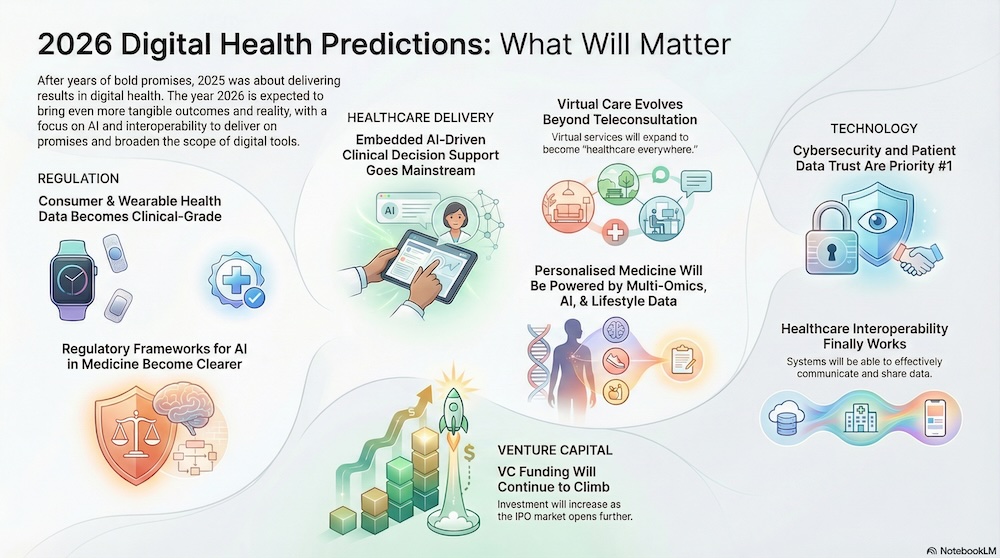

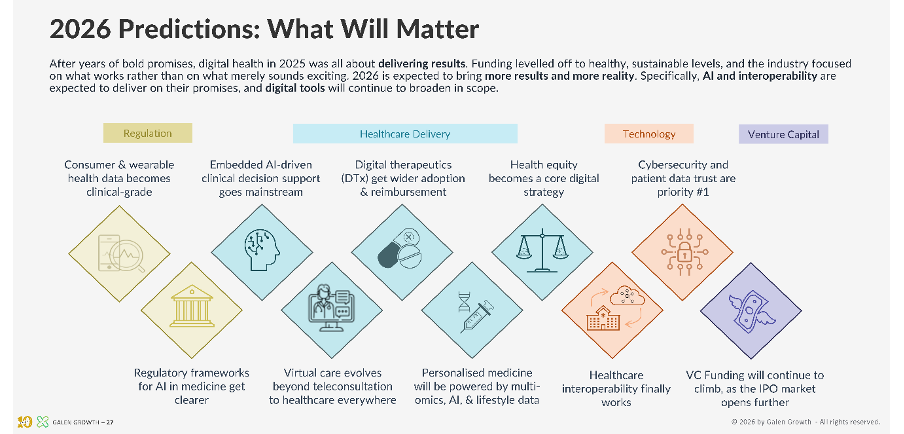

Digital health 2026 marks a structural turning point for the industry. After spending the better part of a decade selling a future tense—will reduce cost, will improve outcomes, will fix access—the market has begun pricing those verbs in the present. In 2025, capital became more selective, health systems asserted workflow and ROI demands, and the ecosystem shifted from ambition to proof as funding stabilised on firmer ground.

As a result, digital health in 2026 will look less like experimentation and more like infrastructure. Not slower—more embedded. The winners will increasingly resemble utilities: trusted data, trusted models, trusted pipes, trusted reimbursement, trusted security. Our ten predictions for 2026 follow that logic. Digital health’s next phase will be defined by clinical-grade data, operational AI, and interoperability that finally works—underpinned by governance, cybersecurity, and a reopening of capital markets that rewards durability.

Before looking forward, it is worth checking our own scorecard. In January 2025, we published our “10 Predictions for 2025” (link) across IPOs, AI funding, obesity-care platforms, AI regulation, consolidation, reimbursement, telehealth, AI in delivery, primary care scalability, and the policy impact of the new U.S. administration. With the benefit of 2025 evidence, we estimate that around eight of the ten predictions happened either fully or directionally.

There were clear wins—digital health IPOs returning, AI regulation accelerating, consolidation persisting—and a couple that were more partial or timing-dependent, including reimbursement reform and policy impact. Digital health IPOs did reopen: Hinge Health and Omada became emblematic of a market willing to fund credible businesses again, not just narratives. Regulation tightened in parallel. FDA draft guidance on AI-enabled device software functions landed early in 2025, while Europe stayed on track with the AI Act implementation timetable.

That brings us to 2026.

1. Consumer and wearable health data becomes clinical-grade

The first prediction is deceptively simple: consumer and wearable health data becomes clinical-grade. Not because consumers suddenly behave like trial participants, but because devices, data fusion, and validation pipelines are converging. The shift is from “steps and vibes” to longitudinal, multi-signal datasets that can support triage, monitoring, and reimbursement.

Late-2025 FDA guidance recognising real-world evidence from wearables—provided standards for integrity, bias mitigation, and explainability are met—accelerates this shift. As a result, wearables will be pulled into regulated workflows, procurement, and liability frameworks, while facing materially higher bars for data quality and validation.

2. Regulatory frameworks for AI in medicine get clearer

2025 began the process. FDA guidance and the EU AI Act timeline made it clear that “move fast and break things” is not an acceptable operating model for high-risk healthcare AI. In 2026, the practical effect is that compliance becomes a product function.

The best teams will not treat regulation as drag; they will treat it as a moat. Clarity also accelerates procurement, because buyers can finally anchor decisions in standardised expectations rather than bespoke risk debates in every sales cycle.

3. Embedded AI-driven clinical decision support goes mainstream

Clarity unlocks the next shift: embedded AI-driven clinical decision support goes mainstream. The market is moving away from “AI as a destination app” and toward “AI as a feature inside the system of record.” Ambient documentation and workflow automation are early proof points—health systems are buying back clinician time because it is a direct operating-margin lever, not a speculative benefit.

In 2025, Epic Systems validated this category shift, further analysed in this coverage. In 2026, the competitive battleground will be integration depth and measurable throughput gains, not model demos.

4. Virtual care evolves beyond teleconsultation to healthcare everywhere

Telehealth is no longer defined by video visits. It is defined by distributed care pathways—remote monitoring, asynchronous care, home diagnostics, and integrated chronic care. Even after post-pandemic normalisation, physician usage remains structurally higher than the pre-2020 baseline, particularly across telemedicine platforms.

In 2026, “virtual care” becomes less of a channel and more of a default operating model for defined populations and conditions. The winners will be those who can coordinate across settings, not those who merely schedule appointments.

5. Digital therapeutics gain wider adoption and reimbursement

This is not a blanket endorsement of the category; it is a prediction about the survivors. Evidence-based software treatments for mental health, pain, insomnia, and related conditions will increasingly be prescribed like medications, with broader payer coverage.

The reimbursement signal strengthened in 2025 with new CMS codes for behavioural-health DTx and expanding reimbursed mHealth pathways in other markets. Category context is explored further here. In 2026, digital therapeutics will win on economic credibility: outcomes tied to utilisation, adherence, and total cost-of-care impact.

6. Personalised medicine becomes an operational decision layer

The scientific spine of the decade is personalised medicine powered by multi-omics, AI, and lifestyle data. The value is not technical novelty; it is the conversion of biology into a decision layer.

In 2026, personalised medicine increasingly looks like operational decisioning—risk stratification, treatment selection, dosing support, and relapse prediction—blending omics signals with behavioural and environmental context. The constraint is not compute, but data quality, integration, consent, and trust.

7. Health equity becomes a core digital strategy

In 2026, health equity moves out of CSR slides and into product requirements: language accessibility, inclusive training datasets, bias monitoring, and procurement criteria that reward real-world representativeness.

This shift is driven by both regulation and economics. Solutions that work only for advantaged subpopulations will fail to scale in value-based environments. Improvements in virtual care will increasingly benefit patients in rural and underserved regions.

8. Healthcare interoperability finally works—enough to matter

This is the promise the industry has made for two decades. In 2026, interoperability does not work everywhere or perfectly, but it works meaningfully enough to change outcomes.

The difference is focus. Interoperability becomes less about raw data exchange and more about workflow continuity. When data moves with semantic consistency and auditable permissions, care coordination, AI enablement, and longitudinal measurement become achievable rather than aspirational.

9. Cybersecurity and patient data trust become the top priority

Clinical-grade consumer data, interoperable infrastructure, and embedded AI expand the attack surface. Trust therefore becomes existential.

In 2026, buyers will treat security posture as a first-order selection criterion, not a procurement checkbox. The message for digital health leaders is blunt: if you cannot demonstrate trust, you will not be allowed to scale.

10. VC funding continues to climb as IPO markets reopen

Digital health funding stabilised in 2025 (analysis), and IPOs returned for credible businesses. Exits matter because they recycle innovation capital and reset market expectations.

In 2026, capital will not return to growth at any cost. It will flow to companies with defensible data assets, embedded distribution, reimbursement durability, and clear unit economics.

Taken together, these predictions point to a single thesis: 2026 is when digital health stops being a category and starts being infrastructure. The companies that win will not be those who shout the loudest about AI. They will be those who quietly keep healthcare’s promises—by making data reliable, workflows simpler, care more continuous, and trust non-negotiable.

These predictions are a direct read-through from the market signals and stakeholder implications in our latest flagship analysis, Global Digital Health 2025: Re-Priced, Re-Proved, Re-Focused. Capital has concentrated into operational winners, buyer power has tightened procurement standards, and evidence plus distribution has become the decisive differentiator as exit conditions reopen.

The implications for 2026 are clear. Investors will reward discipline over breadth. Corporates should pivot from broad innovation scouting to fewer, deeper partnerships with measurable outcomes. Health systems must codify ROI requirements and demand interoperability and workflow fit before scaling. Ventures must build for integration, security, and proof at speed—because “AI” alone is no longer differentiation unless it measurably reduces workload and improves outcomes in real environments.