In the ever-evolving landscape of Digital Health, Europe has emerged as a formidable leader, breaking the mold and setting new benchmarks for innovation and growth. This report delves into the remarkable achievements of the European Digital Health sector in the first half of 2025, highlighting how the region has outperformed other global regions in funding, partnerships, and technological advancements.

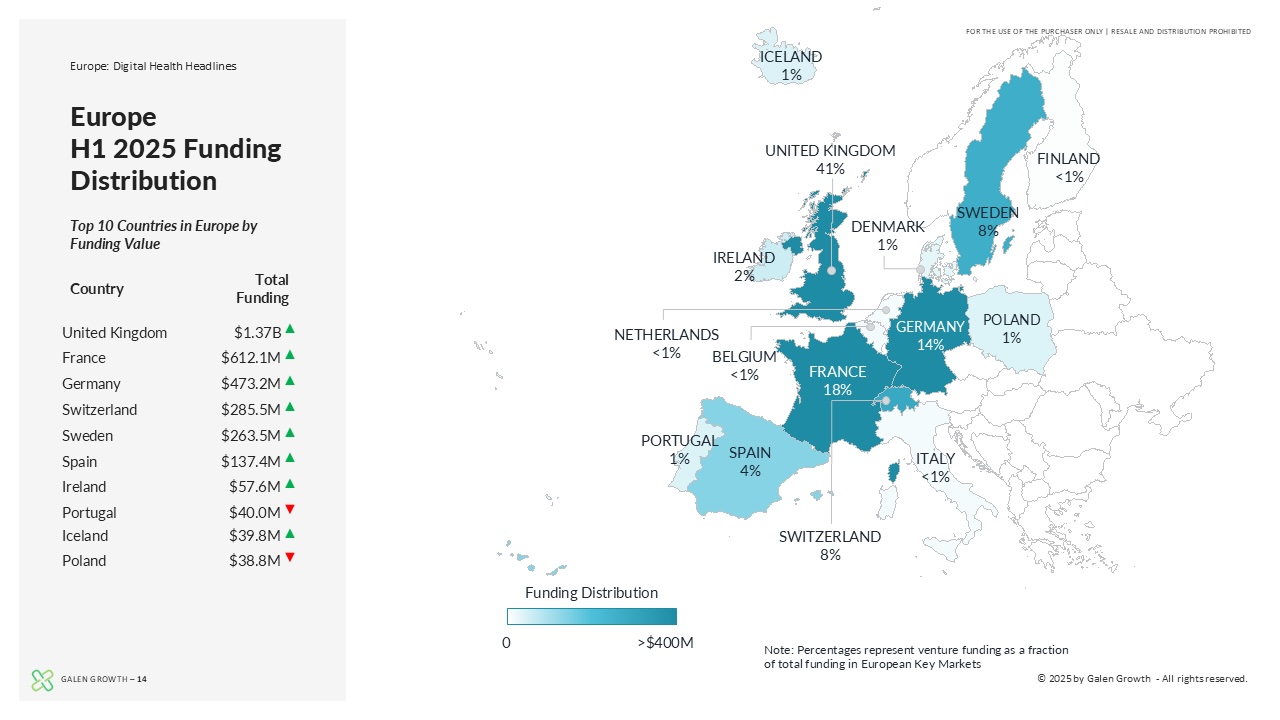

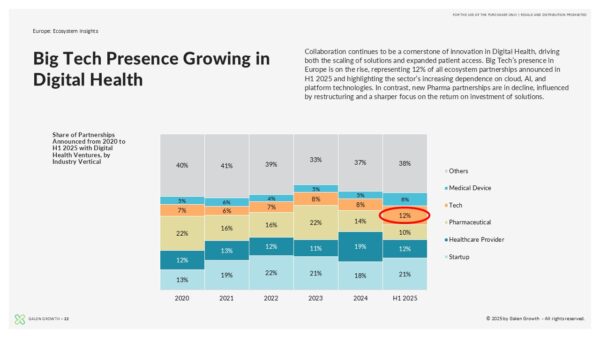

With a record 26% share of global Digital Health investments, Europe has demonstrated a new prowess in attracting substantial private investments, particularly in AI-powered ventures. The surge in funding, driven by a strategic shift towards growth and late-stage investing, underscores the region’s commitment to fostering proven ventures ready to make a real-world impact.

This report, powered by HealthTech Alpha- a Galen Growth proprietary solution and the world’s leading Digital Health private market data, intel, and insights platform- offers unmatched, non-biased, non-hyped, and data-driven coverage of the global Digital Health ecosystems.

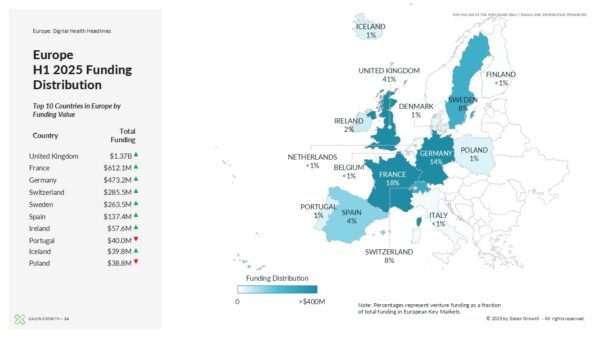

H1 2025 Digital Health Funding Highlights from Europe

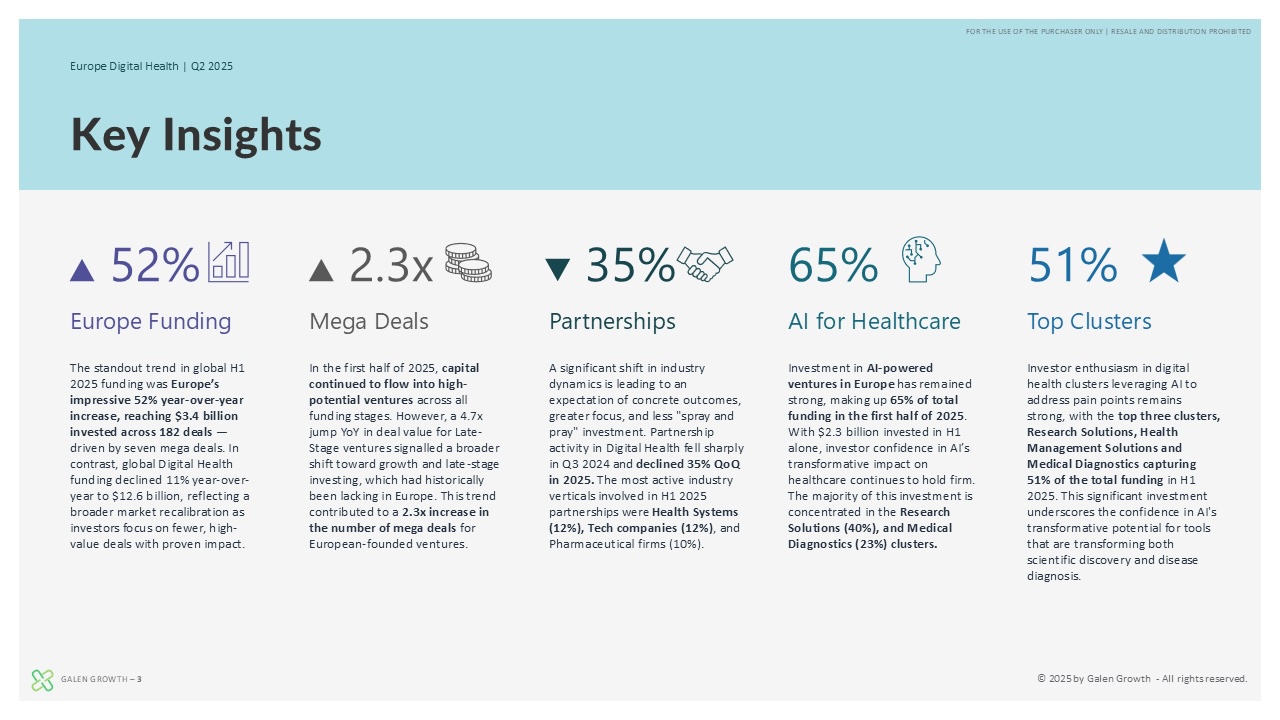

- Europe Funding: Europe’s digital health funding rose 52% YoY to $3.4B across 182 deals in H1 2025, contrasting with an 11% global decline.

- Mega Deals: Europe saw a 2.3x increase in mega deals, driven by a 4.7x YoY surge in late-stage venture deal value.

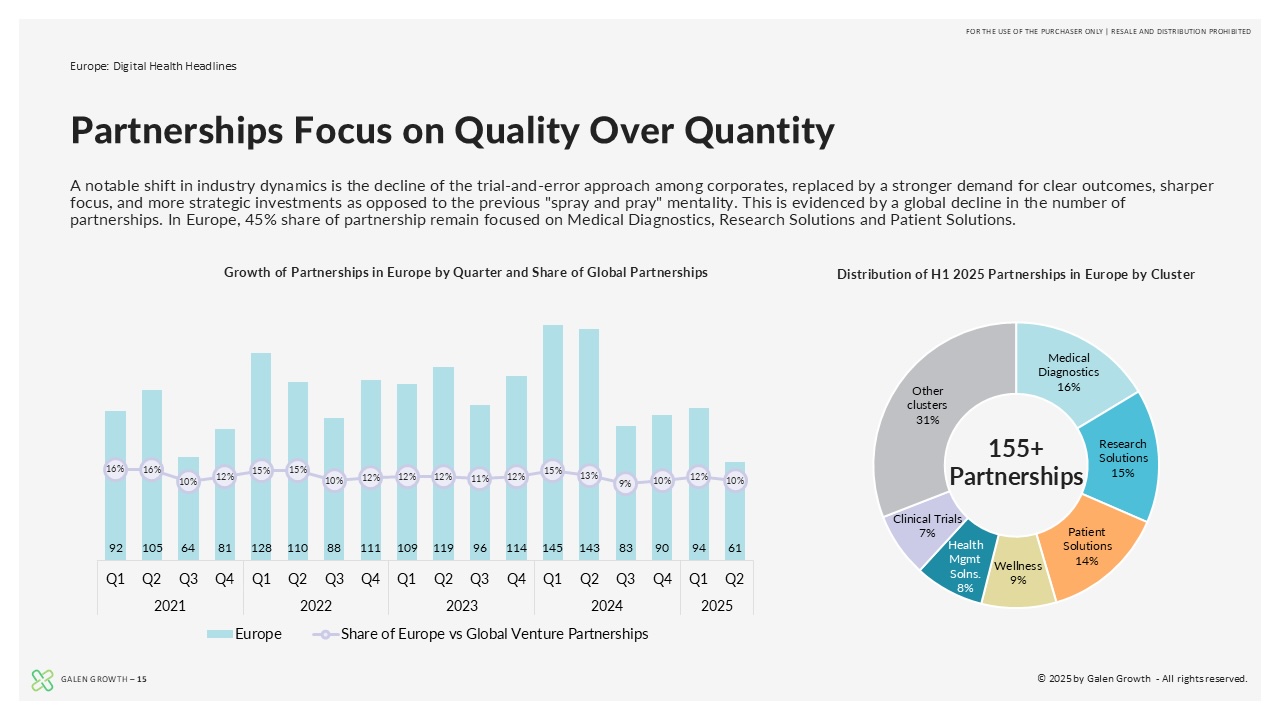

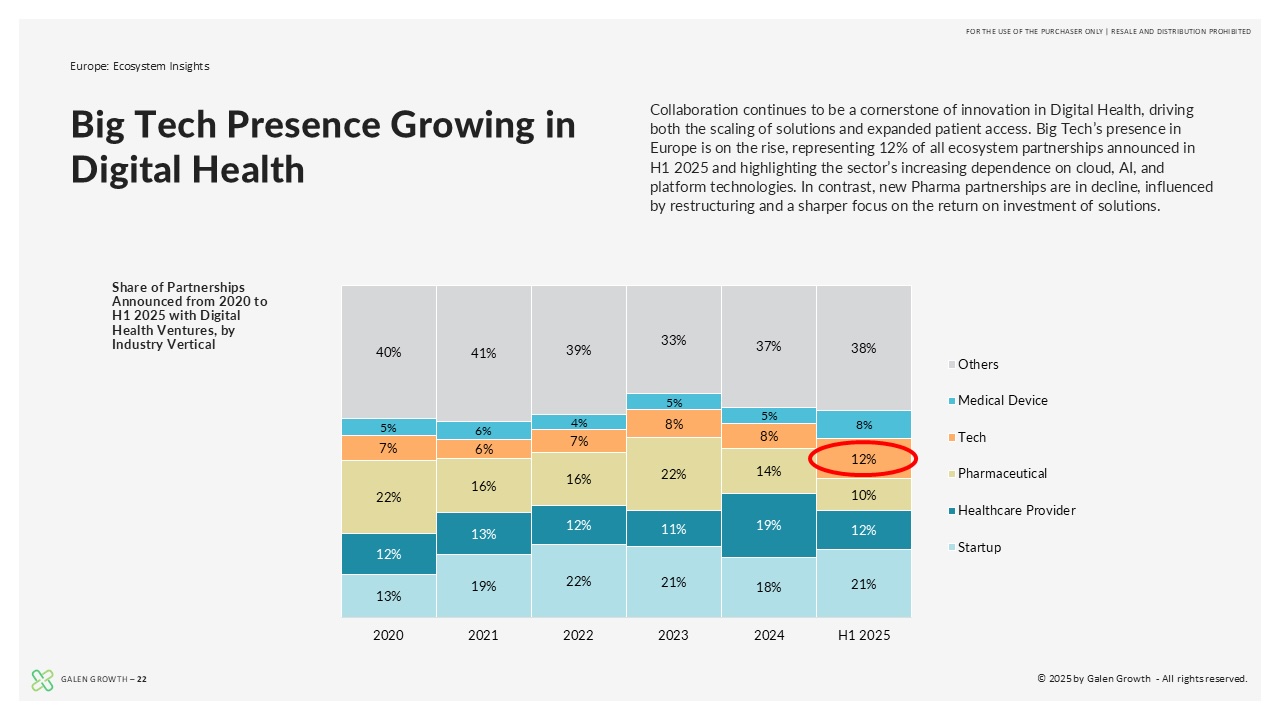

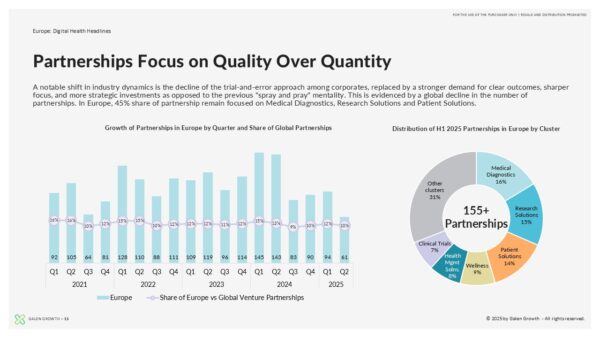

- Partnerships: Partnerships in digital health fell 35% QoQ in 2025, reflecting a shift toward more focused, outcome-driven collaborations.

- AI for Healthcare: 65% of total funding ($2.3B) in H1 2025 went to AI-powered ventures, concentrated in research and diagnostics.

- Top Clusters: The top three clusters—Research Solutions, Health Management Solutions, and Medical Diagnostics—captured 51% of funding in H1 2025.

Ventures and Companies Covered in the Report

The “2025 Q2 Digital Health Europe Funding and Key Trends Report” report includes data on the following companies:

Nabla, Hilo, Sword Health, Haya Therapeutics, Nuclivision, Isomorphic Labs, Neko Health, Fitness Park, CMR Surgical, AMBOSS, Cera, Khosla Ventures, HV Capital, Redalpine, Sofinnova Partners, LUMO Labs

Explore the Full Report

Gain a deep dive into the global H1 2025 digital health funding trends, cluster performance, and therapeutic priorities, with actionable insights for investors, corporates, and healthcare leaders.

Powered by HealthTech Alpha

The Q2 digital health Funding report is powered by HealthTech Alpha, the premier digital health intelligence platform delivering unparalleled data and insights into the evolving healthcare technology landscape. Leveraging an extensive database of over 15,000 ventures and cutting-edge analytics, HealthTech Alpha provides a data-driven foundation to analyse the critical trends shaping the future of digital health.

Designed to empower stakeholders—including investors, pharmaceutical leaders, and medical device manufacturers—HealthTech Alpha offers actionable intelligence to navigate digital transformation complexities. This collaboration ensures readers gain a comprehensive, evidence-based view of the intersection between digital health and healthcare, equipping them to identify strategic opportunities, assess market dynamics, and stay ahead in this fast-evolving industry.

About our Premium Reports

Our Premium Reports are specialized reports that are only available to active users with HealthTech Alpha Pro and HealthTech Alpha Enterprise accounts and are provided at no additional cost.

Source of Data

Galen Growth’s proprietary platform, HealthTech Alpha, provides the data source for this report. Corporate Business Development, Business Intelligence, and Digital Health Partnership teams worldwide prefer HealthTech Alpha, the world’s most-trusted Digital Health data, intel, and insights platform. Visit https://www.healthtechalpha.com to learn more about our data or https://www.galengrowth.com research for our reports.

Our Mission

Founded in 2016 by Digital Health experts, Galen Growth empowers global Fortune 500 companies, institutional investors, and promising Digital Health ventures to fast track their digital health strategy to create significant financial and social values. To find out more, visit https://www.galengrowth.com

| Pages | Section | Content |

|---|---|---|

| 2–5 | Introduction | – |

| 6–8 | About Galen Growth | |

| 9–19 | Digital Health Headlines | 12 charts, 4 tables |

| 20–25 | Ecosystem Insights | 7 charts, 1 tables |

| 26–31 | Investment Insights | 7 charts, 1 tables |

| 32–37 | Cluster Focus | 3 charts, 2 tables |

| 38–44 | Therapeutic Focus | 4 charts, 2 tables |

| 45-51 | Key Information | – |

PRO

-

Sign up now to download all premium research

-

Access and download all data in HealthTech Alpha

Enterprise

-

Get full access to unmatched premium research for your organization

-

Additional collaboration features to take your team's research and collaboration to the next level