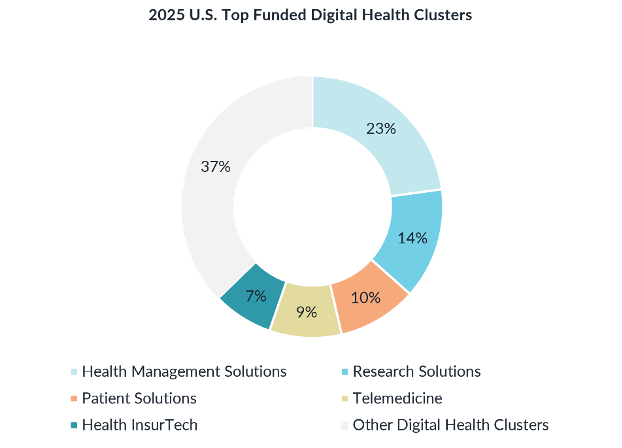

For years, Research Solutions (often grouped under TechBio) dominated digital health investment. In 2025, that era ended. Health Management Solutions—technologies that support clinical workflow, hospital operations, and EHR integration—became the most funded digital health cluster globally and in the U.S., overtaking Research Solutions for the first time.

This was not a coincidence. U.S. hospitals are no longer buying innovation for innovation’s sake. Workforce shortages, administrative overload, and capacity constraints have pushed provider leadership to prioritise technologies that keep clinicians productive and hospitals operational.

Capital followed the customer. In 2025, U.S. funding into Health Management Solutions jumped 70%. A defining example is the $300 million Series E raised by Abridge, a generative AI documentation platform designed to integrate directly into the EHR and remove hours of clerical work from physicians’ days.

The Launchpad: Health Systems as Market Makers

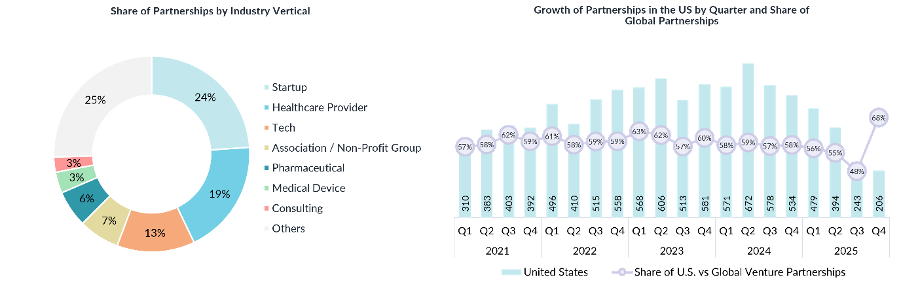

In 2025, U.S. providers solidified their role as the launchpad for scaling digital health products. Even as total partnerships declined globally amid market consolidation, U.S. health systems still accounted for 19% of all regional partnerships.

This marks a clear departure from the pilot-heavy experimentation of prior years. Health systems are increasingly unwilling to engage in one-off trials that lack a credible path to enterprise-wide rollout. CIOs are rationalising digital stacks and favouring platform strategies over fragmented point solutions.

This shift is reinforced by the gravitational pull of incumbents. Epic Systems’ move into ambient AI has raised the bar for startups, forcing them to answer a simple question: why should a health system buy externally when its core EHR vendor offers a native solution? As explored in Galen Growth’s analysis, “Epic Joins the AI Scribe Race: Can Startups Still Win?”, survival now depends on seamless integration and defensible differentiation.

AI’s Real Job: Diagnostics and Capacity

While AI remains a buzzword, U.S. health systems in 2025 made their priorities explicit: improve diagnostic accuracy and unlock capacity.

Medical Diagnostics remained the second most funded digital health cluster, attracting $2.6 billion globally. These investments focus on throughput—processing imaging and pathology faster and more accurately—directly supporting hospital margins rather than replacing clinicians.

At the therapeutic level, Oncology remained the top-funded area in the U.S., capturing $2.1 billion. Health systems are backing AI platforms that support trial matching, personalised treatment planning, and remote monitoring to prevent costly readmissions.

The Pharma Angle: Leveraging the Provider Network

The influence of health systems is now reshaping pharma strategy. In 2025, nearly 94% of large pharmaceutical companies operated Direct-to-Patient platforms. Yet pharma has learned that patient engagement cannot exist in isolation.

To succeed, these platforms must connect into provider workflows. As a result, pharma increasingly partners with the same digital health ventures used by health systems—those delivering telehealth infrastructure, digital pharmacy, and remote monitoring. The shared goal is “Healthcare Everywhere”: care that extends beyond hospital walls while remaining anchored to clinical systems.

Why It Matters

The 2025 U.S. data make one conclusion unavoidable: provider adoption now determines what scales. Capital allocation, product strategy, and partnership dynamics all flow downstream from procurement requirements, workflow fit, and measurable operational ROI.

Bottom line: U.S. digital health has entered a provider-led scaling era. Investors must underwrite deployability. Startups must build for integration and immediate operational impact. Health systems now sit firmly in the driver’s seat.

The full global analysis can be downloaded from Galen Growth’s Research Collection, offering deeper data, insights, and forward-looking perspectives on where digital health is heading next.