TL;DR

- Sword Health’s $285m acquisition of Kaia Health marks a decisive shift from fragmented point solutions to vertically integrated digital MSK platforms, optimised for scale, evidence, and unit economics.

- The deal combines Sword’s high-fidelity, therapist-led, sensor-based model with Kaia’s scalable, camera-driven computer-vision approach, enabling a tiered “high-low” care strategy across acuity and price points.

- Strategically, the acquisition secures Sword an immediate regulatory and reimbursement moat in Germany via Kaia’s DiGA approvals, while strengthening its competitive position against U.S. heavyweight Hinge Health.

- The combined entity gains unmatched clinical depth, therapeutic breadth, and a uniquely valuable AI training dataset on human movement—but faces execution risk in U.S. customer migration and cultural integration.

- Overall, this is a mature, transatlantic consolidation play that signals digital health’s transition from growth narratives to defensible, platform-scale incumbents

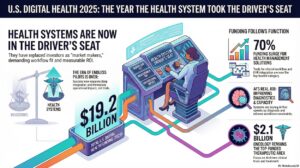

The era of “growth at all costs” in digital health has evaporated, replaced by a ruthless mandate for unit economics, clinical validity, and market consolidation. It is against this sober backdrop that Sword Health, the Portuguese-founded musculoskeletal (MSK) unicorn, announced the acquisition of Munich-based Kaia Health for $285 million.

This is not merely an acquisition; it is a calculated bid to engineer a transatlantic hegemony capable of fending off domestic heavyweights like Hinge Health while establishing rare, dual-market dominance in both the United States and Germany.

The Valuation Reality Check

To understand the significance of this deal, one must first look at the capital efficiency—or lack thereof—that precipitated it. Kaia Health had raised a total of $123.3 million in disclosed financing prior to this acquisition, including a $75.3 million Series C in 2021 led by Optum Ventures. A sale price of $285 million implies a multiple that, while providing liquidity, suggests a “soft landing” rather than the venture-scale home run investors envisioned during the frothy days of 2021.

In stark contrast, Sword Health has raised $468.1 million and commanded a valuation of $2 billion as early as 2021, recently closing a Series D1 of $130 million in mid-2024. That Sword is the acquirer speaks to the divergence in their fortunes: Sword’s capital-intensive but high-ROI model of “digital physical therapy” ultimately proved more resilient than Kaia’s lighter-touch, software-first approach. Sword has signalled it is on the cusp of profitability, a claim bolstered by a recent $54 million secondary sale to provide employee liquidity—a luxury rarely afforded to companies burning cash.

The Strategic Pivot: Hardware Meets Computer Vision

The central industrial logic of this merger resolves a decade-long debate in digital MSK care: sensors versus cameras.

Historically, Sword Health has championed a high-fidelity model, utilising FDA-listed inertial measurement units (IMUs) and licensed Doctors of Physical Therapy to treat patients. This yields impressive clinical outcomes—Sword claims a 3.2:1 ROI and 67% of members becoming pain-free. However, shipping hardware creates logistical friction and higher Cost of Goods Sold (COGS).

Kaia Health, conversely, bet the farm on scalability. Its “Motion Coach” technology utilises smartphone cameras and computer vision, requiring no external hardware. This allowed Kaia to scale rapidly, securing partnerships with UnitedHealth Group and ramping coverage to 60 million lives.

By acquiring Kaia, Sword executes a classic “hybrid” strategy. It can now deploy Kaia’s lower-cost, vision-based technology for preventative care and low-acuity cases, while reserving its premium, sensor-based therapy for post-surgical and chronic pain patients. This segmentation allows Sword to compete for massive population health contracts where price sensitivity previously hampered its hardware-heavy model.

The Fortress of Germany

Perhaps the most astute aspect of this deal is its geopolitical dimension. While U.S. competitors like Hinge Health have launched global initiatives, the European healthcare market remains a fortress of regulation. Kaia Health holds the keys to the kingdom: Germany’s DiGA (Digitale Gesundheitsanwendungen) reimbursement pathway.

Kaia’s Back Pain and COPD applications are fully reimbursed by German statutory health insurance, covering over 70 million lives. Achieving DiGA certification requires rigorous clinical trials and compliance with data sovereignty requirements that can take foreign competitors years to replicate. By acquiring Kaia, Sword instantly bypasses these barriers. Crucially, Sword’s integration strategy acknowledges this regulatory reality. While Sword intends to replace Kaia’s solution with its own brand in the U.S., it will maintain the Kaia brand and infrastructure in Germany. This ensures no disruption to the government-backed revenue streams that make Kaia a unique asset in the digital health portfolio.

SWOT Analysis: The Combined Entity

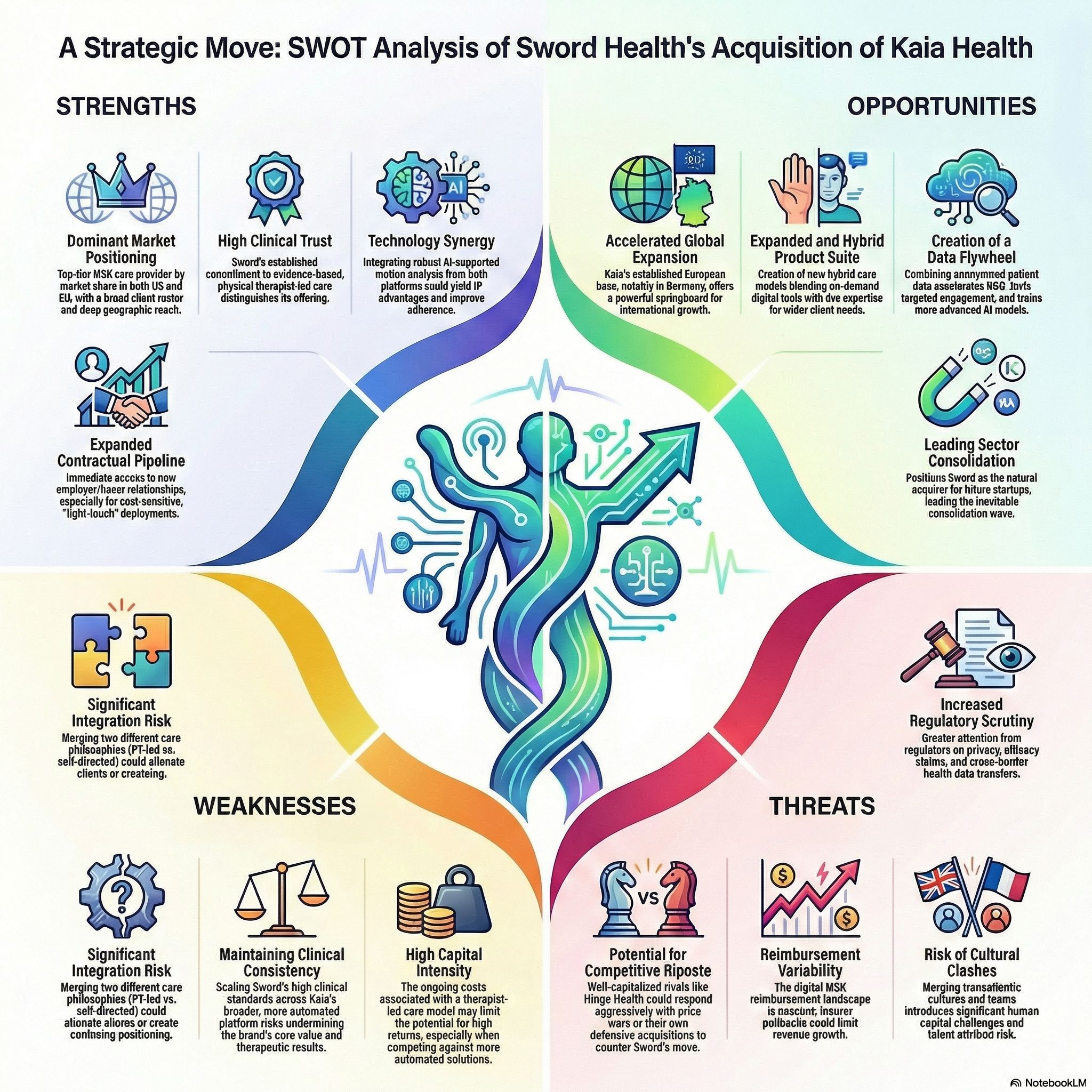

To evaluate whether this $285 million bet will pay off, we must assess the strategic balance sheet of the new Sword-Kaia entity.

Strengths

- Regulatory Moat: The combined entity possesses FDA-listed hardware capabilities in the U.S. and DiGA-certified reimbursement status in Germany. This dual-market compliance is virtually impossible for new entrants to replicate quickly.

- Clinical Depth: Sword’s 3.2:1 ROI and Kaia’s extensive randomised controlled trials (including the industry’s largest, with nearly 140,000 participants) create an overwhelming evidence dossier for payers.

- Therapeutic Breadth: The portfolio now spans MSK, women’s pelvic health (via Sword’s Bloom), mental health (via Sword’s Mind) and COPD (via Kaia’s unique pulmonary DiGA). This moves the company from a “point solution” to a comprehensive platform.

Weaknesses

- Integration Friction: Replacing Kaia’s U.S. solution with Sword’s platform is a high-risk manoeuvre. Kaia’s U.S. clients, including those from its partnership with Mutual of Omaha, chose a software-first solution. Migrating them to a more intensive model could trigger churn.

- Cost Structure: Despite the addition of Kaia’s software, Sword’s core business remains dependent on licensed physical therapists and hardware logistics. Scaling human labour is inherently less profitable than pure SaaS margins.

Opportunities

- The UK Public Sector: Sword has already acquired UK-based Surgery Hero and partnered with Guy’s and St Thomas’ NHS Trust (https://www.healthtechalpha.com/corporate/guy-s-and-st-thomas-nhs-foundation-trust). Adding Kaia, which is listed in NICE guidance for low back pain, positions Sword to dominate the NHS waiting list crisis with a “high-low” offering of pre-hab and digital triage.

- AI Training Data: Combining Sword’s sensor data with Kaia’s computer vision repository creates the world’s largest dataset on human movement. This will fuel Sword’s “Phoenix” AI agent, potentially automating more of the therapist’s role and improving margins.

- Cross-Selling: Sword can now push its Bloom women’s health solution into Kaia’s German user base, leveraging Kaia’s existing medical device infrastructure to expand the total addressable market.

Threats

- Hinge Health: Sword’s arch-rival IPO’d in May 2025 and reported over $574 million in revenue with newfound profitability. Hinge has the capital to wage a price war or acquire other European assets to counter Sword’s move.

- Cultural Dilution: Merging a Portuguese-American culture focused on high-touch clinical rigour with a German-American culture focused on software scalability presents significant human capital risks.

- Reimbursement Volatility: In the U.S., payers are increasingly scrutinising the ROI of digital solutions. If economic headwinds return, point solutions are often the first budget items to be cut.

The Verdict

Sword Health’s acquisition of Kaia is a mature, defensive, and offensive play all at once. It defends against Hinge Health’s global expansion by locking down the European continent, and it goes on the offensive in the U.S. by acquiring a major competitor’s book of business.

The deal signals the end of the fragmentation phase in digital health. CEO Virgílio Bento (https://www.linkedin.com/in/vbento/ ) is betting that the future belongs to vertically integrated platforms that can offer everything from COPD care in Munich to post-surgical rehab in New York. If Sword can successfully migrate Kaia’s U.S. customers without significant attrition, it will have cemented itself not just as a unicorn but as a trans-continental institution. If not, the $285 million price tag may be remembered as an expensive lesson in the difficulties of cross-border healthcare integration.

For now, however, Sword Health has firmly grasped the blade.