Inside Galen Growth’s New Pharma Innovation Index – The Evidence-Led Rankings Every Pharma Leader, Investor and Digital Health Pioneer Should Read

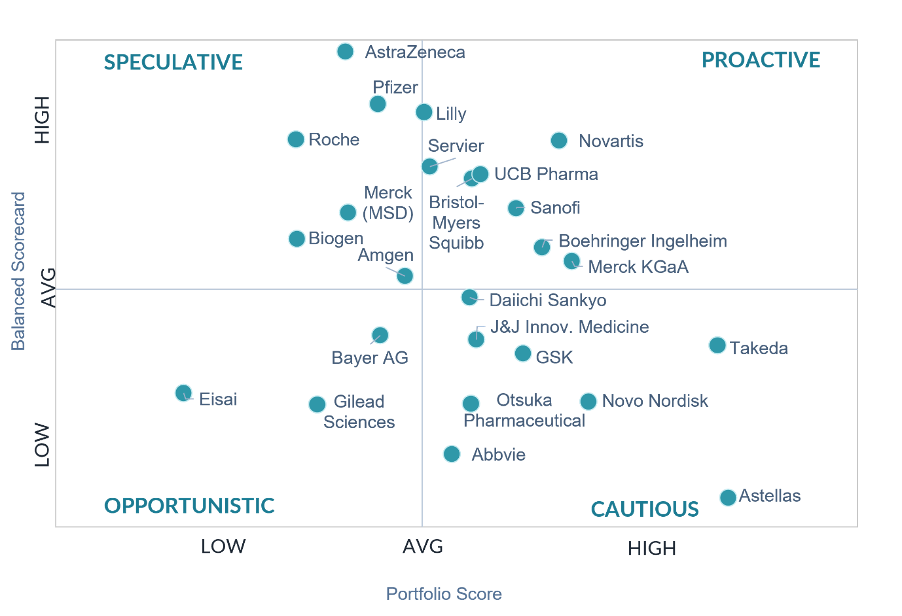

Galen Growth’s Pharmaceutical Digital Health Innovation Index 2025 (the fifth edition of this annual report) offers one of the clearest answers yet – and it does so in a single chart that many readers immediately zoom into: the 2×2 matrix on page six.

The 2×2 matrix everyone turns to first

The matrix plots each of the 25 most active global pharma companies in digital health along two axes: their Balanced Scorecard for digital health strategy and execution, and the strength of their venture portfolio. Together, those axes create four quadrants – Cautious, Opportunistic, Speculative and Proactive – that reveal not just who is doing “a lot” in digital health, but who is doing it well.

In the coveted Proactive quadrant sit the companies that have managed to do two hard things at once: build a robust, forward-looking digital health strategy and assemble a portfolio of ventures that can actually deliver it. Novartis is the standard-bearer here, combining a high Balanced Scorecard rating with a strong, carefully curated portfolio. Alongside it are Eli Lilly, Servier, UCB Pharma, Bristol Myers Squibb, Sanofi, Boehringer Ingelheim and Merck KGaA – a mix of global giants and more focused players that have found the sweet spot between reliability and experimentation.

These are not merely the companies with the most partnerships. They are the firms that have built digital ecosystems capable of influencing everything from discovery and clinical development to patient engagement and new commercial models. In boardrooms from the US to Europe and Asia-Pacific, this matrix is fast becoming a shorthand for one of the sector’s most strategic questions: are we just active in digital health, or are we genuinely effective?

Companies that fall into the Cautious or Opportunistic quadrants may still be building sizeable portfolios, but their activities are skewed – either towards safe, mature ventures without much edge, or towards scattered bets that lack a coherent strategic backbone. The matrix makes those trade-offs visible in a way that tables of numbers rarely can, which is why it has become the most pored-over visual in this annual report.

The new digital health leaderboard

Behind the matrix sits a more traditional ranking – the Balanced Scorecard – which evaluates how well each company is embedding digital health across four perspectives: commercial reach, patient and HCP impact, internal R&D and operations, and long-term learning and growth.

On this measure, AstraZeneca keeps its position at the top of the table for the second year running. Over the past three years it has announced 40 digital health partnerships and, with the launch of AstraZeneca Direct in October 2025, has made a bold push into direct-to-patient (DTP) services in the US.

The rest of the Balanced Scorecard top five underlines how concentrated leadership has become:

- Pfizer sits in second place

- Eli Lilly takes third

- Roche is fourth

- Novartis completes the top five, having jumped from 17th in last year’s ranking

Servier, UCB Pharma, Bristol Myers Squibb, Sanofi and MSD (Merck & Co) round out the top ten. These companies are not just experimenting with apps and pilots; they are using digital health to reshape their value chains – whether through AI-enabled discovery, trial optimisation or new DTP and patient-support models as part of their broader biopharma digital transformation.

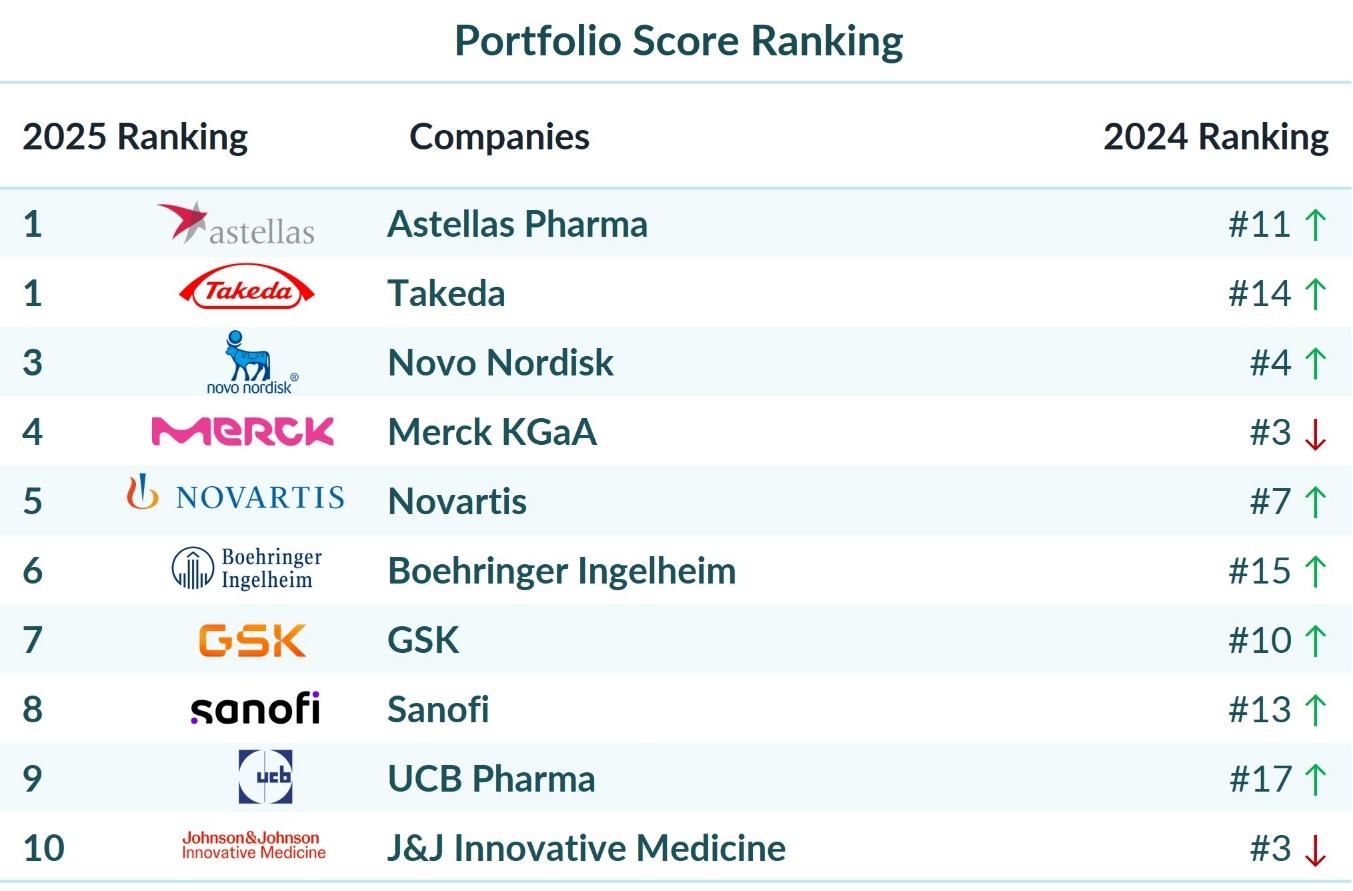

Who is backing the right ventures?

If the Balanced Scorecard shows how digital health is being embedded, the Venture Portfolio Score asks with whom. Size alone does not guarantee success; the quality, maturity and evidence base of the ventures matter just as much.

This ranking looks only at partnerships announced in the past three years, filtered through HealthTech Alpha’s proprietary analytics on management strength, clinical evidence, financial robustness and venture maturity.

Here, the top of the table looks markedly different:

- Astellas Pharma and Takeda share the number one position

- Novo Nordisk ranks third

- Merck KGaA is fourth

- Novartis again makes the top five, in fifth place

Boehringer Ingelheim, GSK, Sanofi, UCB Pharma and J&J Innovative Medicine complete the top ten. These companies have built portfolios that tilt decisively towards ventures with proven teams, strong evidence and sound finances – yet still leave room for emerging innovators with disruptive potential.

The contrast with the Balanced Scorecard rankings is telling. Some firms shine as strategic orchestrators, others as sharp venture pickers. A handful – notably Novartis, Merck KGaA and Sanofi – appear consistently across both lists and in the Proactive quadrant, suggesting that they are beginning to master both dimensions at once.

R&D powerhouses and patient-first pioneers

The report then slices the portfolios by their impact on two critical parts of the value chain: Research & Development and Patient Engagement.

For R&D-focused solutions – spanning research platforms, AI-driven discovery tools and digital technologies for clinical trials – Servier tops the ranking. It is followed by Eli Lilly, Merck KGaA, AbbVie and Gilead Sciences in the top five, with MSD, Bayer, Astellas Pharma, Takeda and Bristol Myers Squibb completing the top ten.

On the patient side, the leaderboard looks very different again. For ventures centred on patient solutions, adherence and awareness tools, Otsuka Pharmaceutical claims first place, followed by Daiichi Sankyo and Eisai. Servier appears once more, this time in fourth, with UCB Pharma in fifth. Gilead, Novo Nordisk, Boehringer Ingelheim, Lilly and Biogen fill the remaining positions in the top ten.

Download the full report to get the full ranking.

Taken together, these rankings suggest that true digital health leadership is multi-dimensional. Some pharma companies are becoming R&D powerhouses, harnessing AI and digital platforms to re-engineer discovery and trials; others are pushing furthest into continuous patient engagement and disease management. A growing minority are attempting to do both.

Why this matters – for leaders, investors and innovators

For pharma leaders, the Index is more than a vanity ranking. It acts as a mirror, reflecting how well their digital health efforts line up with commercial priorities, therapeutic focus and operational bottlenecks. It highlights, for example, that while AI tools are now widely used in research, the real frontier lies in digital solutions for clinical trials – the most expensive and risky part of the development process.

It also shows that the race is tightening. In 2021, the top 25 pharma companies accounted for 57% of all digital health partnerships with pharma; by 2025 that share has fallen to 42%, as hundreds of other companies build their own collaborations. Pharma’s share of all digital health partnerships now stands at just 13%, underlining how crowded the wider ecosystem has become.

For investors, the Index provides a rare cross-view of which digital health ventures are winning repeat mandates from leading pharma – and in which therapeutic areas. Oncology continues to dominate, accounting for 36% of partnerships, followed by neurology and cardiovascular disease. Women’s health and diabetes also command significant attention.

Crucially, pharma is raising the bar on evidence: around three-quarters of partnerships now involve ventures with strong, demonstrable clinical data, particularly in diagnostics, remote monitoring, patient solutions and clinical trial technologies. For anyone allocating capital, this is a powerful signal of where the most demanding customers in healthcare believe value is emerging.

For digital health innovators, the message is blunt. Strategic fit and evidence are non-negotiable. The Index makes clear that ventures which secure durable relationships with top-tier pharma tend to combine three things: a tight alignment with therapeutic priorities, robust clinical validation and the ability to move beyond pilots into integrated, scaled use. The rankings effectively function as a roadmap for how to become a “must have” rather than a “nice experiment”.

Inside the methodology

Behind the visuals lies a deliberately disciplined methodology. The Digital Health Innovation Index takes a snapshot of the 25 most active global pharmaceutical and biotech companies – those with at least 21 publicly announced partnerships with digital health ventures over the past three years. Regionally focused firms and relationships limited to accelerators or corporate venture capital are excluded.

Two pillars underpin the scoring:

- The Balanced Scorecard, which evaluates each company across four perspectives:

- Commercial: how digital tools expand market reach and support new models such as DTP

- Patient and HCP: how effectively solutions serve patients and clinicians, and how closely they align with core therapeutic areas

- Internal processes: the use of digital and AI to enhance R&D productivity, streamline operations and improve trial execution

- Learning and growth: whether the company is building sustainable digital capabilities, as shown by the trajectory and diversity of its partnerships

- The Portfolio Strength assessment, which zooms in on the ventures themselves. It uses HealthTech Alpha’s proprietary signals to examine management quality, financial strength, evidence base and venture maturity – the latter combining indices on money, market, momentum and innovation.

All data is drawn exclusively from HealthTech Alpha’s database; pharma companies are neither required nor incentivised to submit information. That independence, combined with the use of only observable, public partnerships from the last three years, is central to the credibility of the rankings.

Why this has become the industry’s benchmark

What sets the Index apart is less the format and more the foundation. It is built on more than a decade of longitudinal data on digital health ventures, partnerships and funding, all classified using Galen Growth’s detailed digital health taxonomy. It draws on over a billion structured data points and proprietary venture-analytics signals, rather than on surveys, self-reporting or anecdotal scoring.

For many in the industry, this combination of depth, discipline and independence explains why the Index is increasingly treated as the reference point for pharma’s digital health performance. It is not a marketing exercise; it is a data product, designed to be interrogated by strategy teams, BD&L leaders, innovation units and investment committees alike.

The 2026 question: molecule and machine

Looking ahead, the report’s authors are clear that the real test will come in 2026 and beyond. Direct-to-patient platforms are proliferating – seven major pharma companies have launched DTP offerings in the US alone in the past two years – even as new entrants and policy shifts challenge the economics of those models. At the same time, AI-enabled research tools are rapidly commoditising at the basic level, shifting the differentiation battleground to how deeply they are embedded in core workflows.

The emerging consensus is that digital health is no longer an either/or strategy. Biopharma companies will not be able to choose between being “a molecule powerhouse” or “a digital health leader”. To survive – let alone win – they will need to be both.

On one side sits the traditional engine of value: high-impact medicines, backed by strong clinical data and robust market access. On the other sits an increasingly sophisticated digital infrastructure: tools for identifying and engaging patients, platforms that make trials faster and more inclusive, and services that wrap around therapies to improve adherence and outcomes. The Proactive quadrant of the Index is, in effect, a preview of the companies that are closest to balancing these two engines today.

As patent cliffs loom and competition intensifies, digital health will not simply be a differentiator; it will be integral to maintaining growth, protecting margins and defending relevance with patients, payors and providers. The 2025 rankings show who has built the foundations. The real question now is who can translate that position into measurable performance in 2026 and beyond.

Who is Galen Growth – and what is HealthTech Alpha?

Galen Growth has spent the past decade specialising in one domain: digital health. From hubs in Singapore, Switzerland and the U.S., it tracks ventures, funding flows and partnerships across the full spectrum of digital healthcare technology – from bioinformatics and clinical trial platforms to remote monitoring, virtual care and digital therapeutics.

At the heart of this work is HealthTech Alpha, Galen Growth’s proprietary intelligence platform and the data engine behind the Pharmaceutical Digital Health Innovation Index 2025. HealthTech Alpha aggregates and structures data on tens of thousands of digital health ventures worldwide, applying specialised analytics such as the Alpha Score, Evidence Signal, Team Signal and Partnership Signal to assess maturity, robustness and ecosystem position.

For pharma companies, investors and health systems, it functions as both a radar and control tower: a way to see which ventures are emerging, which are scaling, which are backed by the strongest evidence, and which are already integrated into the strategies of leading pharmaceutical partners. The 2025 Index is, in many ways, HealthTech Alpha’s story told through the lens of 25 of the world’s most influential drug makers.

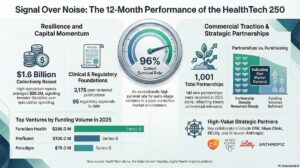

In an industry where digital health is rapidly moving from the margins to the mainstream, that perspective is becoming indispensable – not just for tracking who is ahead, but for understanding what it will take to catch up.