The investors who will shape the next decade of digital health are no longer just spraying capital across the sector. They are picking their spots, backing evidence over hype, and building dense partnership networks that turn point solutions into infrastructure. In other words: digital health investors are becoming builders of ecosystems, not just financiers.

Galen Growth’s new HT50 Core Investors 2025 report, the 3rd edition of this annual analysis, was launched exclusively at Health Tech Forward, and sets out to identify exactly who those investors are, and what sets them apart. Drawing on HealthTech Alpha’s unrivalled dataset of more than 2 billion digital health data points, including the activities of 16,100 investors worldwide, it offers one of the most granular views yet of capital, clinical evidence and ecosystem power in digital health.

A maturing market – and a more demanding investor

Global digital health has come through its post-pandemic reset with surprising resilience. Since 2021, ventures have raised USD 164 billion across more than 10,100 deals, even as broader venture markets cooled and interest rates climbed. While the extraordinary surge of 2021 now looks like an outlier, 2025 is on track to beat 2024, with an estimated USD 28 billion in annual capital once the year closes.

Crucially, the ecosystem itself is still expanding. The number of active digital health ventures has climbed to around 16,000 in 2025, roughly 15% more than in 2021. Investor appetite has become more selective, but the pipeline of innovation – from virtual care and clinical AI to TechBio and new trial models – shows no sign of drying up.

Investors’ focus, however, is changing. Early-stage deals remain the largest slice of activity, but their dominance is ebbing: their share has slipped from 52% of all digital health transactions in 2021 to 49% in the first half of 2025, having briefly peaked at 62% in 2023. Growth-stage deals have strengthened to nearly 40% of the market. In comparison, late-stage transactions now account for 11% – not because of a sudden surge at the top, but because total deal volume has retracted, forcing investors to concentrate on fewer, stronger bets.

Partnerships have become the other major axis of power. Publicly disclosed collaborations grew from 2,675 in 2021 to 4,051 in 2024 – a compound annual growth rate of 14–15%. Healthcare providers account for around 20% of these partnerships, tech companies for 16%, and pharma, med dev and insurers collectively for another 20%, with 40% involving a broader mix of stakeholders. The message is clear: capital alone no longer wins markets; ecosystems do.

From 16,100 investors to 50 core digital health investors

Against this backdrop, the HT50 Core Investors 2025 report set out to answer a deceptively simple question: who are the most important investors in digital health today?

From 16,100 investors that have backed digital health ventures since 2002, Galen Growth identifies just 695 “Core Investors” – those that have been meaningfully active in the post-pandemic period and have portfolios with real weight in the ecosystem. To qualify, an investor needed at least three digital health investments between January 2022 and June 2025, plus sufficient data to assess portfolio maturity, evidence and partnerships.

Within this Core universe, the report highlights a cohort of leading investors across funding stages, geographies, and strategic themes such as TechBio, femtech, clinical evidence, and clinical trials. The rankings are based on a composite Investor Score that blends traditional metrics (new deals, exits, large-cap holdings) with HealthTech Alpha’s proprietary Alpha Score, Momentum and Partnership scores.

The result is a who’s who of influence in digital health – and a useful guide for founders, pharma executives and LPs trying to separate signal from noise.

Leaders by stage: early, growth and late

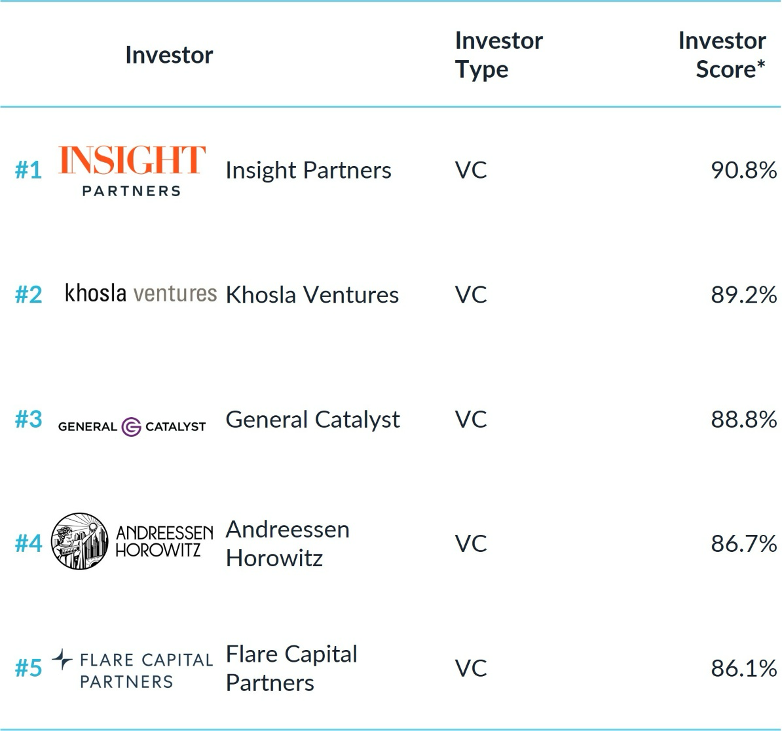

At early stage, where experimentation and thesis-driven investing still matter most, the 2025 ranking is led by Insight Partners, which tops the table with an Investor Score of 90.8%. It is followed by Khosla Ventures in second place, General Catalyst in third, Andreessen Horowitz in fourth and Flare Capital Partners in fifth. Together, these firms have assembled portfolios that combine a high volume of new investments with strong venture-maturity and partnership profiles, suggesting they are not only writing cheques but also building resilient, connected companies.

Top 5 Core Early Stage Investors in 2025

At growth stage, where ventures have moved beyond pilots into scaled commercial deployment, the centre of gravity shifts towards strategic capital. CVS Health Ventures takes the top spot, reflecting the US healthcare group’s increasingly muscular role in shaping care delivery, pharmacy and benefits through digital tools. Index Ventures and Questa Capital occupy second and third places respectively, with Insight Partners again featuring in the top five, alongside GV (Google’s corporate venture arm).

In the late-stage bracket, dominated by crossover investors and public-markets specialists, Wellington Management leads the ranking, followed closely by SoftBank and Ally Bridge Group. Perceptive Advisors and Fidelity Management & Research Company round out the top five. These names matter because they often anchor the rounds that take digital health ventures from growth-stage promise to global scale – and, ultimately, into the public markets or strategic exits.

Regional champions: US, Europe and Asia-Pacific

The report also highlights the investors shaping regional ecosystems.

In US digital health, CVS Health Ventures again emerges as the leading Core Investor, ahead of Insight Partners, GV, Khosla Ventures and General Catalyst. This cluster of payers, tech giants and blue-chip venture firms mirrors the US market’s continued tilt towards integrated care platforms, data-rich population health and AI-enabled clinical workflow tools.

In Europe, the top of the table tilts firmly towards thematic venture capital. Khosla Ventures takes first place, reflecting its increasingly global lens and backing of European AI- and data-heavy ventures. Eurazeo, Verve Ventures, Index Ventures and General Atlantic follow it. These investors straddle major hubs from Paris and Berlin to London and Zurich, and sit at the intersection of digital health, life sciences and software.

In Asia-Pacific, a different set of names comes to the fore. . Accel Partners tops the list with an Investor Score of 94.9%, ahead of Novo Holdings, HealthQuad, Khosla Ventures and Mirae Asset. Together, they anchor ecosystems stretching from India’s fast-growing provider and insurance markets to advanced biopharma and med dev clusters in North-East Asia.

Thematic powerhouses: TechBio, Femtech, clinical evidence and trials

Beyond stage and geography, HT50 Core Investors 2025 zeroes in on four high-impact themes: TechBio, Femtech, clinical evidence and clinical trials.

In TechBio, where computation and biology converge, Insight Partners again leads the ranking, ahead of GV, RA Capital Management, Khosla Ventures and Wellington Management. This group is notable for backing companies at the frontier of drug discovery, computational biology, and precision medicine – areas where digital health meets core biopharma R&D.

In Femtech, an area that has historically been underfunded but is now moving firmly into the mainstream, GV takes first place. Khosla Ventures and General Catalyst follow, with SemperVirens VC and Felicis Ventures completing the top five. Their portfolios span reproductive health, menopause, oncology, chronic disease and workplace-focused women’s health, signalling a broadening of Femtech beyond fertility and period-tracking apps.

For clinical evidence-led investing – ventures that have accumulated substantial clinical trial validation, real-world data or regulatory filings – Wellington Management sits at the top of the table. Ally Bridge Group, Perceptive Advisors, Fidelity Management & Research Company and T. Rowe Price Associates occupy ranks two to five. These investors are playing a pivotal role in financing companies whose value proposition is grounded in robust evidence rather than pure digital convenience.

Finally, in clinical trials innovation, Insight Partners again emerges as the leading Core Investor, followed by General Catalyst, Novo Holdings, Ally Bridge Group and Breyer Capital. Their portfolios include decentralised trial platforms, real-world evidence generators and AI-enabled patient recruitment solutions – the very tools that pharma R&D teams are now relying on to de-risk and accelerate development pipelines.

Why this matters – to pharma, investors and innovators

For pharma, health systems and medical device leaders, this is not just a ranking exercise; it is a forward-looking map of who is quietly shaping your future operating environment. The investors at the top of these tables are effectively acting as external R&D arms for the industry – deciding which new care models, data platforms, clinical AI tools and evidence engines will exist for you to partner with, license or acquire in three to five years. Understanding their portfolios, thematic focus and partnership patterns gives you an early read on where the next wave of strategic assets is likely to emerge, long before they appear in conventional deal pipelines.

For health systems and providers, the implications are equally stark. Many of the ventures backed by these Core Investors are designing the infrastructure that will determine how your clinicians work, how patients flow through your services and how data is captured and monetised. Knowing which investors consistently back ventures that can navigate regulation, integrate with clinical workflows, and demonstrate outcomes enables you to distinguish between transient point solutions and platforms that are likely to endure – and therefore worth the organisational effort to adopt.

For financial investors and LPs, the HT50 Core Investors universe is a mirror. It exposes where peers are leaning in – clinical trials, TechBio infrastructure, evidence-rich therapeutics, virtual care platforms – and where there may be under-explored white space. It also challenges a purely volume-driven view of success. In an era of tighter capital and slower exits, backing companies with strong Alpha, Momentum and Partnership Scores is no longer a “nice to have”; it is increasingly the difference between portfolios that compound value and those that stall in mid-stage limbo.

For digital health innovators, this report amounts to a highly curated “map of money and conviction”. It highlights which investors genuinely understand the regulatory, evidence and integration realities of selling into healthcare, and which are aligned with your stage, geography and domain. In a crowded fundraising environment, being able to focus on investors whose portfolios already demonstrate deep engagement with payers, providers and pharma can compress fundraising cycles and materially improve your odds of building something that not only gets funded but gets used.

Inside the methodology

One of the report’s distinguishing features is its methodological rigour. All underlying data are drawn from HealthTech Alpha, Galen Growth’s proprietary intelligence platform, which tracks close to two billion data points and more than 15,000 digital health ventures worldwide.

The Investor Score combines direct metrics – such as the number of new digital health investments between January 2022 and June 2025, exits completed over the same period, and the count of portfolio companies valued above USD 100 million – with indirect metrics that capture portfolio quality and ecosystem fit. These include:

- Alpha Score: a 360-degree venture-maturity rating that blends Money, Market, Momentum and Innovation indices.

- Partnership Score: a measure of a venture’s collaboration network strength, connectivity and co-creation potential.

- Momentum Score: an assessment of growth velocity, traction signals and evidence-driven acceleration.

Traditional performance metrics account for 40% of the overall weighting, while venture-maturity and category-specific Focus Scores make up the remaining 60%. Investors are then ranked within specific categories – by stage, region and theme – to identify the top performers in each, culminating in the HT50 Core Investors cohort.

This approach matters because it moves the conversation away from vanity metrics such as total capital deployed and towards a more nuanced view of quality, resilience and ecosystem leverage.

Who is Galen Growth?

Founded a decade ago, Galen Growth has become a specialist authority on digital health ecosystems, advising global pharma, payers, investors and technology firms. With teams in the US, Europe and Asia, it combines on-the-ground market expertise with deep data science to help clients identify opportunities, benchmark performance and make better innovation decisions.

The company’s work ranges from global digital health market scans and bespoke landscape analyses, through portfolio and partnership benchmarking, to the production of widely used reference indices such as the Pharmaceutical Digital Health Innovation Index, and to thematic deep dives into areas such as clinical trials and US health systems.

What is HealthTech Alpha?

At the heart of Galen Growth’s analysis sits HealthTech Alpha, its on-demand digital health intelligence and analytics platform. HealthTech Alpha aggregates and audits billions of structured and unstructured data points to provide a constantly updated view of ventures, investors, partnerships, evidence and valuations across more than 100 countries.

Users – from corporate strategy and R&D teams to investors and consultants – rely on HealthTech Alpha to:

- discover and shortlist best-fit ventures,

- generate ecosystem insights,

- perform structured due diligence, and

- monitor competitive and innovation activity in near-real time.

More recently, Galen Growth has layered Alpha CoPilot, an AI-powered research assistant, on top of HealthTech Alpha. This allows users to ask natural-language questions and receive precise, data-grounded answers without combing through dashboards, while retaining strict reliance on verified HealthTech Alpha data rather than open-web sources.

Where next?

Digital health is no longer an experimental side-bet for health systems and pharma. It is increasingly embedded in how care is delivered, how evidence is generated and how biopharma assets are developed and commercialised. In that context, knowing which investors are shaping the field is not a nice-to-have; it is strategic intelligence.

The HT50 Core Investors 2025 report provides a rare, data-rich lens on that question. For pharma leaders, it highlights future partners and acquisition targets. For investors, it offers a benchmark and a map of emerging value pools. For innovators, it identifies the capital that truly understands – and is prepared to back – the next generation of digital health infrastructure.

To explore the full rankings, dive into the underlying data and run your own cut of the market, readers can access HealthTech Alpha or request a briefing from Galen Growth’s team. In a world where capital is once again scarce and scrutiny is rising, the ability to see clearly which investors are really moving the needle in digital health may prove to be an edge.