TL;DR

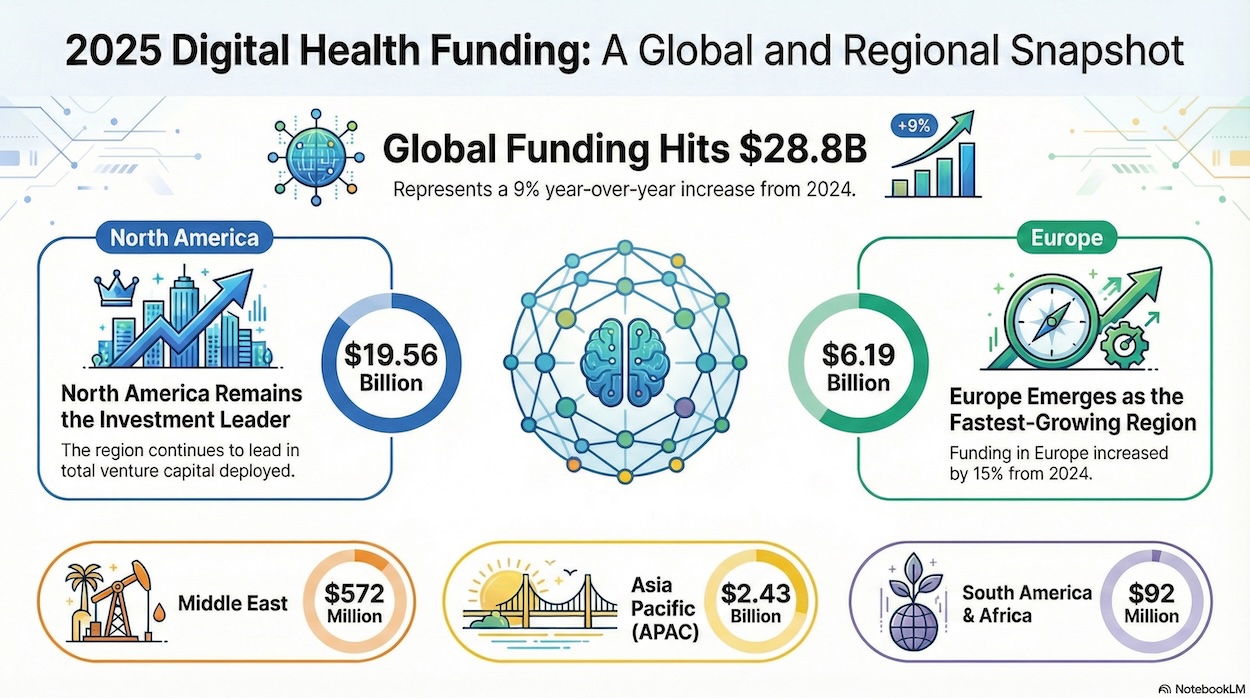

- Global digital health funding reached USD 28.8 billion in 2025, with larger cheques flowing into fewer, scaled ventures.

- Mega-deals made up 49 per cent of capital, reinforcing a winner-takes-more landscape.

- Europe was the fastest-growing region, helped by a surge of US investors into late-stage European rounds.

- Health Management Solutions overtook research-focused TechBio as the top-funded cluster, reflecting a pivot to workflow and reimbursement-ready tools.

- Providers tightened their grip on adoption, demanding interoperability, hard ROI and clinical evidence as partnership volumes fell to a five-year low.

Digital health has not “come back” so much as been re-priced, re-proved, and re-focused. In 2025, capital returned—but only to ventures that can demonstrate adoption, economics and impact under real-world constraints. The result is a market that looks healthier in aggregate, yet feels harsher: fewer deals, more scrutiny, and a sharper divide between scaled winners and everyone else.

A market that recovered—by concentrating

Global digital health funding reached USD 28.8 billion in 2025, up 9 per cent year on year. That headline masks the defining reality of the year: capital concentrated into fewer companies as deal activity continued to compress. Total deal count fell to 1,335 transactions, and quarterly volume dropped to a five-year low of 277 deals in Q4.

5-Year Trend of Global Digital Health Funding, by Quarter

The defining feature of 2025 was capital concentration. Mega-deals of USD 100 million or more accounted for 49 per cent of all digital health funding, with 65 such transactions totalling USD 14.0 billion across the year. The U.S. remained the epicentre of these outsized rounds, but Europe sustained the elevated mega-deal momentum it achieved in 2024.

| Venture | Funding | Category | Investors |

| Ōura | $900M | Wearables | Fidelity, ICONIQ Partners, Whale Rock, Atreides Management |

| Neko Health | $260M | Medical Diagnostics | Lightspeed Venture Partners, General Catalyst, OG Venture Partners, Rosello, Lakestar, Atomico |

| Amboss | $259M | Medical Education | KIRKBI, M&G Investments, Lightrock and more. |

| Isomorphic Labs | $600M | Drug Discovery | Thrive Capital, GV, Alphabet |

| CMR Surgical | $200M | Prescriptive Analytics | Trinity Capital, Lightrock, SoftBank |

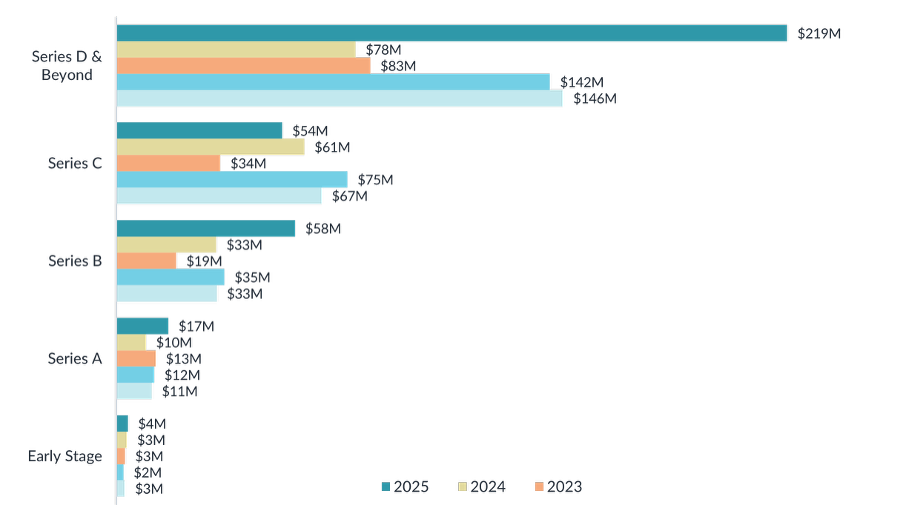

Across stages, pricing signals a decisive shift in investor conviction. Early- and late-stage rounds both saw average ticket sizes increase 1.6 times compared with 2024, while global average deal size rose across every stage of the funding stack.

Series B funding value increased 19 per cent and Series D and beyond 16 per cent, underscoring a renewed willingness to back scale-up stories that can plausibly reach the reopening exits window in 2026 and beyond.

Europe’s moment – with an American accent

Europe delivered the strongest regional growth, with funding up 15 per cent year on year to USD 6.2 billion, against 7 per cent growth in North America, which reached USD 19.5 billion.

By 2025, US investors accounted for 62 per cent of participants in European late-stage digital health deals, roughly triple their share in 2023. Average late-stage deal size in Europe grew 4.1 times over 2024, supported by transactions such as Oura’s USD 900 million Series E (led by Fidelity Management & Research Company) and Neko Health’s USD 260 million Series B (led by Lightspeed Venture Partners).

From hype to workflows: what actually got funded

The centre of gravity in digital health has shifted from speculative science to practical infrastructure. Health Management Solutions emerged as the top-funded cluster in 2025, attracting USD 5.45 billion and overtaking research solutions.

Research Solutions remained substantial at USD 4.49 billion, but funding declined by 19 per cent. Medical Diagnostics and Telemedicine drew USD 2.62 billion and USD 2.53 billion, respectively.

Evidence, partnerships and the new buyer power

Evidence becomes a currency, not a nice-to-have

In 2025, evidence stopped being a differentiator and became the price of admission. Regulatory filings and peer-reviewed publications increased again, even as the number of formal clinical trials dipped, as ventures focused on generating targeted proof instead of chasing costly, unfocused studies.

Health systems and payers are internalising this shift. Procurement criteria increasingly demand outcome measures mapped to local environments rather than controlled demo conditions.

Fewer partnerships, higher standards

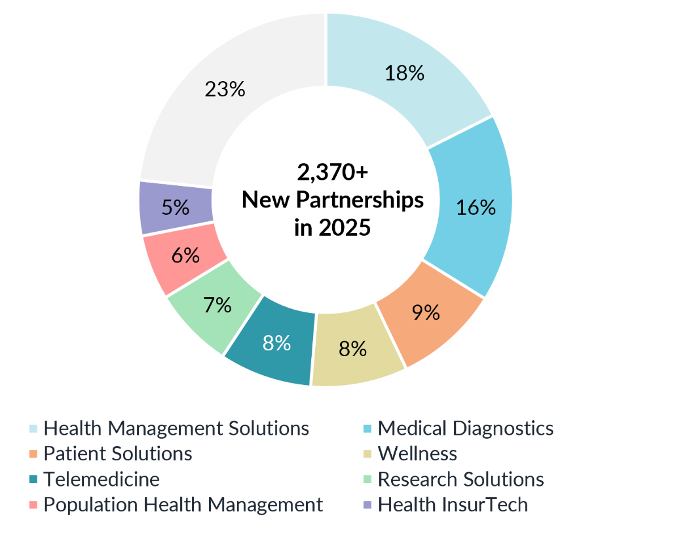

Partnerships fell to a five-year low, with just over 2,370 deals announced in 2025, continuing a decline that began in mid-2024. Health Management Solutions and medical diagnostics nonetheless remained the most active partnership clusters, indicating a sustained focus on infrastructure and diagnostic innovation.

Providers strengthened their influence, accounting for 18 per cent of all partnerships and emerging as the single most important adoption engine.

The message for all sides is unambiguous. Partnerships are no longer experimental pilots or branding exercises. They are scarce resources that must come with defined integration milestones, adoption targets, evidence plans and commercialisation pathways. “Announce and move on” is no longer tolerated in a market where implementation fatigue is widespread.

Beneath the surface: runway risk and investor consolidation

The apparent return of capital disguises a growing solvency problem for large parts of the ecosystem. Global “funding strength” indicators show that only 23 per cent of early-stage ventures, 31 per cent of growth-stage ventures, and 47 per cent of late-stage ventures raised funding in the previous 18 months – a typical runway period. For growth-stage companies in Asia-Pacific, the average time since last raise for growth-stage ventures is nearly 15 months longer than for peers in Europe and the US.

At the same time, the investor base is narrowing. More than 15,000 investors have backed at least one digital health deal in the past 15 years, but annual participation peaked at 3,968 investors in 2021 and has since fallen to 2,472 in 2025 – a 38 per cent decline. Only 3.6 per cent of investors active between 2021 and 2025 participated in a deal each year. A small cadre of repeat players – such as General Catalyst, Andreessen Horowitz and the Gates Foundation – now wields disproportionate influence, together participating in more than 75 digital health deals in 2025 alone.

| Investor | # of Digital Health Deals in 2025 | # of Digital Health Investments since 2010 | Recently Participated Investment | Date | Deal Value |

| General Catalyst | 36 | 218 | Chai Discovery | 12 / 2025 | $130M |

| Andreessen Horowitz | 20 | 169 | Function Health | 11 / 2025 | $298M |

| Gates Foundation | 19 | 231 | EMGuidance | 11 / 2025 | $914k |

| Khosla Ventures | 17 | 201 | Faeth Therapeutics | 10 / 2025 | $25M |

| Alumni Ventures | 17 | 79 | Emm | 11 / 2025 | $9M |

Stakeholder playbook for Digital Health Funding in 2026

Investors should lean into concentration and diligence: stress-test burn rate, gross margin trajectory, and renewal resilience; privilege workflow-adjacent categories where ROI is measurable; and treat evidence as a valuation input rather than a marketing claim.

Corporations should move from perpetual scouting to operating outcomes: fewer, deeper partnerships anchored in measurable impact (time saved, throughput improved, cost reduced), with interoperability and data governance as gating criteria and evidence co-creation built into contracts from day one.

Health systems should codify value rather than rely on anecdotes: standardise procurement around interoperability, security and evidence; avoid pilots without a route to scale; and prioritise vendors that simplify—rather than compound—technology stacks.

Ventures should internalise the new baseline: AI and design quality are now table stakes. Durable advantage comes from workflow fit, embedded distribution, proprietary data, interoperability and evidence that travels across buying centres—supported by implementation playbooks and repeatable go-to-market motions rather than bespoke deployments.

Why this matters now – and where to go deeper

As 2026 begins, the digital health market is simultaneously more credible and more unforgiving. Funding has stabilised and is rising, yet it is more selective; partnerships are harder to secure; and buyers are more demanding. The winners will be those who can prove impact inside real workflows, under real constraints, with real economics—because the market has moved decisively from hype to hard results.

Galen Growth’s full analysis of 2025, packed with detailed data, insights, and forecasts, can be downloaded from Galen Growth’s Research. Don’t miss out on this indispensable resource for understanding the future of digital health.